Austin, Texas-based Trammell Enterprise Companions (TVP) has launched the outcomes of its second annual survey of the booming Bitcoin-native startup and enterprise capital ecosystem.

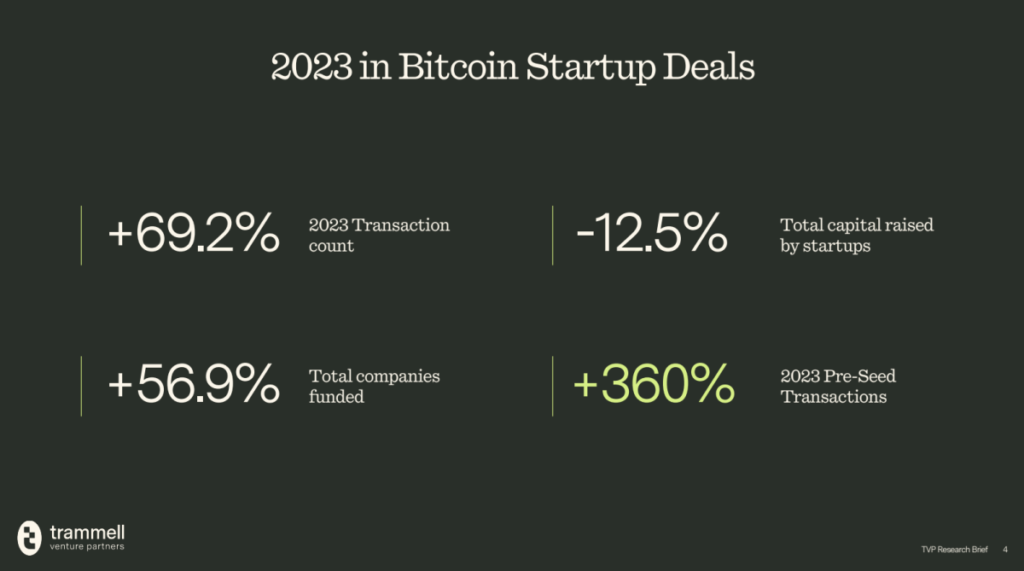

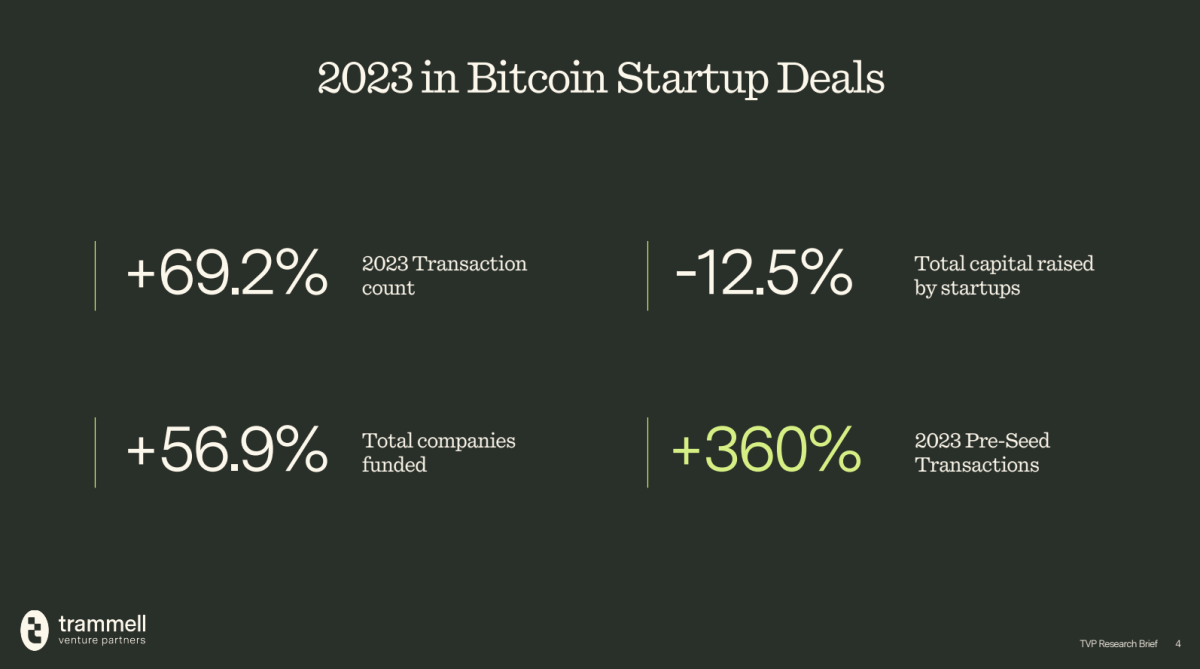

Regardless of a big decline in cryptocurrency enterprise market funding in 2023, TVP’s analysis highlights vital development within the Bitcoin startup sector, notably within the pre-seed stage, with a 360% year-on-year enhance within the variety of offers.

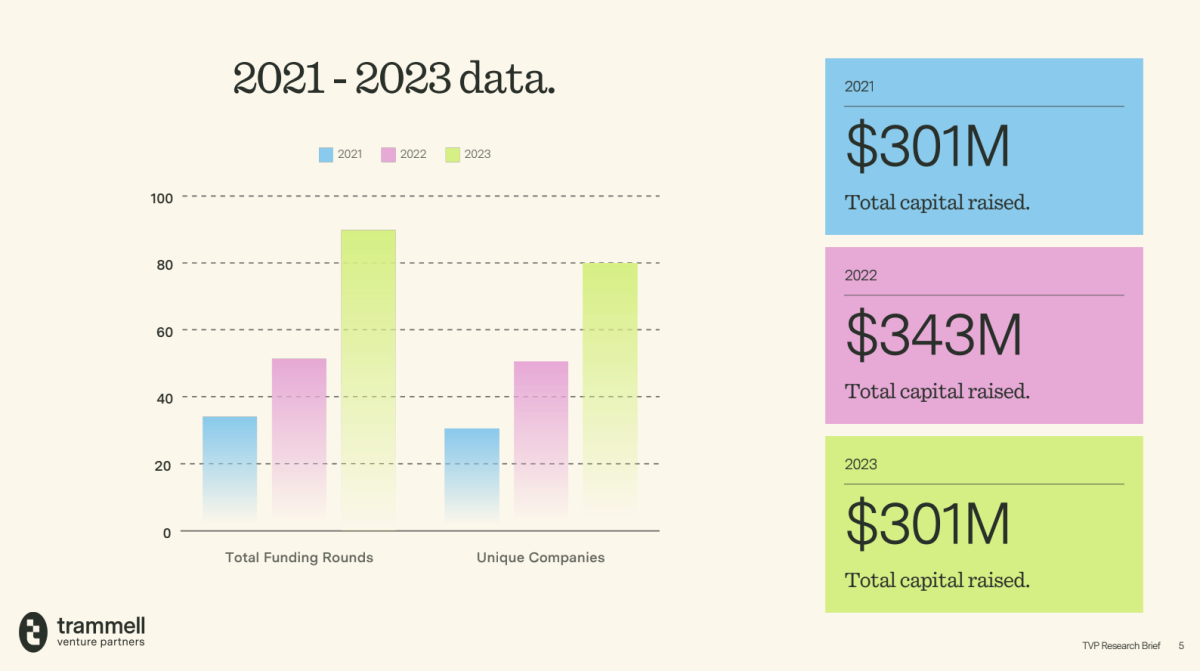

Opposite to broader startup exit exercise, which dropped to a 10-year low in 2023, Bitcoin-native startups have proven resilience and development, rising 69.2% yearly. Knowledge from TVP exhibits that these early Bitcoin startups raised a complete of almost $1 billion between 2021 and 2023, indicating sturdy curiosity and funding within the area.

TVP managing director and founding associate Christopher Calicott commented on the survey outcomes, noting that founders have a powerful need to construct on Bitcoin. He highlighted the rising supporting infrastructure and technological developments which are driving innovation inside the Bitcoin ecosystem.

“Early indicators from TVP analysis are in line with our expectations for the top state of ‘cryptocurrency’ companies: Founders do need to be completely Bitcoin-based,” Calicotte mentioned. “With a quickly rising set of technical assist enhancing Bitcoin’s scalability and buildability, this long-held TVP speculation is turning into a actuality supported by proof and information.”

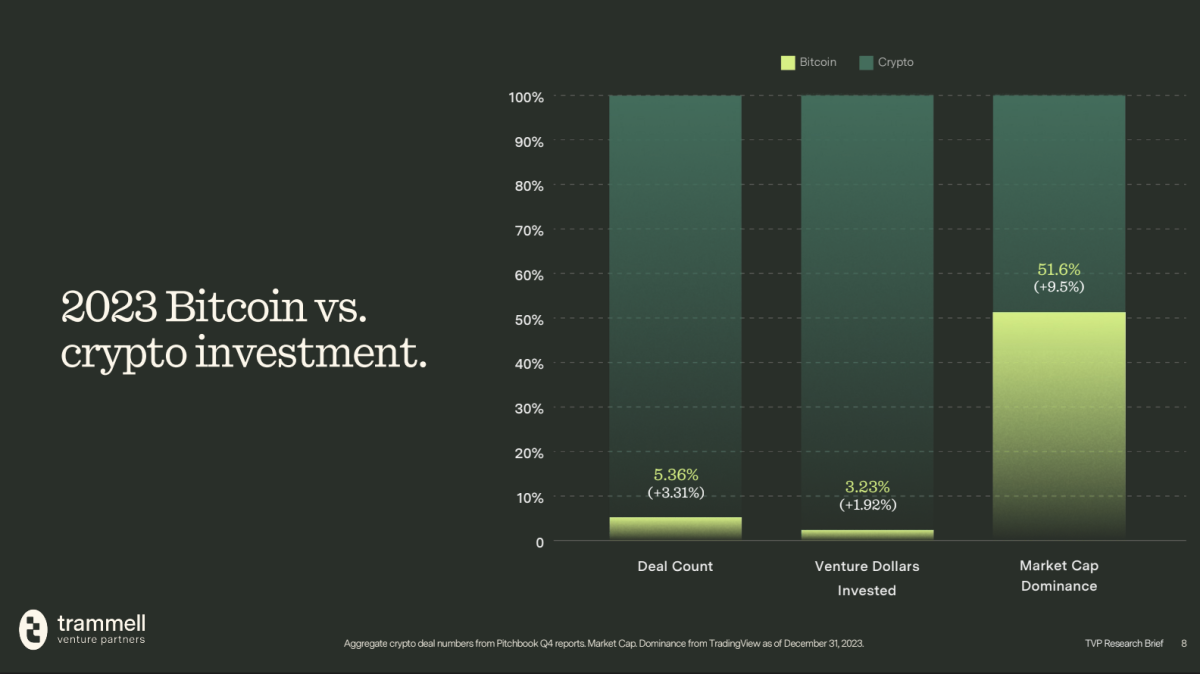

In 2023, the variety of Bitcoin-native enterprise transactions grew considerably, rising by 69.2%, whereas the variety of broader cryptocurrency enterprise transactions fell by 35.3%. Regardless of the rise in Bitcoin-native enterprise offers, cryptocurrency enterprise offers nonetheless account for the overwhelming majority of deal quantity and enterprise capital funding.

“On account of cyclicality and Bitcoin’s institutional acceptance, its market cap dominance is even larger than after we reported in 2023,” Calicott continued. “Nonetheless, allocation to Bitcoin-native enterprise capital stays very low in relative phrases. We consider that as extra allocators start to see the advantages of the quickly increasing Bitcoin design area introduced by these early Bitcoin startups, The compounding advantages are coming and Delta will begin to shut.”

TVP is dedicated to driving insights and analysis within the enterprise capital area, ensuing within the launch of the trade’s first fund sequence in 2021 centered on the Bitcoin native ecosystem. TVP’s annual analysis temporary on the rising Bitcoin-native enterprise capital sector goals to supply worthwhile data and assist for institutional traders searching for to discover alternatives within the rising Bitcoin startup trade.

The entire TVP Bitcoin Startup Ecosystem Analysis Transient is accessible for obtain, offering a complete overview of the evolving panorama and funding alternatives for Bitcoin-native know-how.