The long-awaited arrival of a spot Bitcoin ETF has sparked a gold rush within the cryptocurrency world, attracting each new and skilled buyers. Whereas these new funding automobiles provide a handy and accessible option to purchase Bitcoin, their influence on the cryptocurrency’s core rules and long-term stability stays a fancy difficulty.

Bitcoin ETF: Preliminary Surge, However Possession Shifts Issues

The information paints an enchanting image. After the SEC permitted 11 ETFs, the variety of non-zero Bitcoin wallets initially surged, peaking at practically 53 million in January. This surge is probably going pushed by the accessibility and safety supplied by ETFs, attracting people who had been beforehand hesitant to take part instantly in advanced crypto wallets and exchanges.

Nonetheless, in line with information supplied by Santiment, a worrying pattern emerged after 30 days: the variety of wallets holding Bitcoin dropped by practically 730,000, indicating a potential shift to holdings by way of ETFs moderately than proudly owning the token instantly. This raises questions in regards to the long-term influence of Bitcoin’s decentralized nature and the potential for diminished on-chain exercise.

📊 729.4K much less #bitcoin Pockets holdings are larger than 0 Bitcoin USD, in comparison with a month in the past.after #SEC 11 Spot Bitcoins Authorised #ETF, the variety of non-coin wallets peaked on January 20, reaching 52.95 million.That is attributed to elevated curiosity in #hodlers

(continued)👇 pic.twitter.com/FThtSDOMk0

— Santiment (@santimentfeed) February 21, 2024

ETFs increase, however provide and demand dynamics stay unchanged

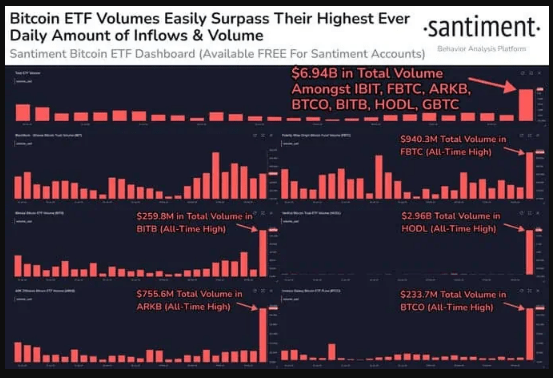

Whereas the ETF market is booming, its influence on Bitcoin’s core rules is unclear. Latest report buying and selling volumes and greater than $7 billion in inflows throughout the seven largest ETFs spotlight sturdy market curiosity and the potential for mainstream adoption.

Supply: Santiment

Nonetheless, it is necessary to keep in mind that these ETFs can maintain each precise Bitcoin and futures contracts. This implies buyers acquire publicity with out instantly affecting the underlying provide or demand for the cryptocurrency itself. This raises questions on whether or not ETFs are literally driving adoption or just making a derivatives market with its personal dangers and dynamics.

Hypothesis surges, elevating purple flags

Maybe probably the most worrying pattern is the surge in speculative buying and selling utilizing derivatives. Open curiosity on centralized exchanges, particularly for Bitcoin, has reached unprecedented ranges, exceeding $10 billion for the primary time since July 2022.

BTC market cap stays within the $1 trillion area. Chart: TradingView.com

This means buyers are utilizing derivatives to tackle extra threat, probably pushed by the “mass craze” surrounding Bitcoin and the lure of potential fast positive aspects. This echoes the speculative frenzy of 2017, elevating issues about potential market volatility and a possible crash. Ethereum, Solana, and Chainlink are additionally exhibiting enormous open curiosity, suggesting a broader market pattern past Bitcoin.

Conclusion: A double-edged sword

The arrival of spot Bitcoin ETFs has definitely opened the door for brand spanking new buyers, nevertheless it’s necessary to acknowledge the potential drawbacks. Whereas accessibility has elevated, direct possession could also be declining, and the rise of speculative buying and selling utilizing derivatives has raised issues about future market stability.

Going ahead, it is going to be essential to watch how these tendencies evolve and their long-term influence on the general well being of the crypto ecosystem. Moreover, ongoing regulatory developments round ETFs and derivatives could additional form the panorama.

Featured picture by way of Nicola Barts/Pexels, chart by way of TradingView

Disclaimer: This text is for instructional functions solely. It doesn’t symbolize NewsBTC’s opinion on whether or not to purchase, promote or maintain any funding, and funding naturally entails dangers. It is strongly recommended that you just conduct your personal analysis earlier than making any funding determination. Use of the data supplied on this web site is fully at your personal threat.