Bitcoin on-chain information exhibits that so-called “accumulation addresses” have been shopping for giant quantities of the cryptocurrency this month.

Bitcoin accumulation addresses have seen giant inflows lately

As analyst Ali factors out in a brand new report postal On X, the Bitcoin accumulation tackle has been observing inflows of late. The “accumulation tackle” right here refers back to the pockets of a year-round cryptocurrency holder.

Addresses should meet sure standards to be included within the queue. Maybe most uniquely, wallets will not be allowed to document outgoing transfers.

Because of this cumulative addresses are people who solely bought tokens (i.e. solely acquired incoming transfers) and by no means participated in any gross sales.

An tackle will solely be thought of a part of this group if it has acquired no less than two incoming transactions and holds greater than 10 BTC in its steadiness.

Exchanges and miner-related wallets are excluded from such buyers as a result of the provision held by these entities represents the sell-side of the market (since buyers deposit to exchanges on the market, whereas the miners themselves are the continuation of promoting strain out there supply) market).

The availability held by accumulation addresses is believed to be tightly locked into the fingers of those holders, so when these buyers buy extra merchandise, the obtainable provide really decreases.

Wallets that final acquired an influx greater than seven years in the past are additionally excluded from this group, as such inactive addresses are typically thought of misplaced as a consequence of being forgotten or shedding their keys. Such wallets naturally can’t be thought of “HODLers”, no less than not voluntary wallets.

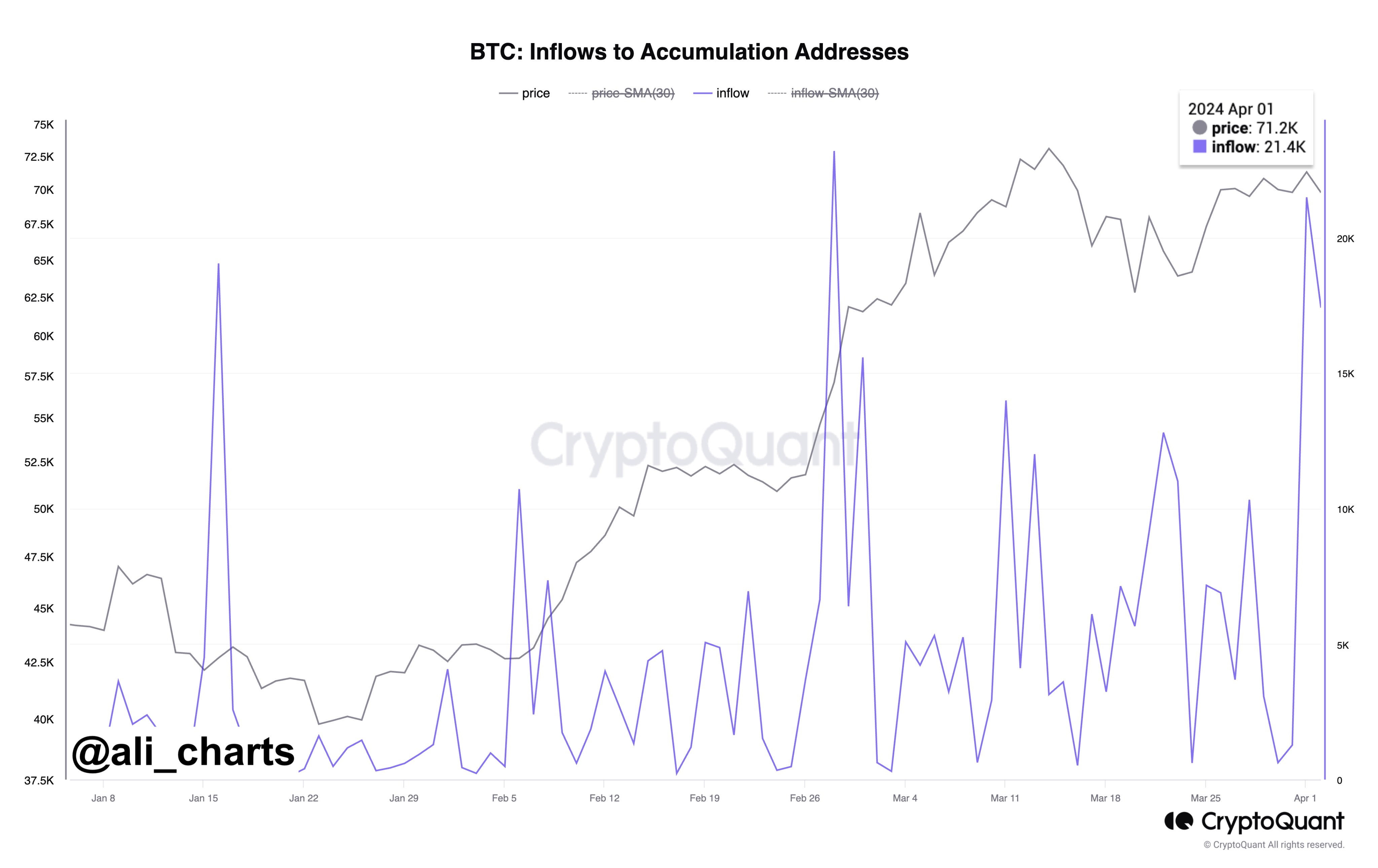

Now, here’s a CryptoQuant chart shared by Alibaba, exhibiting the pattern of Bitcoin flows into these gathered addresses for the reason that starting of the yr:

Seems like the worth of the metric has been fairly excessive in current days | Supply: @ali_charts on X

As proven within the chart above, Bitcoin inflows to accumulation addresses have been greater this month, indicating that these buyers have continued to purchase lately.

On the primary day of the month, the indicator even reached a worth of 21,400 BTC. At present cryptocurrency trade charges, the stack is price over $1.4 billion.

That’s a giant quantity and never too distant from the all-time excessive (ATH) of 25,300 BTC that the indicator reached a month and a half in the past.

After all, these buyers’ newest purchases are a constructive signal for cryptocurrencies. As if in response to this, Bitcoin seems to be discovering its footing once more because it has recovered over the previous day.

bitcoin worth

Bitcoin has recovered above $68,100 after rising greater than 3% at present.

The worth of the asset seems to have been going up over the previous day | Supply: BTCUSD on TradingView

Featured pictures from Shutterstock.com, CryptoQuant.com, charts from TradingView.com