At the moment, discrete log contracts are an outdated idea on this subject, proposed by Thaddeus Dryja (co-founder of the Lightning Community Protocol) in 2017. DLC is a great contract construction that goals to unravel three issues with earlier contract options: first, the scalability of the sensible contract itself, which requires a bigger on-chain footprint to provide extra potential outcomes; second, dividing the The issue of knowledge outdoors the blockchain “getting into the blockchain” for contract settlement; lastly, the privateness of sensible contract customers.

The fundamental scheme could be very easy, two events create a multi-signature handle consisting of two individuals and select an oracle. After doing so, they create a set of contracts that work together with the oracle to execute the transaction. Suppose an oracle is saying the value of Bitcoin, and members are betting on the value of Bitcoin, then what the oracle is doing is issuing a set of commitments to the message it’s going to signal with a purpose to “announce” Bitcoin at a selected time s value. time. CET is constructed so that each signature on the CET supplied by one participant to a different participant is encrypted utilizing the adapter signature. Every signature that settles a contract at any given value can solely be decrypted utilizing data from the signature oracle message that proves that given value. Oracles merely publish their dedication to any information that acts as an oracle, and any participant can use this data non-interactively to create DLC. The ultimate half is a time-locked refund transaction, the place if the oracle by no means broadcasts the data required to settle the DLC, each events merely refund the cash after the time-lock interval that exceeds the validity of the contract expires.

This solves the three predominant issues that Tadge (Thaddeus) described within the unique DLC white paper: it’s scalable, requiring just one transaction to fund the contract and one transaction to settle it; it permits exterior information to be Bringing in blockchain; it solves the privateness challenge as a result of oracles simply blindly broadcast information to the general public they usually haven’t any means of understanding who’s utilizing them as an oracle in a contract. You may even use a federation of a number of oracles and if the values they show are shut sufficient to one another, the contract can settle accurately. The final essential factor to notice about DLC is that oracles incorrectly settling contracts is a really completely different mannequin than conventional escrow multisigs. In a custodial mannequin, an oracle can select to selectively hurt a single person by signing inappropriate settlement agreements. It’s potential to mitigate the reputational injury there, however within the DLC mannequin, the oracle can not do that. After they signal a message, that message will likely be used to settle each DLC related to that settlement message and time, so there isn’t any strategy to selectively do malicious issues to 1 social gathering as a result of they do not know who’s utilizing them.

Aside from the inevitable belief within the oracle, the one actual downside to this scheme is the coordination drawback. Relying on the character of the contract, equivalent to a guess on the value of Bitcoin versus a guess on a sports activities match (group X wins or group Y wins), there could also be a small quantity of CET, or there could also be a considerable amount of CET to cowl the whole lot. potential outcomes. This brings about two issues: First, if the transaction set is giant sufficient, community issues and DoS assaults might happen, thus losing individuals’s time attributable to incomplete contract settings; second, there could also be points with free selection, Requires on-chain transactions to course of. The free possibility challenge is that if the contract is established and finalized however the social gathering that finally will get the complete signature of the funds doesn’t broadcast it. This could permit them to fund DLC on-chain provided that it advantages them and never in any other case, and the one means for the opposite social gathering to get out of this case is to double their on-chain funding output.

DLC Market

LN Markets just lately printed an article describing the brand new DLC specification they’ve designed to tailor the DLC mechanism to institutional gamers. Current DLC-based venture suites are extra geared towards retail shoppers, which leaves room for design modifications to fulfill the wants of bigger institutional gamers.

A few of the points confronted by institutional purchasers are: the free possibility challenge, which isn’t acceptable in any such surroundings; the second is the dearth of margin calls, i.e. if one social gathering doesn’t have sufficient margin capital to pay its counterparty on the present value, then the place will likely be closed, or the social gathering will add the extra margin required to maintain the place open; and at last, the flexibility to make use of capital in a extra environment friendly method somewhat than locking capital in a single place from the start of the contract to the top.

To unravel all these issues, LN Markets launched the idea of DLC Coordinator. As a substitute of friends on the contract coordinating straight with one another to deal with the funding and negotiation of the contract, a coordinator can sit within the center and assist facilitate the method. This solves the free selection challenge fairly elegantly by having the coordinator facilitate contract negotiations. As a substitute of every peer interacting straight with one another to signal contract execution and financing transactions, they submit signatures for all of those to the coordinator. At any time, no single participant can receive the signatures required to fund the contract, thereby eliminating one’s means to have free selection. The Coordinator is the one particular person with two signatures, and to handle the difficulty of them colluding with the members or performing in dangerous religion and never submitting the Funding Transaction for different causes, the Funding Transaction includes paying them a price to behave because the Coordinator. This offers them a direct incentive to submit a funding deal as soon as the DLC has been negotiated and signed.

One other enormous effectivity is first mirrored within the coordination means of constructing DLC. And not using a coordinator concerned, members must talk with one another, trade addresses and UTXO messages, after which coordinate to arrange the DLC. By the coordinator, customers can merely register xpubs and a few UTXOs with the coordinator, in addition to their contract phrases quotes. When somebody accepts an current supply, the coordinator has all the data wanted to assemble a CET, which they’ll then merely present to the particular person accepting the supply to confirm and signal, then transmit the signature to the coordinator. The unique offeror will then obtain CET to confirm, signal and return as quickly because it goes dwell and decides to just accept the counterparty, and sends it again to the coordinator who can then merge the signatures and submit the funding transaction.

liquidation

Involving a coordinator can even present a dependable communication level, including the ultimate lacking piece to DLC utilized in knowledgeable surroundings: clearing and processing, including further margin.

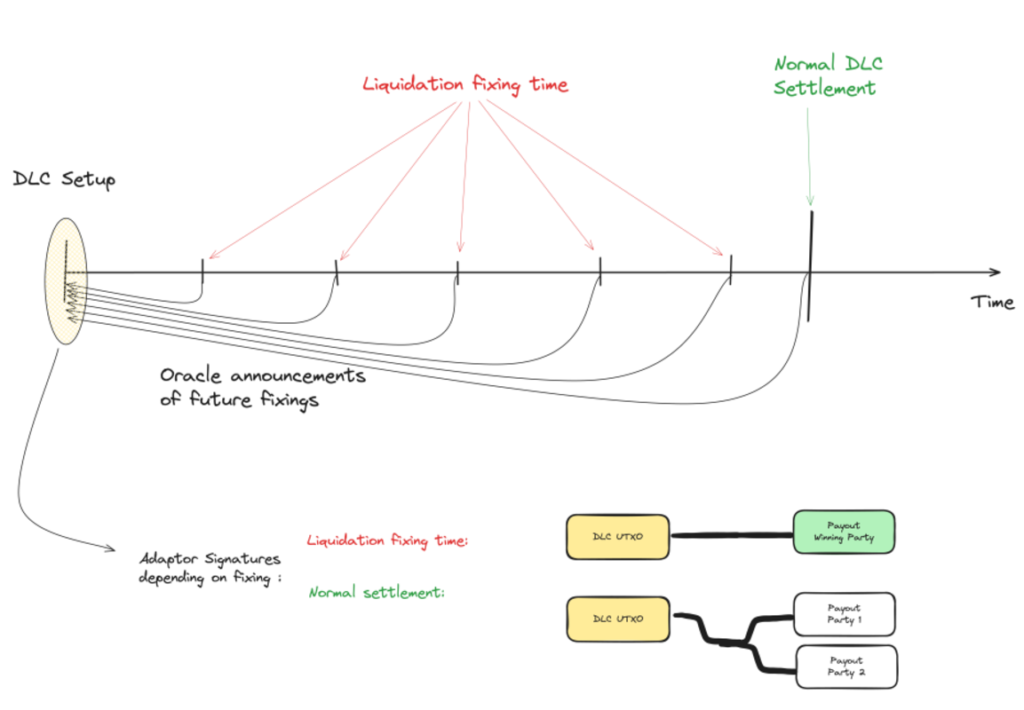

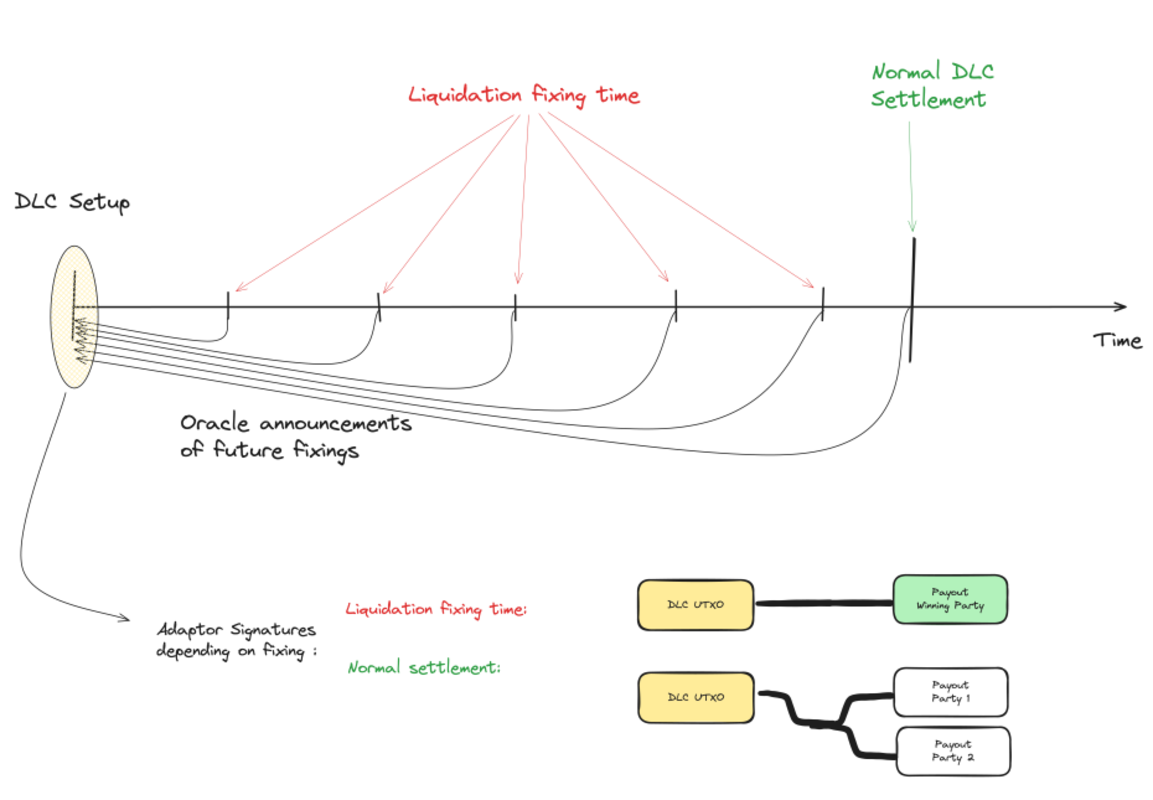

The article LN Markets wrote when saying the proposal included a pleasant white paper infographic, however I discover this infographic simpler to grasp. Along with all of the CET that comes with oracle messages for value bulletins that will happen at contract expiration, there are additionally particular settlement transactions within the interval earlier than the precise contract expiry, the intervals of which might be decided by the frequency of the oracles by the members. The machine publishes value information on the following areas. Every social gathering has a particular CET for every “liquidation time”, and if at any one of many liquidation occasions the value exceeds the contract vary (i.e. all funds are owed to 1 social gathering), they’ll merely submit this transaction and signal the contract as early as potential.

If at any level near liquidation time one social gathering is in liquidation, they’ll use a coordinator to coordinate including margin to the contract and permit the opposite social gathering to understand a few of the proceeds by withdrawing funds from the contract. It will contain each events collaborating to multi-signature spend the funds into a brand new DLC, which is able to obtain extra funds from the undercollateralized social gathering and permit the “successful” social gathering to withdraw some funds. In any other case, the brand new DLC will likely be set to the identical expiry time and the identical liquidation level earlier than that.

This dynamic brings these options extra in keeping with institutional investor expectations; the flexibility to handle liquidity extra effectively, permitting contracts to run out early if a celebration is undercollateralized based mostly on present market costs, and including extra collateral to account for upcoming liquidations occasion capabilities.

What is the massive deal?

To some, this may occasionally seem to be a sequence of very small and finally inconsequential tweaks to the unique DLC specification, however these small modifications take a few of the benefits of the sport earlier than it was utilized by retail shoppers attributable to its current shortcomings. One thing that doesn’t have a whole lot of potential on the market, and bringing it into the alliance may have the ability to fulfill the wants of a bigger pool of financial gamers and capital. If the Lightning Community is a large leap ahead for the transactional use of Bitcoin, then I feel it’s potential that will probably be an identical leap ahead for using Bitcoin by capital and monetary markets.

Not each use case for Bitcoin will likely be one that everybody likes or wants, and a few might even have externalities created for different use instances, however as an open system, that is the fact of how Bitcoin works. Anybody can construct on it. This proposal might not be a main use case for many individuals studying this, however that should not lead you to disregard the truth that it might develop into one thing very massive.