BitMEX founder Arthur Hayes gives an in-depth evaluation of the present monetary panorama and its potential impression on Bitcoin, particularly given the current challenges confronted by New York Neighborhood Financial institution (NYCB) and the broader banking trade.

Hayes’ evaluation attracts on the advanced interaction between macroeconomic coverage, banking sector well being and cryptocurrency markets. His feedback are significantly insightful in mild of current developments at NYCB. The financial institution’s shares plunged 46% amid surprising losses and a pointy dividend minimize, largely as a consequence of a tenfold improve in mortgage loss provisions that far exceeded expectations.

The incident raises pink flags concerning the stability and threat publicity of regional U.S. banks, significantly in the true property sector, which is notoriously cyclically delicate and weak to financial downturns. Inventory markets reacted negatively to those developments, with regional US financial institution shares additionally falling on NYCB’s efficiency.

Is Bitcoin headed for a weekend rally?

Hayes made it clear point out“Jeba [Jerome Powell] and Bartlett Yellen [Janet Yellen] Cash will probably be printed quickly. NYCB introduced an “surprising” loss as mortgage loss provisions elevated 10 occasions greater than anticipated. I suppose the financial institution hasn’t been fastened but. The feedback highlighted the continued fragility of the banking sector, which continues to be reeling from the shock of the 2023 banking disaster. He added, “The plunge in 10-year and 2-year Treasury yields means that markets predict some form of new bailout from bankers.” measures to resolve the issue. “

As well as, Hayes additionally highlighted the upcoming finish of the Federal Reserve’s Time period Financing Program (BTFP), which was launched in response to the 2023 banking disaster. BTFP is a vital software for offering liquidity to banks, permitting them to lend utilizing a wider vary of collateral.

Hayes predicts that market turmoil will result in the Federal Reserve presumably reinstating BTFP or introducing related measures. He famous in a current assertion that “if my predictions are appropriate, the market will bankrupt some banks throughout this era, forcing the Fed to chop rates of interest and announce the restoration of BTFP.” He believes that this case will generate an injection of liquidity, Thus boosting cryptocurrencies equivalent to Bitcoin.

In his newest submit on X, Hayes drew an analogy to how cryptocurrencies carried out in the course of the March 2023 banking disaster.he predict An identical trajectory reveals a quick dip adopted by a pointy rise:

Bitcoin is predicted to fall barely, but when NYCB and another establishments unload over the weekend, new bailouts are anticipated quickly. Then BTC began to compete, similar to the worth motion on March twenty third. […] I assumed perhaps it was time to get again to the practice household. Maybe after a number of U.S. financial institution failures this weekend.

In the course of the disaster in March, Bitcoin’s worth jumped greater than 40%, fueled by its position as a digital gold or safe-haven asset in occasions of economic instability. Taking a longer-term perspective, contemplating the 2008 monetary disaster, he additional said: “What did the Fed and Treasury do the final time U.S. actual property costs plummeted and world banks failed? Let the cash printing presses start. Bitcoin Cash = $1 million. Yacht.”

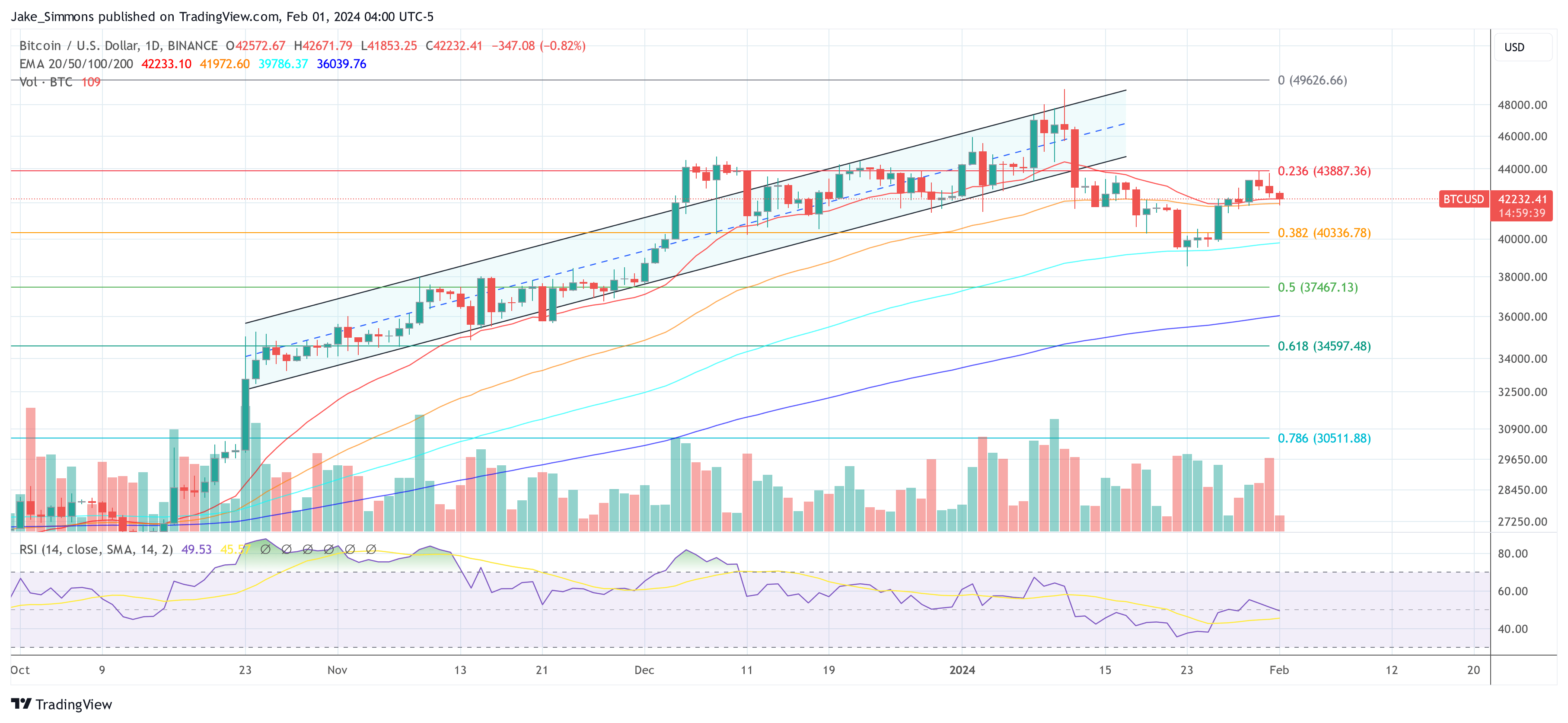

At press time, BTC was buying and selling at $42,232.

Featured picture created with DALL·E, chart from TradingView.com

Disclaimer: This text is for academic functions solely. It doesn’t symbolize NewsBTC’s opinion on whether or not to purchase, promote or maintain any funding, and funding naturally includes dangers. It is suggested that you just conduct your personal analysis earlier than making any funding choice. Use of the data offered on this web site is solely at your personal threat.