Undeniably, launch Spot Bitcoin ETF Total, the worth of Bitcoin and different cryptocurrencies has achieved wonders.These ETFs at the moment are Unlock institutional wants Enter the world’s largest crypto asset to alter the dynamics forward of the subsequent halving. Then again, latest tensions between Iran and Israel precipitated Bitcoin to fall to $61,000 prior to now 24 hours, erasing weeks of value positive factors.

Bitcoin ETF Pockets Now a Whale Tackle

Institutional demand for Bitcoin has been growing for the reason that begin of the 12 months amongst issuers of varied spot Bitcoin ETFs. These fund suppliers have been buying Bitcoin left and proper and presently maintain 4.27% of the overall BTC provide, in line with information from on-chain analytics platform IntoTheBlock.

These whale wallets have now joined the massive record of whales on the Bitcoin community who collectively owns Accounting for 11% of the overall circulation.

In contrast to earlier Bitcoin halvings, this time the brand new supply of demand comes from the standard institutional sector.

The newly launched Bitcoin ETF has pushed institutional demand, leading to ETF wallets already accumulating 4.27% of the Bitcoin provide! pic.twitter.com/volLU15Wgd

— IntoTheBlock (@intotheblock) April 13, 2024

It’s value noting that BlackRock’s IBIT Constancy’s FBTC ETF has positioned itself as a frontrunner.in line with Information from BitMEX analysisAs of the shut of buying and selling on April 12, these two spot ETFs presently maintain 405,749 BTC.

Surge in institutional funding fuels Bitcoin’s fast development rises to file excessive $73,737, underscoring its potential as a mainstream asset class. Nevertheless, the brewing battle between Iran and Israel seems to be offsetting months of value positive factors. Specifically, Bitcoin has fallen considerably from $67,800 to $61,000 prior to now 24 hours.

Nevertheless, fundamentals counsel that this value drop is momentary and the cryptocurrency has reversed most of its losses. As of this writing, Bitcoin is buying and selling beneath $65,000.

Bitcoin is now buying and selling at $64.330. Chart: TradingView

Altering Halving Dynamics

one These fundamentals level to Steady Bitcoin Costs to rise in coming months The Bitcoin halving is coming. Traders are steadily approaching the end result of this halving, with the Bitcoin blockchain now lower than 1,000 blocks away from the subsequent halving.

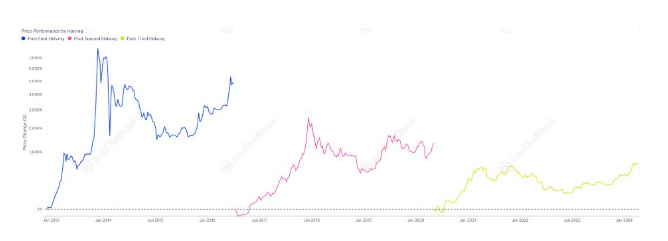

Previous halvings themselves resulted in Bitcoin value will increase within the days following the halving. Bitcoin surged greater than 7,000% within the months following the primary halving in 2012. The newest halving occurred in Might 2020, inflicting the worth to surge by practically 1,000% within the following months.

As IntoTheBlock factors out, the upcoming halving is completely different from earlier halvings. In contrast to the earlier three halvings, “new sources of demand from the institutional sector” have emerged by spot Bitcoin ETFs. A Repeat previous halvings The consequence may see Bitcoin simply surge to cost ranges above $100,000.

Featured picture from Pixabay, chart from TradingView

Disclaimer: This text is for academic functions solely. It doesn’t signify NewsBTC’s opinion on whether or not to purchase, promote or maintain any funding, and funding naturally includes dangers. It’s endorsed that you just conduct your individual analysis earlier than making any funding choice. Use of the data offered on this web site is solely at your individual threat.