Over the previous 24 hours, the market has witnessed a big improve within the worth of Bitcoin, rising by 10% from a each day low of $60,805 to a peak of $68,250. This important worth motion could be attributed to a number of key elements, together with yesterday’s Federal Open Market Committee (FOMC) assembly, a big change in Coinbase premium, and Bitcoin’s technical breakout from the descending channel.

#1 FOMC assembly: Jerome Powell’s dovish feedback gasoline optimism

As reported yesterday, the macro surroundings for Bitcoin and cryptocurrencies is again within the highlight following higher-than-expected U.S. Client Value Index (CPI) and Producer Value Index (PPI) inflation knowledge. Buyers seem to have de-risked their positions forward of the FOMC assembly. Nevertheless, buyers acquired favorable outcomes.

The pivot level for Bitcoin’s rise could be traced to the Federal Reserve’s newest Federal Open Market Committee (FOMC) assembly, the place Chairman Jerome Powell delivered a speech that was interpreted as dovish by the market. The Fed’s stance, particularly in gentle of latest inflation knowledge, is reassuring to buyers.

Cryptocurrency Analyst Furkan Yildirim if FOMC Highlights Abstract: “‘Dot Plot’ Forecast Reveals Officers Count on a Midpoint of Quarter Fee Cuts in 2024 […] FOMC votes unanimously to maintain federal funds fee unchanged […] The median private consumption expenditures (PCE) inflation forecast for 2024 stays unchanged at 2.4% […] Officers additionally raised their forecasts for long-term rates of interest. “

The response to those bulletins was instantly bullish in conventional monetary markets, in addition to within the Bitcoin and cryptocurrency markets. Singapore-based crypto asset buying and selling agency QCP Capital emphasised the dovish nature of the FOMC’s stance: “1. In Powell’s press convention speech, he was not frightened in regards to the excessive inflation numbers in January and February 2. Within the dot matrix Within the chart, extra members have shifted their forecasts to a few fee cuts in 2024 (9 members vs. 6 members in December).

Analyst Ted (@tedtalksmacro) additional emphasize Optimistic Affect: “FOMC Abstract: – Though inflation stays above 2% (Fed expects core PCE to be 2.6%), rates of interest will nonetheless be lower 3 times this 12 months. Development outlook upgraded. Ship.”

#2 Coinbase Premium Turns Inexperienced: Signal of Spot ETF Demand

The shift within the Coinbase premium in direction of optimistic values could be thought of as one other key issue influencing Bitcoin worth tendencies. Whereas ETF flows turned damaging once more yesterday for the third day in a row, the Bitcoin Coinbase premium gives a glimmer of hope that spot Bitcoin ETFs will push costs even larger.

CryptoQuant analyst Maartunn mentioned: “Coinbase Premium is optimistic once more. About +$50. Lovely.” Coinbase Premium has been essential to BTC costs in latest months as a result of it displays spot Bitcoin earlier than the precise knowledge is launched a day later Demand for ETFs. Consequently, Coinbase hosts 8 of 11 spot Bitcoin ETFs, roughly 90% of Bitcoin ETF belongings. Subsequently, the Coinbase premium is essential for continued positive aspects.

Coinbase Premium is optimistic once more. About +$50. Lovely 😁 https://t.co/YJhYLdbipc pic.twitter.com/Hd3xXsg7Bq

— Maartun (@JA_Maartun) March 20, 2024

GBTC outflows yesterday have been value $386.6 million. Notably, BlackRock solely noticed $49.3 million in inflows, whereas Constancy noticed $12.9 million. This was one of many weakest days but for inflows into the main Bitcoin ETF — an enormous disappointment.

However well-known cryptocurrency analyst WhalePanda mentioned: “We pumped after the Federal Open Market Committee (FOMC), and general it was higher than the child boomers anticipated. Costs are falling now attributable to information of damaging flows, however I Assume they’ll get a shock tomorrow.”

ETF flows turned damaging once more yesterday for the third consecutive time.$GBTC Outflows have been value $386.6 million.

Blackrock noticed inflows of simply $49.3 million, whereas Constancy noticed inflows of $12.9 million.I think precise visitors will solely be seen in tomorrow’s numbers.

We smoke… pic.twitter.com/WVTntqG1by

— WhalePanda (@WhalePanda) March 21, 2024

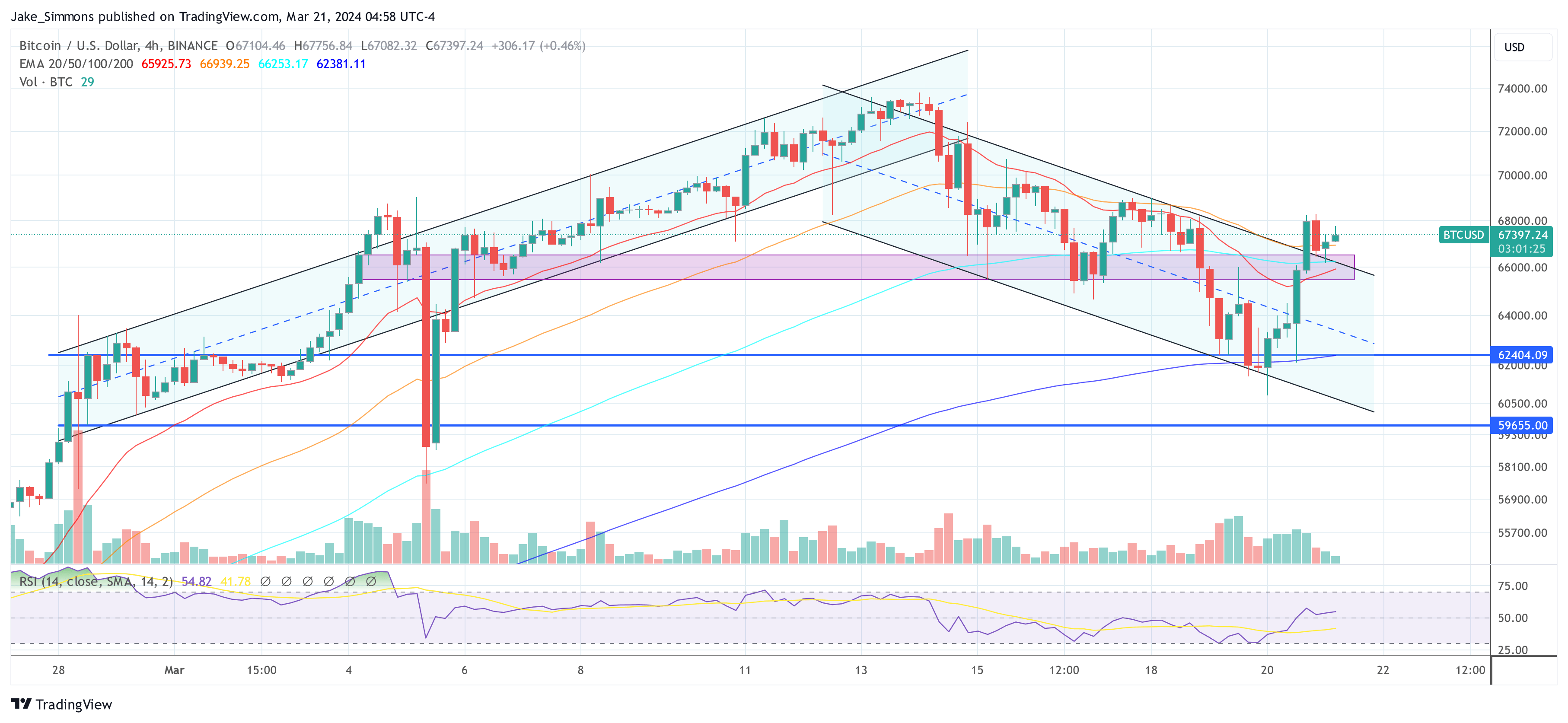

#3 BTC Value Breaks Out of Descending Channel

On the technical entrance, Bitcoin’s breakout of a parallel downtrend channel caught the eye of merchants and analysts. Daan Crypto Trades highlighted the significance of this development on Subsequent step.”

#bitcoin Examined the 4 hour 200MA/EMA and has been holding and breaking out very nicely.

Nonetheless watching this channel it will decide Bitcoin USDsubsequent step.

Bulls wish to see it consolidate above reasonably than fall again into the channel. pic.twitter.com/94etUo6YAR

— Daan Crypto Trades (@DaanCrypto) March 20, 2024

The chart shared by Daan exhibits that BTC worth has been consolidating in a parallel descending channel for greater than per week. Yesterday’s surge noticed worth escape of the channel. Retesting is presently underway. If profitable, Bitcoin costs might rise additional.

At press time, BTC was buying and selling at $67,397.

Featured picture created utilizing DALLE, chart from TradingView.com

Disclaimer: This text is for instructional functions solely. It doesn’t signify NewsBTC’s opinion on whether or not to purchase, promote or maintain any funding, and funding naturally entails dangers. It’s endorsed that you simply conduct your personal analysis earlier than making any funding resolution. Use of the knowledge offered on this web site is totally at your personal danger.