Based mostly on exercise over the previous 24 hours, whole annual charges generated by means of DefiLlama’s high 10 DeFi dApp tracks will attain $4.8 billion. Over the previous day, $13.15 million in charges had been incurred throughout staking, decentralized exchanges, lending, and wallets.

| Identify | class | 24 hours cost | 24 hours earnings |

|---|---|---|---|

| Lido | Liquid pledge | $3.38 million | $337,749 |

| Uniswap | Dex | $2.62 million | $0 |

| Pancake swap | Dex | $2.1 million | $426,372 |

| Curve Finance | CDP | $1.54 million | $659,343 |

| ghost | mortgage | $1.2 million | $172,860 |

| maker | CDP | $1.08 million | $545,105 |

| Rydia | Dex | $1.01 million | $124,524 |

| dealer joe | Dex | $623,784 | $69,357 |

| Metamask | pockets | $391,846 | $391,846 |

| Camelot | Dex | $271,722 USD | $63,802 |

Nonetheless, whole income prior to now day was solely $2.78 million, accounting for 21% of whole bills.

Lido tops the listing when it comes to charge era, whereas Curve stays first when it comes to income, adopted by Maker and Lido. Two examples of the biggest disparity between charges and income are Aave and Raydium, which generated over $1 million in charges prior to now day. Nonetheless, the earnings was $172,860 and $124,524 respectively.

Notably, whereas Uniswap ranks second when it comes to charge era, DefiLlama reported $0 in income as a result of Uniswap facilitates charge assortment. Nonetheless, it doesn’t retain these charges as income from the settlement. As an alternative, these charges enhance the worth of the liquidity token and pay all liquidity suppliers proportionally to their share of the pool.

There have been discussions and proposals throughout the Uniswap group on the implementation of “protocol charges”, which may be activated by means of UNI governance. This charge will enable the Uniswap protocol to earn income by charging a proportion of swap charges that might in any other case go to liquidity suppliers.

This opinion ballot is step one of “temperature test”, and the cross price of 55 million to 144 folks signifies that the improve has not but been carried out. Subsequently, Uniswap won’t report this as income.

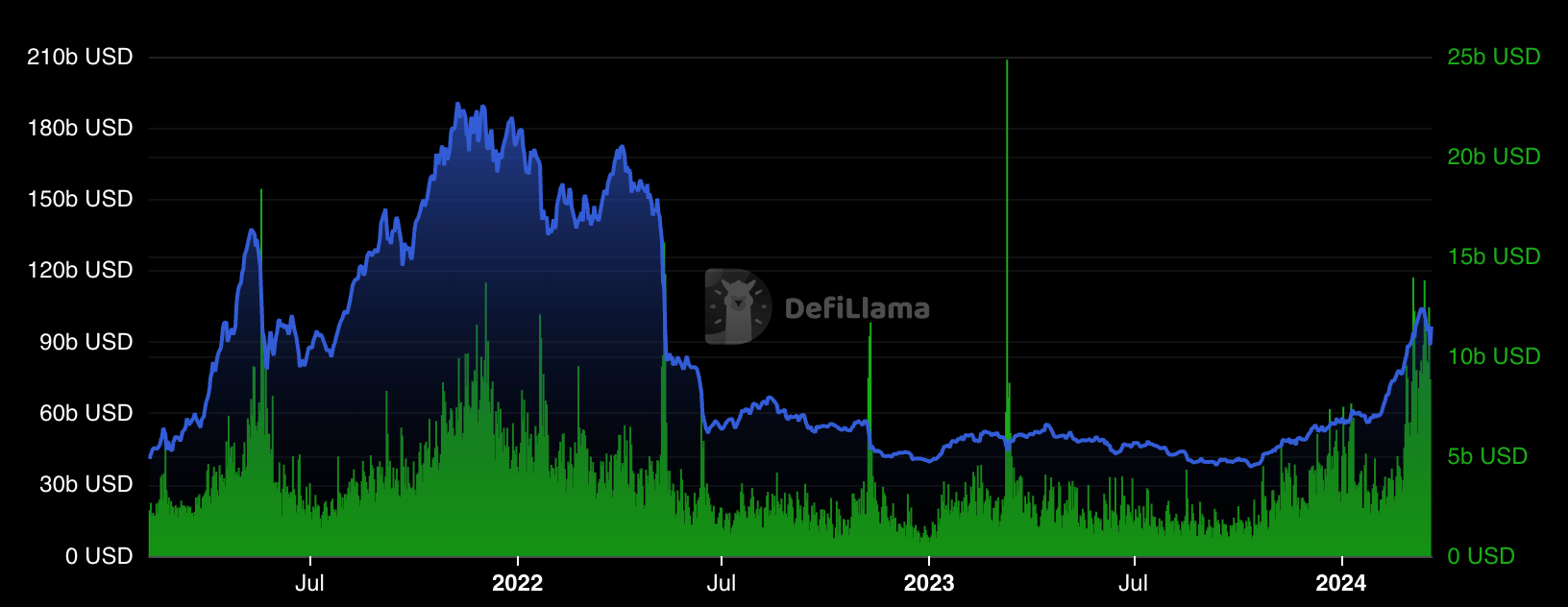

The present whole market capitalization of the DeFi market is $101 billion Encryption Slate Knowledge confirmed that the sector rose 5% prior to now day. DefiLlama information reveals that the DeFi market worth restoration has not but reached its peak in 2021. Nonetheless, quantity has risen to the identical degree, displaying a extra constant pattern. After approaching $5 billion in transaction quantity at first of the 12 months, offers of round $10 billion have change into commonplace prior to now month.

The publish High 10 DeFi dApps producing a median of $4.8 billion in annual charges appeared first on CryptoSlate.