The value of Bitcoin has been rising over the previous few days, returning to the highs seen originally of the yr. Apparently, not solely is the worth of BTC rising, however the coin’s open curiosity has additionally seen vital progress over the previous few days.

Bitcoin Open Curiosity, primarily based on its motion, can typically predict the course of Bitcoin’s value within the close to future.

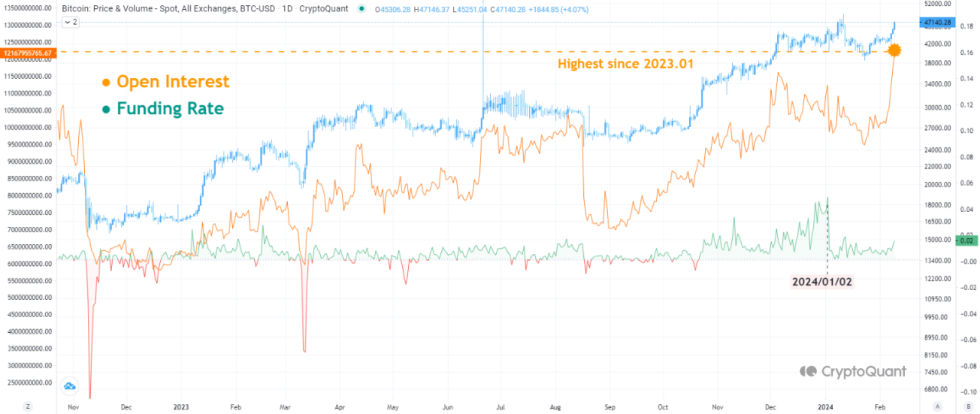

Bitcoin open curiosity surges to $12 billion

Based on the newest on-chain knowledge, Bitcoin holdings throughout exchanges have been rising quickly, comparable to the current value enhance. This indicator tracks the quantity of funds being pumped into BTC derivatives at any given time.

Knowledge from CryptoQuant exhibits that the token’s open curiosity exceeded $11.68 billion as of Friday, February 9. What’s much more attention-grabbing is that this quantity represents the best worth for this metric since Could 2022, which coincided with the notorious Terra Luna ecosystem collapse.

An nameless analyst offered an in-depth evaluation of the current surge in open curiosity and the way it impacts the worth of BTC in a CryptoQuant Quicktake publish. Whereas emphasizing that the current rise in Bitcoin open curiosity may very well be “indicative of short-term overheating ranges,” analysts famous that present funding charges go some technique to dispelling this argument.

A chart exhibiting BTC's open curiosity and funding fee | Supply: CryptoQuant

For context, a funding fee is a periodic cost between lengthy or quick merchants to make sure that the perpetual contract value stays near the spot value of the underlying asset, on this case Bitcoin. A constructive funding fee signifies that lengthy merchants are paying quick merchants, whereas a detrimental funding fee signifies the alternative.

Based on the writer of the Quicktake publish, funding charges are constructive, however that does not imply there’s severe overheating. The analyst added:

This implies that the ratio between lengthy and quick traders just isn’t unusually skewed, just like the regular October-November 2023 rally.

Nonetheless, CryptoQuant analysts warned {that a} sudden spike in Bitcoin funding charges to 0.05 might result in a bull squeeze. A protracted squeeze usually happens when lengthy merchants are compelled to promote their positions to cowl losses, inflicting a sudden drop within the value of an asset.

In the end, a rise in open curiosity is a constructive improvement for Bitcoin value, particularly as historic patterns present that Bitcoin’s worth tends to maneuver in the identical course as its open curiosity.

bitcoin value

As of this writing, the worth of Bitcoin is simply over $47,200, up 4% previously day.

Bitcoin value holds regular above $47,000 on the each day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView