David Krueger, cryptocurrency analyst at X, think Bitcoin (BTC) is about for an enormous rally, surging between 100% and 200% in 5 months, largely as a consequence of worry of lacking out (FOMO) as soon as Bitcoin breaks $50,000.

Will Bitcoin break $50,000 and rally to $100,000?

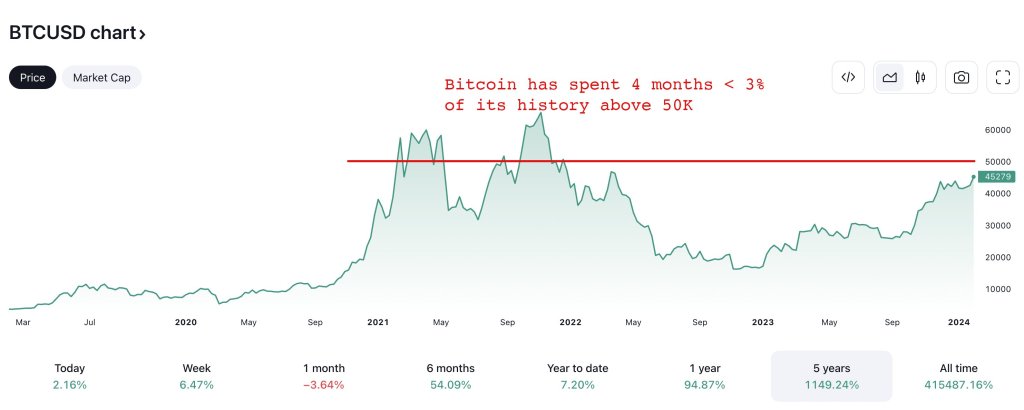

Krueger quoted Tom Lee’s historic evaluation and believed that FOMO normally happens when Bitcoin’s buying and selling value is larger than the worth stage “exceeding 97% of historic buying and selling days.” Lee is a co-founder and researcher at Fundstrat.

Taking a better take a look at the developments on the month-to-month chart, analysts level to the worth level at $50,000, a key psychological stage that bulls have failed to beat for the reason that mid-November 2023 bull run.

Subsequently, if Lee’s evaluation and the analyst’s assertions come true, Bitcoin value could rise within the coming buying and selling days. What stays unclear, nonetheless, is when Bitcoin will break by the $50,000 mark, paving the way in which for a decisive breakout of $100,000 and even $200,000 5 months later.

On the time of writing, Bitcoin costs are agency and rising. The coin is trending above $46,500 and will break above the January 2024 excessive round $48,700. Even so, it stays to be seen whether or not the present uptrend will trigger pleasure and probably even FOMO.

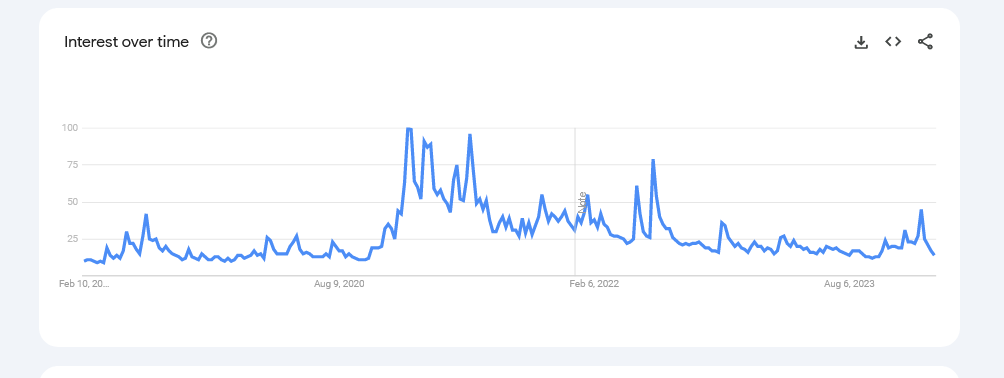

Taking a look at Google Traits knowledge and natural searches associated to Bitcoin, curiosity is disappearing.knowledge programme The variety of individuals trying to find Bitcoin in the USA has declined and is roughly on the stage of early 2021. Even so, round that point, Bitcoin costs began transferring larger, finally reaching a excessive of $69,000.

Halving and spot ETF issuers load extra tokens

Whereas FOMO appears elusive on spot charges, one other analyst discount Totally different views. In response to Krueger’s outlook, analysts famous that traditionally, sturdy curiosity in Bitcoin happens roughly six months after the halving and lasts as much as 18 months. This occasion, together with steady or growing demand, creates an imbalance between provide and demand that might drive up costs.

Bitcoin will halve miner rewards in early April 2024. This occasion might stabilize bulls and set the stage for extra beneficial properties that analysts are predicting.

Bitcoin might additionally edge barely larger given the tempo at which spot Bitcoin exchange-traded fund (ETF) issuers have been shopping for BTC over the previous few weeks for the reason that product was authorised in mid-January 2024.

As Wall Avenue gamers like Constancy, BlackRock, and different crypto corporations like Bitwise load up on extra cash, Bitcoin could develop into much more scarce than after previous halving occasions.

Function photos from iStock, charts from TradingView

Disclaimer: This text is for instructional functions solely. It doesn’t characterize NewsBTC’s opinion on whether or not to purchase, promote or maintain any funding, and funding naturally entails dangers. It is suggested that you just conduct your individual analysis earlier than making any funding resolution. Use of the knowledge offered on this web site is completely at your individual danger.