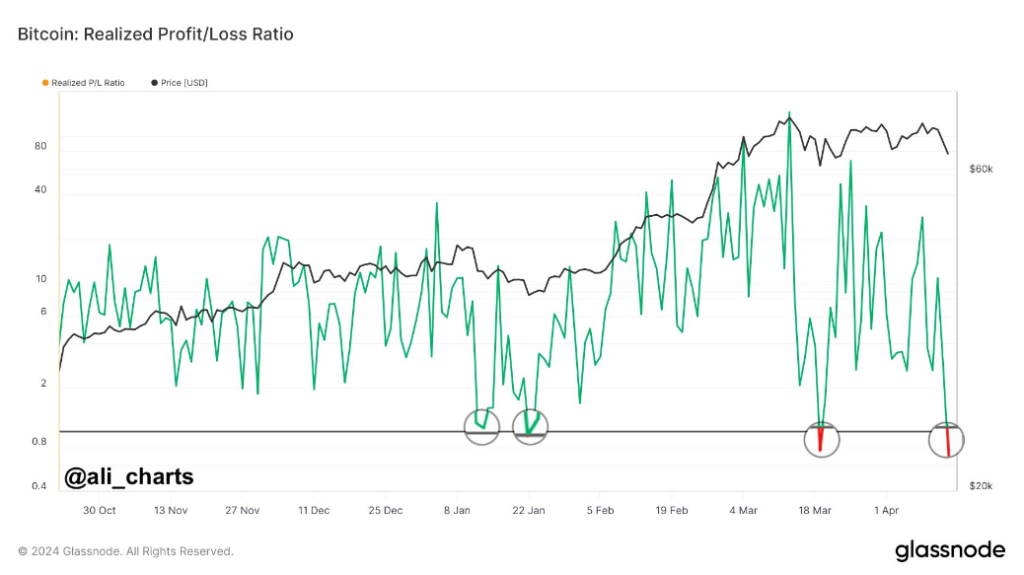

Traders are bracing for a rollercoaster journey because the flagship digital asset Bitcoin navigates uneven waters. The most recent information from Glassnode exhibits a noteworthy growth: Bitcoin’s realized profit-to-loss ratio has dropped beneath 1.

The important thing metric compares Bitcoin’s promoting worth to its shopping for value, exhibiting traders are presently shedding greater than they’re profiting. Traditionally, such declines have usually signaled a possible backside for Bitcoin, which is a crucial sign for market observers.

Optimism stays regardless of Bitcoin value drop

The previous 24 hours have witnessed vital swings in Bitcoin’s value trajectory. Earlier within the day, Bitcoin costs plummeted to round $64,000, worrying many traders.

Nonetheless, a major restoration ensued, with costs steadily climbing and peaking at round $66,000. This sturdy rally infused a way of optimism, with bullish sentiment taking on because the session progressed.

Whole crypto market cap presently at $2.261 trillion. Chart: TradingView

Institutional curiosity in Bitcoin continues to develop, with current developments signaling potential adjustments in capital inflows. Hong Kong regulators’ approval of a spot Bitcoin ETF opens the door to elevated institutional participation, significantly from Asia.

The transfer might inject new capital into the Bitcoin market, which might additional push costs greater. Moreover, regional dynamics play an vital position in shaping investor sentiment and habits. Completely different funding traits in several areas spotlight totally different responses to present market situations.

Whereas some areas might specific warning amid volatility and geopolitical uncertainty, others might embrace Bitcoin as a hedge in opposition to inflation and forex devaluation.

crucial assist degree

Bitcoin analyst Willy Woo factors to the important thing assist degree at $59,000. A breach of this threshold might sign a shift in market sentiment to bearish. As an alternative, traders anticipate potential quick liquidation that would drive costs greater, presumably to between $70,000 and $75,000 if present assist ranges maintain.

These anticipated occasions depend upon market liquidity and investor response to quickly altering value actions. As Bitcoin continues to consolidate close to all-time highs, traders stay cautiously optimistic about its future prospects.

The upcoming halving occasion provides one other layer of complexity to the already intricate market dynamics, with volatility anticipated to extend within the coming days.

Analysts consider that this era of sideways volatility is a crucial stage for traders to reallocate their property, doubtlessly laying the muse for a longer-term, extra sustainable restoration.

The cryptocurrency market, and Bitcoin particularly, goes by means of a interval of heightened uncertainty and volatility. The current decline in realized profit-to-loss ratio marks a possible turning level in Bitcoin’s value trajectory, whereas institutional curiosity and regional dynamics proceed to affect market sentiment.

Featured pictures from Pexels, charts from TradingView