Bitcoin Halving: Gold is on borrowed time

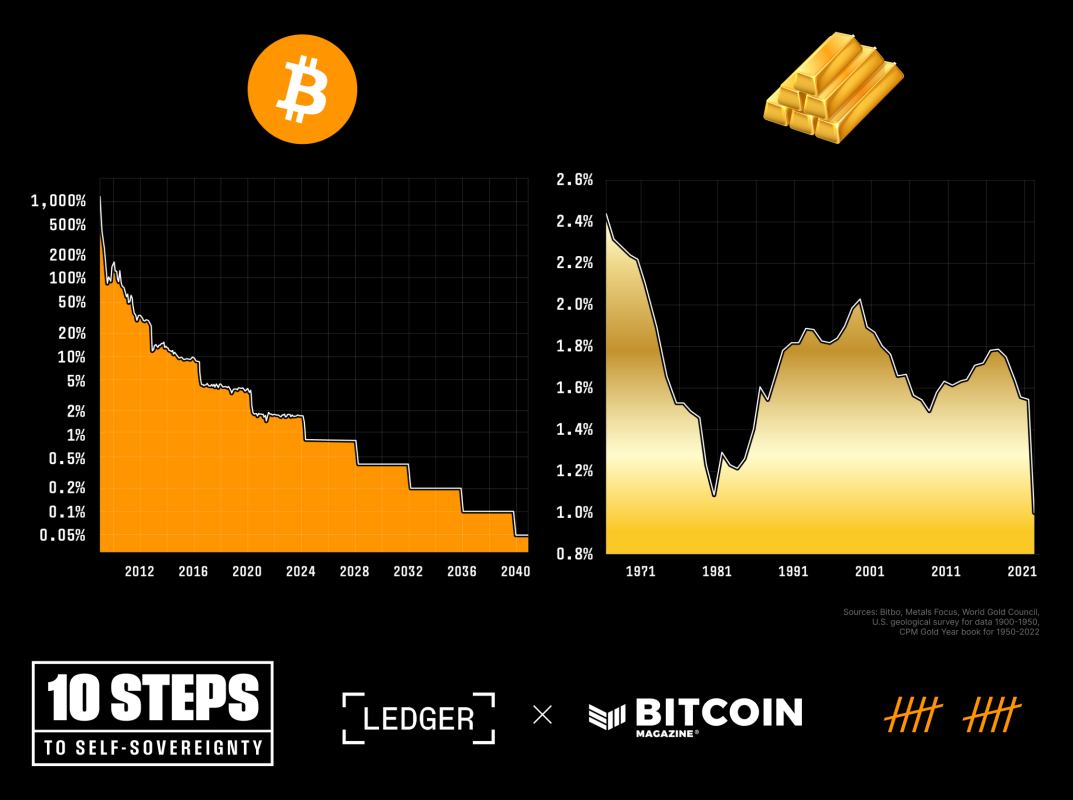

For the primary time since its inception, Bitcoin’s annual inflation price is decrease than that of gold, the standard retailer of worth. When the Bitcoin block top reaches 840,000, the annual provide of Bitcoin will likely be lowered by half, inflicting its annual inflation price to drop from 1.7% to 0.85%. By comparability, gold provide is predicted to extend by 1-2% per yr, relying on technological modifications and financial situations.

Bitcoin has skilled three halving occasions up to now:

November 28, 2012: Bitcoin’s block subsidy was lowered from 50 BTC per block to 25 BTC per block.

July 9, 2016: Bitcoin’s second halving lowered the block subsidy from 25 BTC per block to 12.5 BTC per block.

Might 20, 2020: Bitcoin’s third halving lowered the block subsidy from 12.5 BTC per block to six.25 BTC per block.

The upcoming fourth Bitcoin halving is predicted to happen on April 20, 2024 ET, and with it, the brand new provide of Bitcoin per block will likely be lowered from 6.25 BTC to three.125 BTC. Over this era (210,000 blocks or roughly 4 years), Bitcoin’s provide will enhance by 164,250 BTC (from 19,687,500 to twenty,671,875), leaving it solely 328,124 BTC away from the utmost provide restrict of 21 million.

Roughly 94% of the entire #bitcoin Now out there, will likely be halved in 11 days👀

Digital shortage at its finest 🚀 pic.twitter.com/fjbLs1tq7r— Bitcoin Journal (@BitcoinMagazine) April 8, 2024

Gold by way of the ages

One benchmark usually used to emphasise its store-of-value perform is that an oz of gold is price as a lot as a “gentleman’s go well with” over time. This precept is called the “proportion of gold to respectable go well with” and dates again to historic Rome, the place top-quality robes have been mentioned to value as a lot as an oz of gold. After 2,000 years, the worth of gold required to buy a high-quality go well with remains to be near the worth of an equal historic Roman gown.

Whereas gold has been nicely suited to the expectations of its holders when shopping for males’s fits through the years, the lustrous yellow steel has additionally had its challenges.

For instance, the price of verifying or analyzing gold requires dissolving it in resolution or melting it. That is actually a problem for individuals who need to buy on a regular basis home items that maintain a hard-earned retailer of worth.

Moreover, the fee and onerous nature of transporting and storing gold itself arguably contributed to the demise of the gold normal. Whereas certificates of deposit have been traditionally redeemable for gold, the underlying commodity was usually rehypothecated, resulting in the US completely abandoning the gold normal in 1971, resulting in the notorious “Nixon Shock.”

To not point out the dangers that include buying bodily gold, its bodily nature as soon as once more demonstrates the dangers and liabilities of its perform as foreign money. I am reminded of Government Order 6102, when then-President Franklin Delano Roosevelt banned “gold hoarding,” highlighting the distinctive problem of adequately and privately guaranteeing that valuable metals retain their worth.

Bitcoin shifts from hypothesis to secure haven?

Bitcoin was initially seen as a speculative asset resulting from excessive value volatility in its early days, however is now more and more seen as a retailer of worth. Right now, buyers acknowledge its potential worth and superior qualities as a financial asset. Bitcoin represents the invention of digital shortage whereas offering a spread of use instances that reach far past valuable metals.

In consequence, Bitcoin has turn into an essential drive within the economic system in simply 15 years – with a market capitalization of $1.4 trillion on March 13, 2024.

Whereas this development can’t be attributed solely to Bitcoin fulfilling the store-of-value necessities higher than gold, it’s actually promising. This “magical cyber foreign money” continues to rise quickly on prime of gold’s market capitalization of roughly $15.9 trillion.

Gold’s Financial High quality: Digital Perfection

Shortage: Bitcoin has a restricted provide of 21 million cash, making it proof against arbitrary inflation that plagues conventional currencies in addition to market-driven provide of valuable metals.

Sturdiness: Bitcoin is a purely data-based, immutable type of foreign money. Its digital ledger system makes use of proof of labor and financial incentives to withstand any makes an attempt to vary it, guaranteeing that it stays a dependable retailer of worth over time, barring unexpected catastrophic tail dangers. Given its informational nature, having the ability to retailer Bitcoin regardless of opponents making an attempt to stop you from doing so is one other constructive foreign money attribute.

Immutability: As soon as a transaction is confirmed and recorded on the Bitcoin blockchain, it is vitally troublesome, although not unimaginable, to vary or reverse it. This immutability, derived from the geographical distribution of Bitcoin’s community of nodes and miners, is a key function. It ensures that the integrity of the ledger is maintained and transactions can’t be tampered with or counterfeited. That is particularly essential in an more and more digital world, the place belief and safety are paramount points.

in conclusion

Bitcoin’s rise as a financial commodity—predictable, proof against terminal inflation, and simply transferable—has given it acceptance amongst its holders as a retailer of worth. With the halving approaching, its shortage will surpass that of gold for the primary time and will set off alarm bells for market individuals looking for to keep away from the drag of foreign money debasement.

Whereas there are not any certainties in life, particularly in investing, Bitcoin’s skill to take care of the integrity of its 21 million provide cap by way of its decentralized nature is a close to certainty that continues to drive adoption one block at a time.

Gold is doing nicely. Nevertheless, with the halving proper across the nook, now’s Bitcoin’s time to shine.