Information reveals that Bitcoin Coinbase Premium has fallen into the purple zone, which can clarify why the asset’s value has fallen under $68,000.

Bitcoin Coinbase Premium Index Turns Pink

As on-chain analytics firm CryptoQuant explains in an article postal On Day X, the BTC Coinbase premium index fell into unfavorable territory just a few hours earlier than BTC pulled again.

The “Coinbase Premium Index” right here refers to an indicator that tracks the proportion distinction between Bitcoin costs listed on cryptocurrency exchanges Coinbase (USD pair) and Binance (USDT pair).

When the worth of this indicator is constructive, it signifies that the worth listed on Coinbase is at present larger than the worth listed on Binance. This development signifies that customers of the previous platform make extra purchases than customers of the latter platform.

Alternatively, unfavorable values imply there’s larger promoting stress on Coinbase, as the worth of the cryptocurrency on Binance is at present larger.

Now, the chart under reveals the development of the Bitcoin Coinbase Premium Index over the previous few days:

The worth of the metric appears to have been unfavorable up to now day or so | Supply: CryptoQuant on X

As proven within the chart above, the Bitcoin Coinbase Premium Index has been constructive earlier. Nonetheless, the indicator fell into unfavorable territory yesterday and has remained there for a lot of the day since.

Along with the purple worth of the indicator, the worth of the cryptocurrency has additionally taken a critical hit and has fallen again to the extent of $68,000. Given the timing of the shut, the excessive promoting stress on Coinbase might have one thing to do with this drop.

As everyone knows, Coinbase is the popular platform for US institutional buyers, whereas Binance has extra international visitors, so the worth of the Premium Index can mirror the distinction in US whale and international consumer conduct.

Amid this rally, the Coinbase Premium Index remained constructive general as massive U.S. entities added to their holdings. Given the change in purple’s worth, these buyers might now flip to promoting, inflicting the token to plummet.

This indicator could also be price watching within the coming days. If it returns to constructive values for a sustained interval, it should point out that consumers are again and staying with them, so this could possibly be an uptrend.

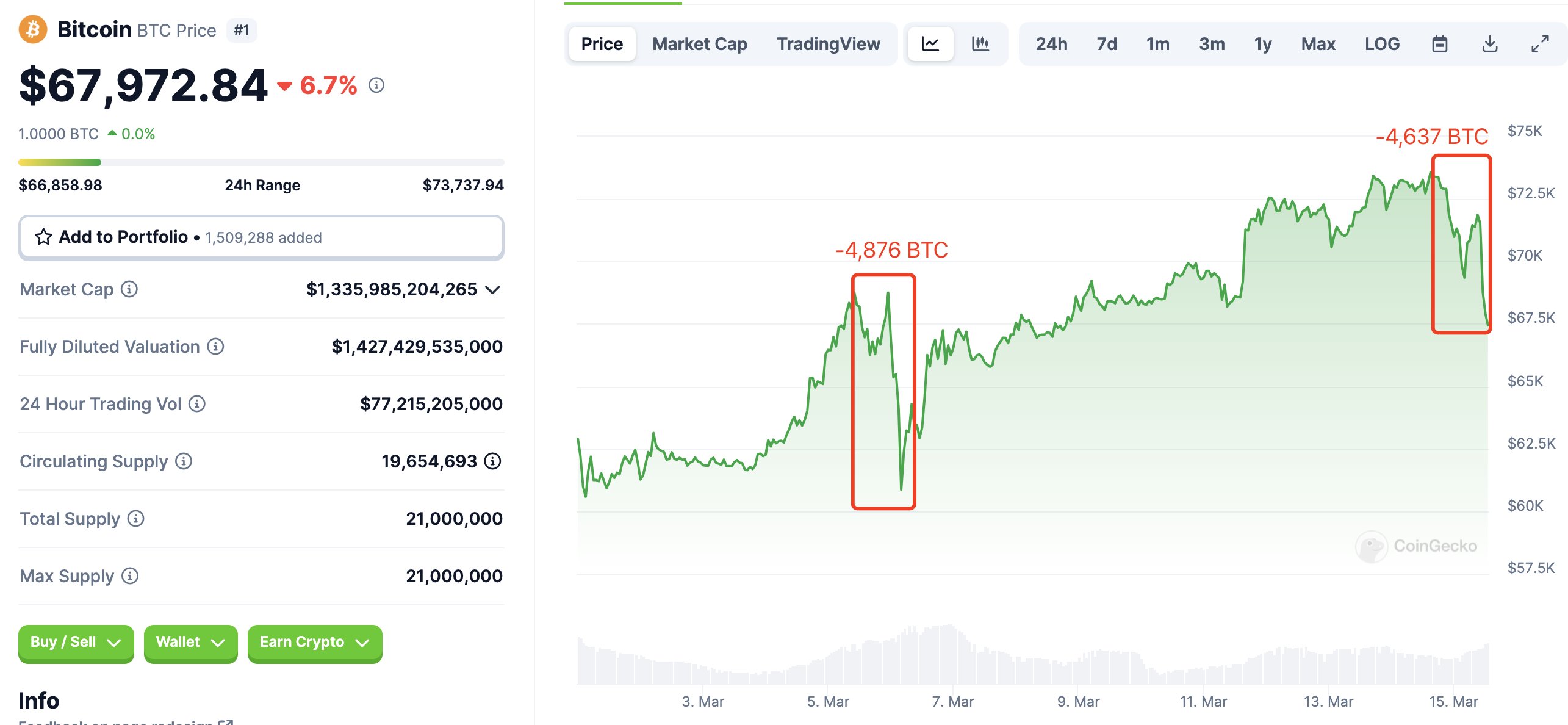

Concerning the Newest Correction, Good Cash Tracker Guan Lian identified that the Binance deposit pockets has transferred $329 million price of BTC to the Binance sizzling pockets up to now 24 hours.

Apparently, this whale additionally retraced the same quantity of Bitcoin through the correction earlier this month, as proven within the chart under shared by consumer X.

The identical whale moved cash throughout each of the most important corrections on this month to this point | Supply: @lookonchain on X

bitcoin value

As of this writing, Bitcoin is buying and selling round $68,100, down 4% up to now 24 hours.

Appears to be like like the worth of the coin has plummeted up to now day | Supply: BTCUSD on TradingView

Featured photos from Unsplash.com, Kanchanara on CryptoQuant.com, charts from TradingView.com