The next is an excerpt from the most recent version of Bitcoin Journal Professional, Bitcoin Journal’s premium market publication. To be among the many first to obtain these insights and different on-chain Bitcoin market evaluation immediately into your inbox, subscribe immediately.

first 5 days

The launch of the Bitcoin spot ETF is an occasion that may go down in historical past. By all accounts, that is the biggest ETF product launch in historical past, beating the document set by the Proshares Bitcoin Technique ETF (BITO) launched in October 2021. First-day buying and selling quantity reached $4.6 billion, nonetheless comparatively robust in contrast with the standard decline seen after different merchandise are launched. Not like inflows, we’re assured about quantity. After the primary two days of buying and selling, the market was confused concerning the move as knowledge offered by TradFi was delayed and incomplete. Consultants like Eric Balchunas Bloomberg, indicating that it’s regular for the site visitors report back to be delayed by T+3 (three days later). Bitcoin is just not used to such poor transparency.

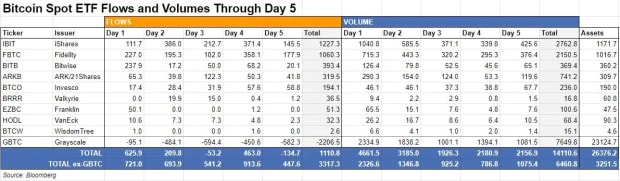

Within the desk beneath, you’ll be able to see that GBTC outflows have now exceeded $2 billion, with the biggest day being Day 3. Nonetheless, many of the site visitors on Day 3 is probably going as a consequence of transactions on Day 2, and the identical on Day 1, and so forth. We additionally can not decide whether or not all issuer data is updated. Is that this all their site visitors or have they not completed counting it but? We merely do not know.

Bitcoin fanatics are supplementing gradual TradFi knowledge by monitoring on-chain site visitors, which may take days. Wednesday morning, James Van Straten hidden slate The report states that 18,400 Bitcoins had been despatched from Grayscale to Coinbase’s Prime OTC desk on the open, following outflows of 9,000 Bitcoins on January 16 and 4,000 Bitcoins on January 12 within the earlier two buying and selling days. The intelligence firm’s on-chain knowledge Arkham is reliable, however the issue is that it doesn’t match the reported outflow. The three days of on-chain knowledge totaled $1.3 billion price of Bitcoin, whereas reported outflows had been solely $1.1 billion. Additionally, apparently, there have been no transactions on the morning of January 18th, however they resumed this morning.

Supply: Arkham @DylanLeClair_

Coinbase already has custody of Grayscale’s Bitcoin, so these are moved from their escrow account to an OTC desk the place different ETF market makers can withdraw the Bitcoin, which limits the impression on spot costs.

The GBTC sell-off could also be coming to an finish

Grayscale gross sales had been anticipated, however we nonetheless do not know what the ultimate gross sales numbers shall be when the mud settles. Will 100% of the cash come out slowly, or solely 10%? There’s hypothesis that the 1.5% expense ratio versus the 0.25% common expense ratio for different ETFs might lead folks to swap ETFs. If that had been the case, it would not translate into any web promoting. GBTC does have its charges lowered upon conversion, from 2% to the brand new 1.5%. If GBTC holders are holding giant quantities of unrealized beneficial properties, they could select to not promote till the subsequent rally. Understand that exchanges even have tax implications.

Many early sellers of GBTC did so for ideological causes. The reductions shaped in February 2021 shocked them and left them feeling trapped. The query is what number of Bitcoins is that? As of January nineteenth, GBTC nonetheless holds over 550,000 Bitcoins, what number of of them nonetheless really feel trapped? Why did not they simply swap it out just a few buying and selling days in the past? I feel it is much less frequent than folks suppose. Sure, in the event that they preserve charge ratios this excessive, all Bitcoin will ultimately be launched, however not in a sustained motion. I feel the dumping shall be unfold out over just a few large bull market rallies. The GBTC sell-off might have slowed, with the NAV low cost falling from 150 foundation factors on day one to 47 foundation factors on January 17.

bitcoin value

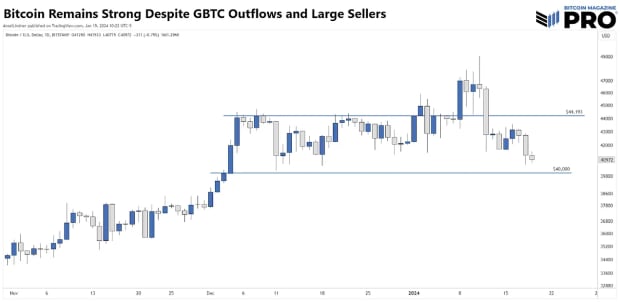

Talking of value, Bitcoin managed to carry on to the $40,000 help stage regardless of large outflows from GBTC and whale promoting. James Van Straten as soon as once more reviews {that a} whale who purchased at $48,000 through the 2021 bull run might have dumped 100,000 BTC on the asking value of $49,000 following the large retracement and FTX crash. For context, all ETFs besides GBTC are nonetheless buying and selling beneath 79,000 BTC. This isn’t a sell-off information occasion, it may simply be a post-breakeven whale sell-off. This implies continued shopping for stress on the ETF will solely be delayed by a couple of week.

We’re nonetheless inside the vary we’ve got been in since early December, however a break beneath that vary is now potential. My focus stays on $40,000 and the $44,193 line we’ve got been watching, which was created from the December 8 every day closing excessive.

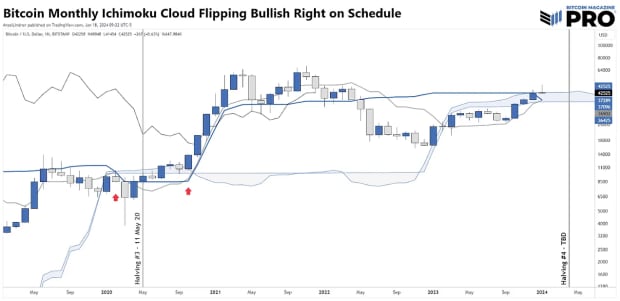

For these readers with a decrease time desire, the month-to-month Ichimoku cloud is popping bullish. That is a particularly bullish sign that solely happens initially of a Bitcoin bull run. It final occurred in October 2020, and the earlier one virtually flipped in February 2020 earlier than the coronavirus pandemic. Curiously, if it had flipped in February, it might be virtually an identical to immediately’s halving. Earlier than 2020, the one time this had occurred was in June 2016, firstly of a large bull market, and a month earlier than the July 2016 halving.

large shopping for stress within the background

Based mostly on the unfinished influx knowledge above, we are able to say that the typical every day shopping for stress, together with GBTC promoting, has exceeded $200 million per day. Curiously, day 4 was the second highest, including some proof to the speculation that purchasing stress may very well be flattening across the $250-300 million mark. To account for this quantity, Microstrategy has simply begun a four-month means of promoting $216 million in new shares to purchase extra Bitcoin. ETFs can do that in a day. Tether additionally retains shopping for Bitcoin as a reserve. Not too long ago, they reported a further $380 million in Bitcoin by the top of 2023. These ETFs exceeded that determine on two of the primary 5 days.

With all of those sources of giant demand in thoughts, take one other have a look at the month-to-month chart above. This market has a route to go. are you prepared?

In the event you like this text, Please like and share On social media so we are able to unfold our message! Thanks!