Bitcoin fell sharply over the weekend, falling from $70,090 on April 11 to $64,400 on April 13. As of April 15 it was $66,000.

To know the character of those fluctuations—whether or not they point out merely a short-term correction or herald a extra important shift—it’s essential to look at the conduct of various market individuals, significantly short-term and long-term holders.

Brief-term holders (STH) and long-term holders (LTH) react in a different way to market fluctuations. STH is mostly extra delicate to cost modifications and exterior occasions, tending to unload its holdings throughout market declines. In distinction, LTH sometimes maintains its place by way of volatility, reflecting a dedication to Bitcoin’s long-term worth.

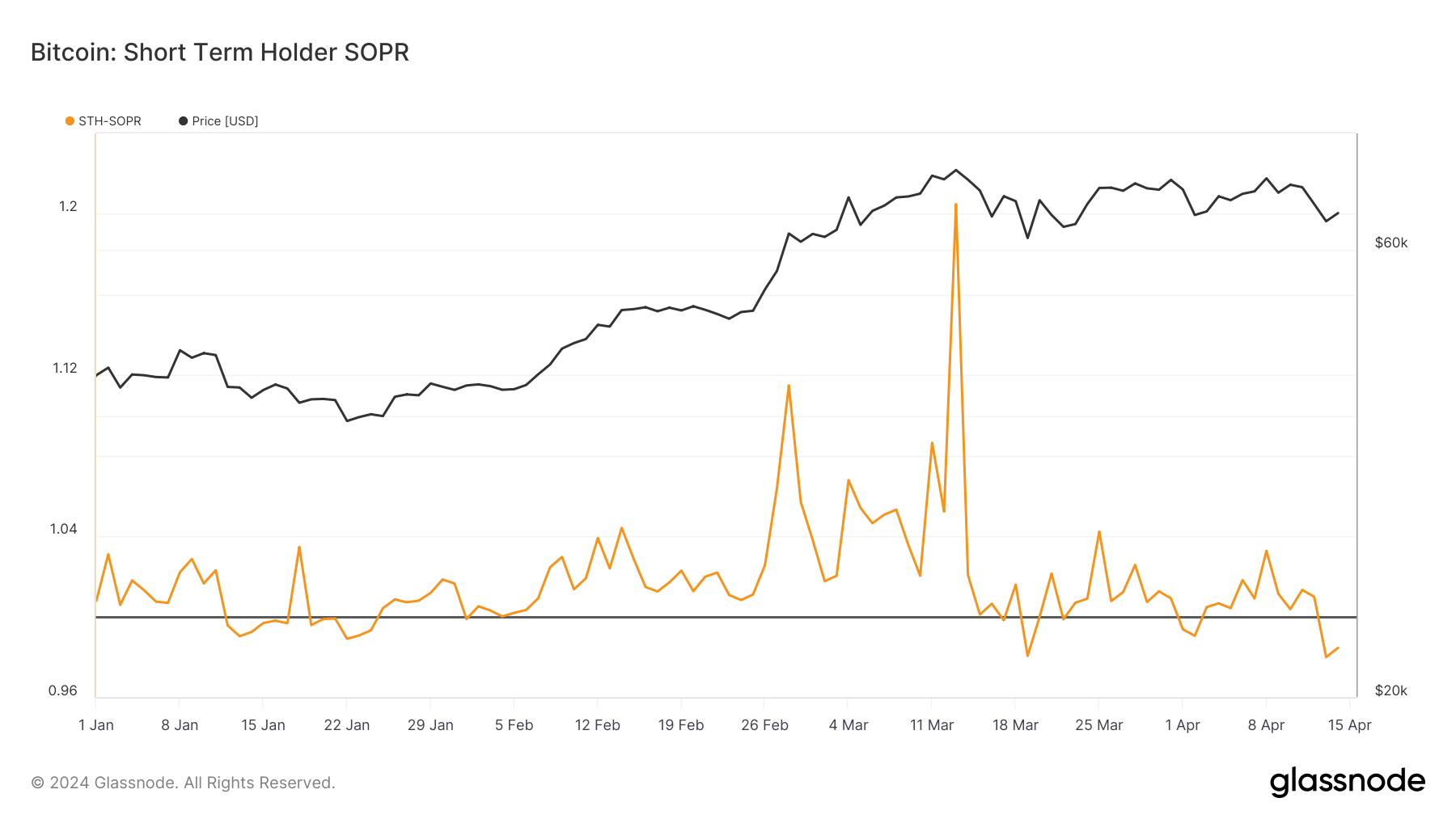

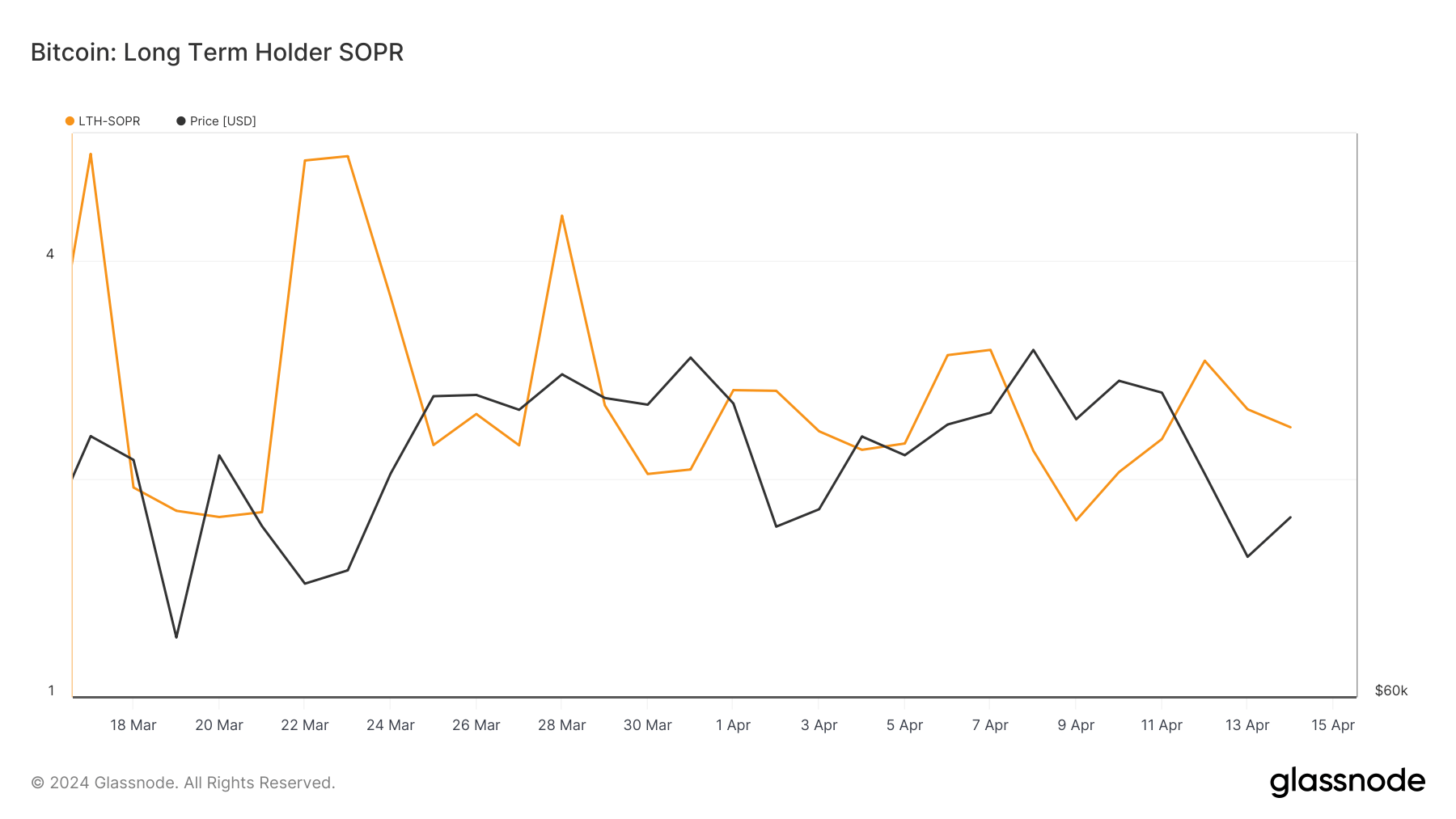

Top-of-the-line metrics for assessing quick market response is the Spend Output Revenue Ratio (SOPR), which measures the revenue margin achieved by way of tokens shifting on-chain. A SOPR worth above 1 signifies that the token is bought at a revenue on common, whereas a price under 1 means it’s bought at a loss. A nuanced understanding requires decomposing this metric into STH SOPR and LTH SOPR to seize the totally different behaviors of those two teams.

In the course of the decline, STH SOPR fell sharply from 1.009 on April 12 to a yearly low of 0.979 on April 13, displaying that short-term holders have been promoting Bitcoin at a loss. By April 14, the indicator had recovered barely to 0.984, nonetheless under the break-even threshold of 1.

Earlier this yr, when Bitcoin reached highs over $73,000, the STH SOPR peaked at 1.204, displaying profit-taking promoting by short-term holders. As well as, the Bitcoin worth spent by STH on April 13 was $65,130, exceeding the spot buying and selling worth of $64,900, displaying that a considerable amount of STH was being bought at a loss.

Lengthy-term holders, alternatively, have proven larger resilience. As Bitcoin costs fell under $70,090, LTH SOPR elevated from 2.271 on April 11 to 2.913 on April 12, indicating that long-term holders are nonetheless promoting at substantial earnings regardless of the financial downturn. By April 14, this quantity had adjusted barely to 2.358, however was nonetheless nicely above the break-even level.

Simply wanting on the SOPR, we are able to see that the weekend’s decline did not shake the arrogance of long-term holders. Whereas long-term holder balances have been rising over the previous week or so, few bought in the course of the decline and are realizing earnings.

On the similar time, the conduct of short-term holders confirmed panic, with many selecting to cease losses and promote Bitcoin. This implies a reactive angle to market information and worth actions, additional confirming the long-term pattern related to STH.

The distinction in responses between the 2 teams demonstrates the significance of segment-specific evaluation and means that whereas short-term sentiment could also be wavering, the long-term outlook stays robust.

The put up Bitcoin’s Brief-term Holders After Weekend Droop appeared first on CryptoSlate.