The next is an excerpt from the newest version of Bitcoin Journal Professional, Bitcoin Journal’s premium market publication. To be among the many first to obtain these insights and different on-chain Bitcoin market evaluation straight into your inbox, subscribe at the moment.

Final week, I put the extraordinary shopping for stress dealing with Bitcoin into context, however there may be one other (maybe largest) potential supply of demand getting into the scene.

We already know that Bitcoin ETFs, MicroStrategy issuing extra shares to purchase extra Bitcoin, continued shopping for of Tether, and the halving will all be main sources of demand this cycle. For instance, within the first two weeks of buying and selling alone, “New child 9” gathered 125,000 BTC. This loss has up to now been offset by GBTC outflows, however it’s unlikely that every one GBTC holders will probably be managed sellers exiting anytime quickly. This outflow ought to begin to taper off within the coming weeks.

A considerably sudden growth is going on throughout China. Readers of my content material right here and on bitcoinandmarkets.com is not going to be unfamiliar with what has been taking place in China over the previous few years. They’re experiencing the tip of an financial mannequin transformation. The China now we have come to know is constructed on debt, producing items for indebted overseas prospects. They rely closely on globalization and a extremely elastic financial setting. That period is coming to an finish, and the collapse of China’s actual property market and now its inventory market are clear indicators that this paradigm is over.

exist January On January 24, China Asset Administration, a big Chinese language fund administration firm and ETF supplier, suspended buying and selling within the Nasdaq 100 and S&P 500 ETFs to stem massive outflows from different funds and into these U.S.-related funds. On Tuesday, different U.S. inventory ETFs within the Chinese language market opened at each day limits, representing a 21% premium to internet asset worth. The inflow of safe-haven property has additionally affected China’s Japan ETF. ChinaAMC’s Nomura Nikkei 225 ETF rose greater than 6% on Tuesday, buying and selling at a premium of twenty-two%.

Chinese language traders are in full panic, whereas authorities are shutting them out. It’s solely a matter of time earlier than extra Chinese language traders begin making the most of Bitcoin’s retailer of worth and portability. Many Chinese language are already aware of Bitcoin. China was the primary supply of Bitcoin demand till the CCP banned Bitcoin in 2021.

Though Bitcoin stays formally banned in mainland China, traders can nonetheless use exchanges corresponding to Binance and OKX. They will additionally purchase over-the-counter, person-to-person, or by way of offshore financial institution accounts. Final yr, Hong Kong very publicly reopened Bitcoin. They’ve been following within the footsteps of U.S. regulators and giving Bitcoin official assist in Hong Kong. It’s unlikely that Hong Kong authorities would push so brazenly to legalize Bitcoin, solely to maneuver on to banning it subsequent yr.

This morning, a Reuters article quoted an government at a Hong Kong Bitcoin change confirming this capital flight story. “Spend money on Mainland China [is] There may be threat, uncertainty and disappointment, so folks want to allocate property abroad. […] Virtually each day, we see mainland traders getting into this market. ”

The supply added, “In case you are a Chinese language brokerage dealing with a downturn within the inventory market, weak IPO demand and different shrinking enterprise, you want a development story to inform your shareholders and board of administrators.”

We’ve been speaking about Bitcoin providing a budding parallel world, and now it’s being acknowledged all over the place.

Flows from China will probably be a major supply of demand this cycle, and U.S. approval of a Bitcoin spot ETF would create good synergy by permitting refined overseas traders to buy each Bitcoin and U.S. property.

We can also’t neglect the shaky European markets. Europe might already be in recession. As of December, EU manufacturing facility exercise had shrunk for 18 consecutive months. Regardless of a GDP forecast of -0.2% in 2023, Germany has narrowly averted a technical recession. In a world of capital flight and detrimental development, Bitcoin’s relative attractiveness may be very excessive. Many Bitcoin lovers concern {that a} recession will result in a inventory market crash, which can drive Bitcoin to unload like in March 2020, however the reverse could also be true this time. As traders understand that the outdated system has develop into stagnant and rotten, Bitcoin’s distinctive mix of attributes as a revolutionary expertise, mounted provide asset, and financial development potential will develop into a spot for capital to flee.

Bitcoin Value Replace

Bitcoin’s worth efficiency has been disappointing because the ETF’s launch. Nonetheless, costs have held up extraordinarily effectively in opposition to the backdrop of $1 billion value of GBTC being offered by the FTX receivers and different massive entities promoting GBTC to translate into decrease capital expenses for brand spanking new ETFs.

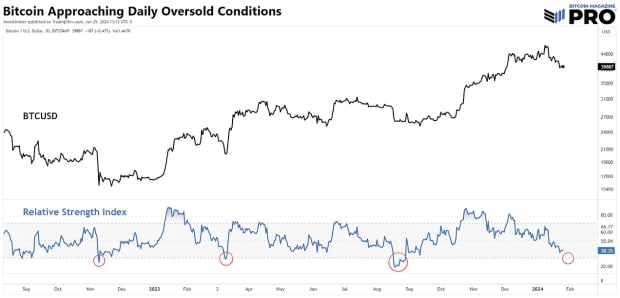

RSI is among the most generally used indicators and subsequently has the Schelling level impact. Folks and bots alike are watching to see if the each day RSI reaches oversold. Due to this fact, we might not see any important worth enhance till the RSI breaks above 30. This may be achieved by promoting to assist once more, as we’re already approaching 30 factors. A extra unlikely risk is that we may have a hidden bullish divergence forming the place worth makes a barely increased low, however the RSI makes a decrease low. I don’t count on any main detrimental penalties from the above confluence of calls for: we’re in a brief deadlock.

Persevering with to take a look at the each day chart under, however zooming in, we see that the 100-day EMA is at the moment offering assist. I am additionally watching the $37,877 stage; an necessary worth from November. Any dip that pushes the RSI oversold is probably going to not go under that stage.

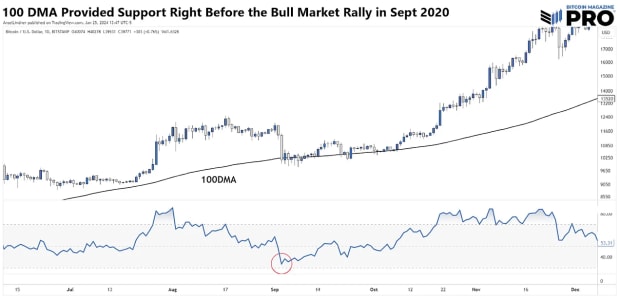

The 100-day shifting common typically doesn’t present a lot assist for Bitcoin, with the 50-day and 200-day shifting averages having probably the most affect. Nonetheless, what I present under is from September 2020, simply earlier than the large bull market rally that ended that yr. 100 Days was a star on the time. It’s doable to carry the 100-day line after which rebound on a pause within the GBTC sell-off. One other fascinating truth about this era in 2020: the RSI stopped being oversold, catching many individuals off guard because it soared increased. This is not my base case, however it does take priority.

On high of that, we’re seeing big new sources of demand for Bitcoin from ETFs and now capital flight from China. ETF issuance dynamics are complicated, however all issues thought of, costs are comparatively steady. It’s solely a matter of time earlier than demand turns into evident in worth.