On-chain analytics agency Glassnode explains that Bitcoin tends to achieve potential tops when long-term holders exhibit this sample.

Lengthy-term Bitcoin holders have been stepping up issuance efforts

In a brand new report, Glassnode discusses the affect that long-term BTC holders have on cryptocurrency provide dynamics. “Lengthy-term holders” (LTH) right here check with Bitcoin buyers who maintain Bitcoin for greater than 155 days.

LTH is among the two primary elements of the BTC consumer base based mostly on holding time, the opposite half known as “short-term holders” (STH).

Traditionally, LTH has confirmed itself to be a sturdy hand out there. It doesn’t matter what occurs within the wider trade, they received’t be promoting their tokens rapidly. STH, alternatively, typically reacts to episodes of FUD and FOMO.

Subsequently, it isn’t uncommon for STH to take part within the sell-off. Nonetheless, LTH exhibiting continued distribution could also be value noting, as promoting by these holders who normally sit on their palms might have an effect available on the market.

There are various methods to trace LTH conduct, however within the context of the present dialogue, Glassnode makes use of the “LTH Market Inflation Fee” indicator.

Because the report explains:

It reveals the annualized charge of Bitcoin accumulation or distribution in LTH relative to each day miner issuance. This ratio helps decide intervals of web accumulation (the place LTH successfully removes Bitcoin from the market) and intervals of web distribution (the place LTH will increase vendor strain available on the market).

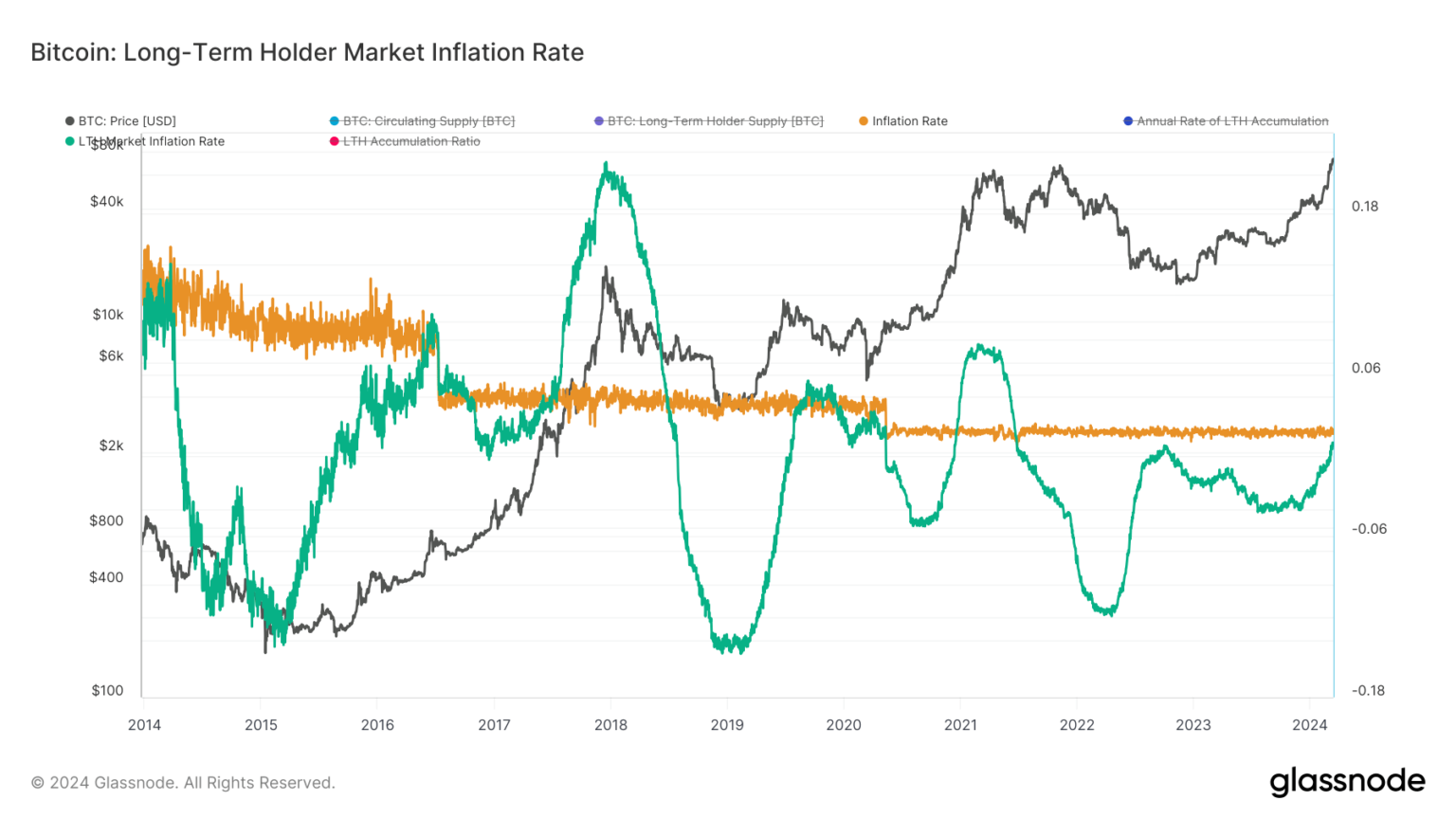

Now, here’s a chart exhibiting how the BTC LTH market inflation charge has trended over the previous few years:

The worth of the metric appears to have been on the rise in latest days | Supply: Glassnode

Within the chart, the analytics agency additionally included knowledge on asset inflation, which is mainly the amount of cash miners convey into circulation by fixing blocks and receiving rewards.

When the LTH market inflation charge is 0%, the quantity amassed by these HODLers is precisely equal to the quantity issued by miners.

Which means an indicator beneath 0% signifies that LTH is withdrawing tokens from the provision, whereas above 0% signifies that they’re both distributing or just not buying sufficient funds to soak up the cash being produced by miners.

The chart reveals that traditionally, when the LTH distribution peaks, the cryptocurrency’s worth tends to achieve equilibrium and should even attain a prime.

LTH market inflation has been rising lately, however has not but reached any vital ranges. As for what this implies for the market, Glassnode stated:

At present, the pattern in LTH market inflation charges reveals that we’re within the early phases of the distribution cycle, about 30% full. This means there will likely be vital exercise in the course of the present cycle till we attain a market equilibrium level from a provide and demand perspective and a possible worth prime.

bitcoin worth

Bitcoin has given again most of its positive factors over the previous few days, with its worth now all the way down to $63,800.

Appears like the worth of the asset has witnessed a drawdown once more | Supply: BTCUSD on TradingView

Featured pictures from Unsplash.com, Kanchanara on Glassnode.com, charts from TradingView.com

Disclaimer: This text is for academic functions solely. It doesn’t signify NewsBTC’s opinion on whether or not to purchase, promote or maintain any funding, and funding naturally includes dangers. It is strongly recommended that you simply conduct your individual analysis earlier than making any funding resolution. Use of the data supplied on this web site is fully at your individual danger.