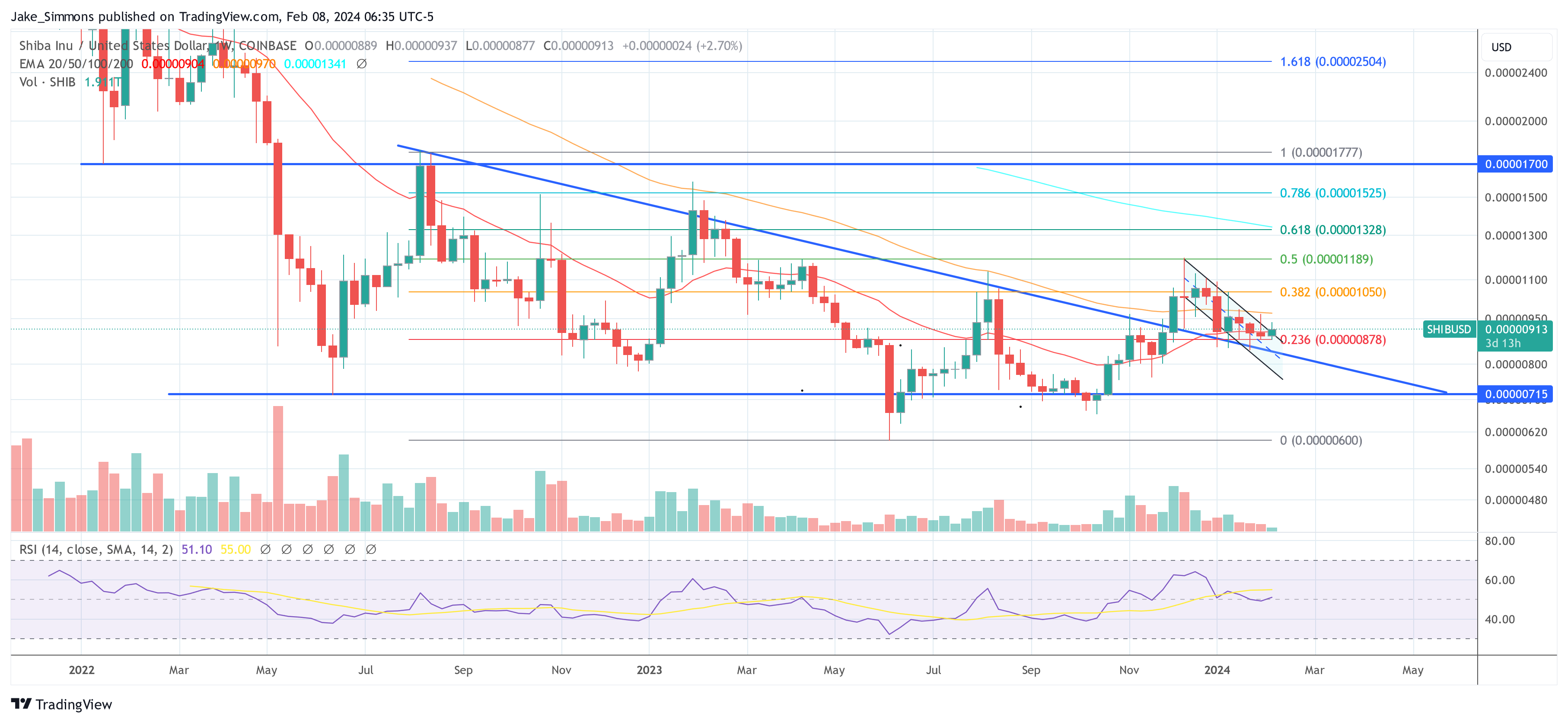

Shiba Inu (SHIB) costs have damaged out of the continued downward pattern that has dominated the previous two months. An in depth evaluation of the every day and weekly (SHIB/USD) charts reveals various key technical components at the moment influencing SHIB value motion.

Shiba Inu bull takes over

On the every day chart, SHIB has damaged out of the higher restrict of a descending channel sample that has been in place since reaching a excessive of $0.00001193 in mid-December. The channel, characterised by decrease highs and decrease lows, has been containing value motion, however a current surge in quantity and shopping for stress has allowed SHIB to interrupt out of this restrict.

The breakout was confirmed by a detailed above the 200-day exponential transferring common (EMA, blue line), which at the moment acts as assist. Nonetheless, the bulls nonetheless have some work to do because the 20-day, 50-day, and 100-day EMA converge at present value ranges (between $0.00000912 and $0.00000932).

Notably, Fibonacci retracement ranges plotted from the height to trough of current main strikes reveal the next key value ranges: The 0.236 stage ($0.00000878) stays a very powerful assist stage, adopted by the 0.382 stage ($0.00001050 ), which is the 0.5 stage at $0.00001189, and the 0.618 stage at $0.00001328 as the following key value targets. These ranges usually act as resistance throughout recoveries and are subsequently necessary targets for merchants to concentrate on.

The relative power index (RSI) on the every day chart is hovering across the 51 mark, indicating impartial momentum and a slight bias in the direction of shopping for stress. This leaves room for the RSI to climb increased earlier than reaching overbought circumstances, that are usually thought-about to be above the 70 stage.

Finish of integration part?

On the weekly time-frame, the bigger trendline is offering assist from an ascending triangle sample, indicating longer-term bullish sentiment behind the current bearish part. This assist line is essential because it has been revered many occasions previously, making it an necessary stage for long-term holders.

Sunday’s shut above the 20-week transferring common at $0.00000904 might pave the best way for large momentum. Consideration then turns to the 50-week transferring common at $0.00000970, signaling potential additional beneficial properties.

Through the breakout, quantity was comparatively excessive on each time frames, offering additional affirmation of the pattern. Nonetheless, merchants ought to stay cautious as excessive quantity can also precede volatility and a possible value pullback.

All in all, SHIB has clearly damaged out of a two-month downtrend, with speedy assist and resistance ranges recognized through EMAs and Fibonacci retracements. Merchants and buyers ought to pay shut consideration to those ranges to evaluate the sustainability of the breakout and the chance of a pattern reversal.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: This text is for academic functions solely. It doesn’t characterize NewsBTC’s opinion on whether or not to purchase, promote or maintain any funding, and funding naturally includes dangers. It is strongly recommended that you simply conduct your individual analysis earlier than making any funding determination. Use of the knowledge offered on this web site is completely at your individual danger.