Bitcoin (BTC), the biggest cryptocurrency by buying and selling quantity and capitalization in the marketplace, has launched into a brand new journey Bullish uptrendIt regained misplaced floor and broke by way of resistance ranges, igniting investor optimism.

Bitcoin is presently buying and selling slightly below its 25-month excessive of $49,000 at $47,900, with the value surging greater than 6% in 24 hours and 11% over the previous seven days.

Charting Bitcoin’s Development Through the Pre-Halving Rally

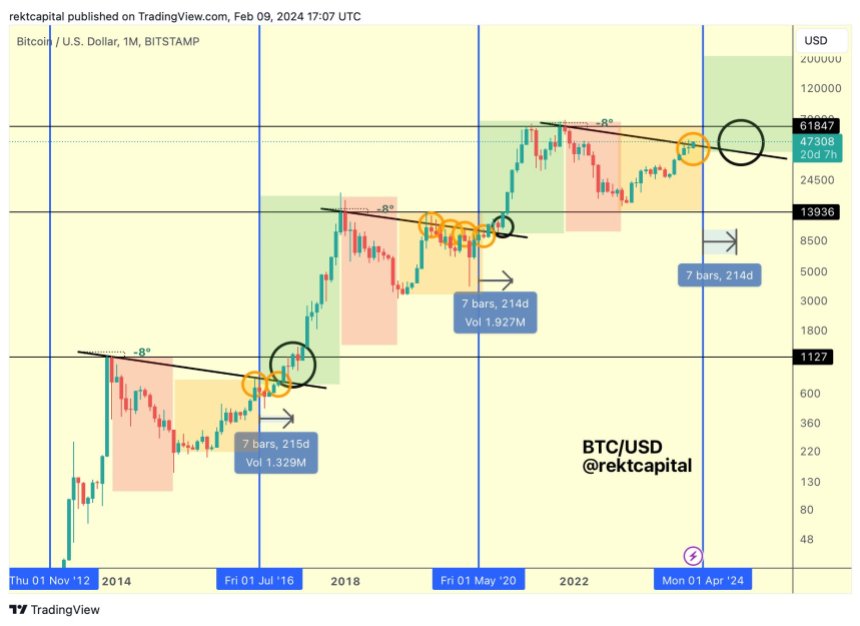

Nonetheless, amid the market pleasure, it’s essential to contemplate historic tendencies and their potential influence on Bitcoin’s trajectory forward of the upcoming halving occasion. Market knowledgeable and analyst Rekt Capital emphasize Two noteworthy historic patterns:

First, the “pre-halving rally” section appears to be starting. This section refers back to the interval when Bitcoin experiences a value surge earlier than the value of Bitcoin will increase. Halving occasion happen.

Secondly, historic knowledge reveals that Bitcoin has struggled to interrupt by way of macro diagonal resistance earlier than the halving, which Rekt believes is $47,000. Moreover, it has had hassle surpassing four-year cycle resistance, which is round $46,000 within the present cycle.

It’s price noting that even when the value has damaged by way of these resistance ranges, the uptrend should be thought of a consolidation or continuation as a result of retracement might occur and BTC value get caught between these resistances.

Given these historic tendencies, it’s attention-grabbing to discover how Bitcoin reconciles these patterns. Rekt Capital gives perception into one attainable path Bitcoin might take:

Bitcoin’s upside potential could also be restricted through the pre-halving rally, resulting in an upward pattern in late February. This sample has been seen in earlier months and in 2019.

After this, Bitcoin could construct one other scope Increased value ranges in March might put the altcoin rally into focus. Lastly, within the weeks main as much as the halving occasion, Bitcoin could expertise a correction, forming a pre-halving retracement.

This proposed path means that Bitcoin might surpass macro diagonal resistance with an ascending shadow, however stay beneath that resistance by way of month-end month-to-month candle closes through the winding down pre-halving interval.

Bitcoin bull indicator flashes purchase sign

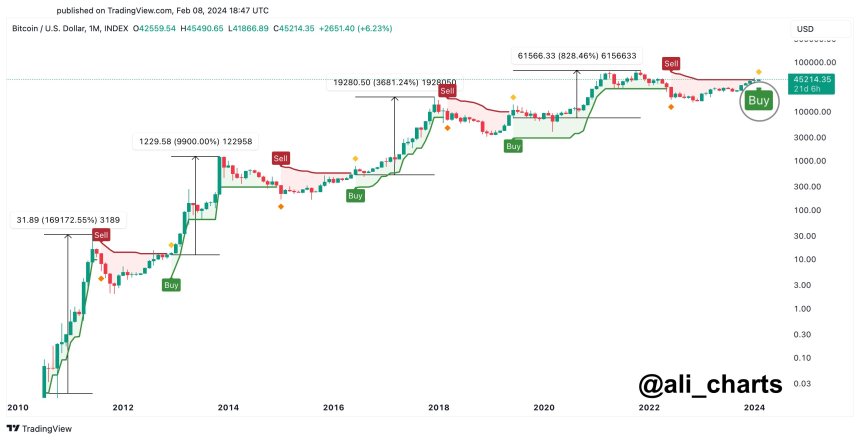

Cryptocurrency analyst Ali Martinez has added to the rising bullish sentiment surrounding Bitcoin by highlighting a key indicator that factors to a possible upward pattern.

in keeping with For Martinez, the supertrend indicator flashed a purchase sign on the BTC month-to-month chart. This software is understood for its correct predictions of bullish tendencies within the Bitcoin market.

This indicator’s monitor file emphasizes the significance of this purchase sign. Martinez identified that because the delivery of Bitcoin, the tremendous pattern has issued 4 purchase indicators, and all 4 indicators have been verified, leading to vital positive factors. These positive factors amounted to a formidable 169,172%, 9,900%, 3,680% and 828% respectively.

Nonetheless, amid the bullish outlook, Martinez additionally highlighted potential methods that might quickly influence Bitcoin costs.

in keeping with In keeping with the Bitcoin Liquidation Warmth Map, liquidity hunters could push the value of Bitcoin as little as $45,810. The intention behind the transfer was to set off a liquidation of as much as $54.73 million.

You will need to perceive that the aim of liquidity hunters is to make use of value actions to set off compelled liquidation of over-leveraged merchants.by way of strategically Decrease coststhey will pressure these merchants to promote their positions, inflicting cascading liquidations that may amplify downward value tendencies.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: This text is for instructional functions solely. It doesn’t symbolize NewsBTC’s opinion on whether or not to purchase, promote or maintain any funding, and funding naturally includes dangers. It’s endorsed that you simply conduct your individual analysis earlier than making any funding determination. Use of the data supplied on this web site is completely at your individual threat.