Think about a doomsday state of affairs. Over the previous few years, you may have labored exhausting to common prices and withdraw cash into your pockets. You have got a lot of small UTXOs1And Bitcoin transaction charges have risen a lot that your Bitcoins flip to mud2. You can’t use your Bitcoins now. For some Bitcoin customers, this isn’t the tip of the world, it’s the actuality they’ve skilled over the previous 6 months.

In 2023, we noticed very giant swings in Bitcoin transaction charges as an ordinal3 Bringing a lot of new Bitcoin customers, the demand for block house has additionally elevated considerably. Regardless of the optimistic strain from the approval of the Bitcoin spot ETF, customers nonetheless face severe challenges with excessive transaction charges, particularly for customers with small quantities of UTXO. In some instances, UTXOs develop into unspendable, also called turning into mud. This transaction price ache has many individuals asking the query: How do I do know if my UTXO is in danger? On this article we’ll discover the purpose at which mud is generated and attempt to assist develop a minimal plan to mitigate this threat.

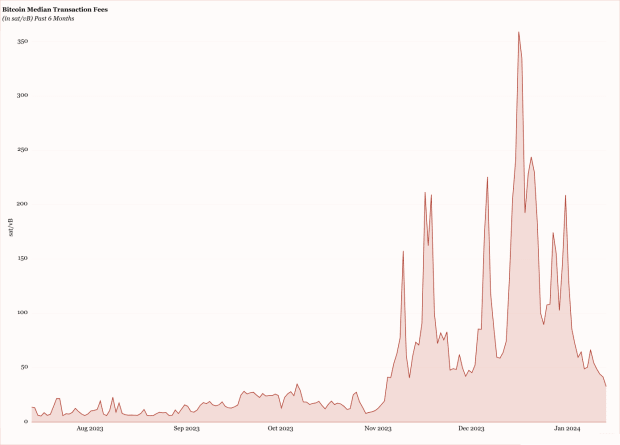

Median Bitcoin transaction charges over the previous 6 months sat/vB

Over the previous 6 months, we have now seen wild swings in median Bitcoin transaction charges. We noticed the reminiscence pool clear 0 sat/vB and spike to 350 sat/vB. Whereas this will not imply a lot to you on the floor, it could signify vital challenges for customers sending a number of small worth SegWit UTXOs in a single transaction. Actually, some customers noticed their UTXOs flip to mud. This clearly brought on panic and, for some, an costly lesson in UTXO administration. This isn’t an article explaining UTXO administration methods, this text is attempting to let you know that you just completely need giant UTXOs. If Bitcoin does what we predict, a number of UTXO transactions as small as 0.001 BTC could also be unspendable in a high-fee atmosphere, and you’ll say goodbye to that.

Earlier than we dive into the information, we have to outline what we need to see. For us, we attempt to perceive whether or not a UTXO is spendable or mud (non-spendable). For this we’d like the next:

- Sum of UTXO despatched

- Whole weight unit4

- Transaction price sat/vB

With this info, we will develop a formulation that exhibits how a lot worth is transferred in a Bitcoin transaction, after transaction charges.

Switch worth = BTC despatched – (((complete weight models / 4) * transaction price (sats/vB) * 0.00000001)

If the worth transferred is detrimental, it means you may have mud and the UTXO sum prices extra to ship than it’s value. Since calculating Bitcoin transaction weight models is a bit advanced, we’ll use real-life eventualities to construct our tables, assumptions, and proposals.

On this instance, we use 5 fundamental SegWit (P2WPKH) monetary transactions with the next weight models:

- Single enter, single output, single signature, single public key, SegWit transaction (P2WPKH script) complete weight unit is about 440 weight models.

- The overall weight unit of the 5 enter, single output, single signature, single public key SegWit transaction (P2WPKH script) is roughly 1,528 weight models.

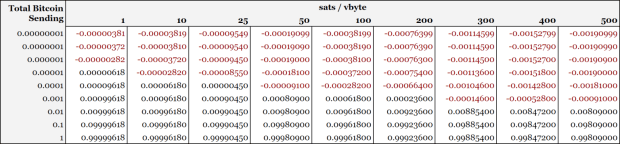

Utilizing the formulation above and a SegWit transaction with (5) inputs (weight of 1,528 weight models), we construct the next mud desk.

mud desk

Mud desk is calculated based mostly on 1,528 weight models5 SegWit enter instance above.

The mud desk reveals some telling info. The mud is actual and the bar is decrease than I believed. As transaction charges proceed to rise, UTXOs with bigger values face better dangers. Throughout the spike in transaction charges over the previous month, our instance commerce for even 0.001 BTC would have been mud. Below present market situations, this value is slightly below $50. It feels unimaginable. 100 thousand satellites all of a sudden became mud. gone. not accessible. that is too scary.

Though this instance state of affairs is not going to have an effect on all customers, the lesson may be very clear, that’s, make UTXO larger! For long-term storage, your UTXO have to be at least 0.01 BTC. Final 12 months we noticed over 300 sat/vB expenses and it will more and more develop into the norm. In that price market, multi-UTXO transactions with charges lower than 0.001 are mud. Do not be that particular person.

Mud could also be an afterthought to you at this time, and we’re fortunate to get returns with sub-50 sat/vB expenses, but when not managed at this time, mud might develop into a expensive drawback for you sooner or later. By understanding the connection between UTXO weight models and transaction charges, we achieve worthwhile insights into the decrease sure of UTXO measurement.

excessive mud

Modeling the mud threshold of UTXOs is an fascinating experiment as a result of it exhibits you ways loopy issues can get and at what level BTC turns to mud. For the desk beneath, we use the identical knowledge as above, 5 enter SegWit transactions with 1,528 weight models.

The desk illustrates the speed at which an quantity of BTC despatched in a 1,528-weight unit transaction will flip to mud.

Signal UTXO

One other vital discovering from all this analysis is the price of signing a single commonplace (P2PKH) UTXO. That is an excessive finish of microtrading because it is likely one of the smallest trades you may make. For this instance, we need to use commonplace scripts (non-Segwit) as it’s the heaviest script kind. particulars as follows:

- Normal (P2PKH) script kind

- 1 enter

- 1 public key

- 0 output

- 632 weight models

contract economics

Economics of signing a single commonplace UTXO with one signature, one public key and 0 outputs (weighing 632 weight models).

With this info, you may study concerning the lowest prices for Bitcoin transactions.

focus

- Mud threshold is decrease than you suppose, particularly in excessive transaction price markets

- When withdrawing BTC from an change, please think about ready till your stability is ≥ 0.01 earlier than sending to your storage.

- When you’ve got many small (< 0.001 BTC) UTXOs, you have to merge them into a bigger UTXO with a decrease price.

You don’t have a crystal ball, and there’s solely a lot you may management. BTC value, block house demand, hash value, hash fee, and Bitcoin typically are all out of your management. You management your keys, and the very best factor you are able to do is put together for the inevitable high-fee market. It can occur or Bitcoin will fail, I do not make the foundations. Do not let your valuable Bitcoins flip to mud. Keep in mind this, if you happen to do nothing, you’ll return to mud.

By the sweat of your forehead you’ll eat your bread till you come back to the bottom, from which you have been born. For you’re mud and to mud you’ll return.

– Genesis 3:19

Footnote

- UTXO (unspent transaction output): [n.]

A part of a Bitcoin transaction that represents the quantity of digital foreign money that has not but been spent and is obtainable for future transactions.

The output of a blockchain transaction can be utilized as enter to a brand new transaction, representing the quantity of cryptocurrency remaining after the transaction is executed. ↩︎ - Within the Bitcoin protocol, mud is a small quantity of foreign money that’s lower than the charges required for transactions. Though “economically unsound”, mud is commonly used to attain unconventional unintended effects quite than to change worth. ↩︎

- Ordinal inscriptions have been a phenomenon for over a 12 months now and have brought on big waves in Bitcoin. They’re melting some individuals’s brains, however will finally be priced out. ↩︎

- weight unit (n.) [Bitcoin]

A unit of measurement used within the Bitcoin community, launched particularly with the Segregated Witness (SegWit) protocol, to calculate transaction and block sizes.

A complete measure that considers each non-witnessed knowledge (resembling transaction inputs and outputs) and attested knowledge (resembling signatures) of a transaction. On this system, non-witness info is given larger weight than witness info.

The usual within the SegWit protocol enforces block measurement limits, with a most restrict of 4,000,000 weight models per block, permitting environment friendly and versatile allocation of block house. ↩︎ - Use Lopp’s open supply buying and selling calculator. Hyperlink↩︎