Cardano (ADA) made important progress within the fourth quarter (This autumn) of 2023, outperforming its rivals and gaining floor in Key indicatorsMessari reported.

Common every day buying and selling quantity surges in fourth quarter

this Report It was highlighted that ADA’s USD income elevated 66.7% sequentially, pushed not solely by ADA worth actions but additionally by a ten.6% sequential improve in ADA-denominated income.

As well as, Cardano’s treasury bond steadiness elevated by 2.6% month-on-month to 1.43 billion ADA, in line with the expansion development noticed in earlier quarters. At present, 20% transaction payment Donations to the treasury may be adjusted by way of governance.

One other key indicator, “transaction quantity,” exhibits that Cardano’s common every day transaction quantity elevated by 10.9% month-on-month, exceeding the 1.6% month-on-month improve in every day lively addresses. The ratio of transactions to lively addresses has steadily elevated over the previous yr, indicating a rise in energy customers.

Within the fourth quarter, the ratio commerce The variety of lively addresses grew 9.2% quarter-over-quarter and 45.0% year-on-year, reflecting a rise in common exercise per person as a result of introduction and improvement of varied protocols in 2023.

When it comes to shareholdings, lively shareholdings fell by 0.5% from the earlier quarter for the second consecutive quarter, reaching 22.8 billion ADA. Lively fairness additionally remained comparatively steady within the second half of 2023. Nonetheless, lively fairness and lively fairness fell 10.2% and 9.6% respectively from the identical interval final yr.

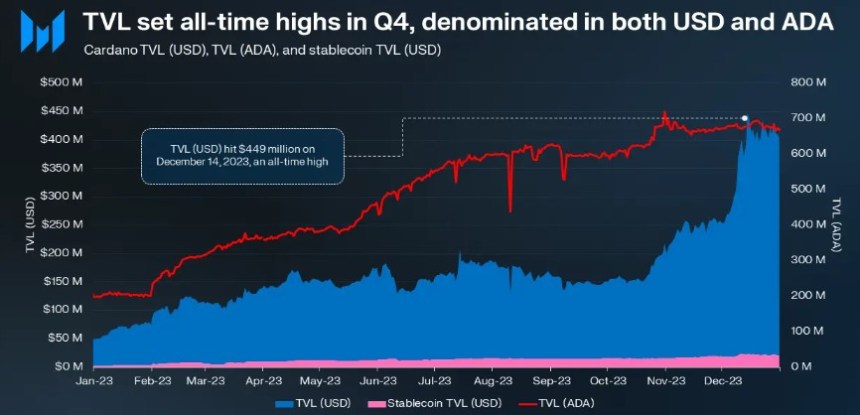

Cardano TVL reaches new milestone

As crypto winter thaws, the Cardano ecosystem’s USD whole worth locked (TVL) has surged, surging 166% month-on-month and 693% year-on-year.

Indigo turns into TVL’s largest settlement, surpassing clear swap. The TVL of stablecoins on Cardano elevated by 37% month-on-month and 673% year-on-year. As well as, it’s deliberate to launch Mehen’s USDM fiat-backed stablecoin in March.

It’s value noting that on December 14, USD TVL reached a file excessive of US$449 million, a development of 166% within the fourth quarter. The surge pushed Cardano’s TVL rating from fifteenth to eleventh in This autumn, in comparison with thirty fourth initially of the yr. TVL denominated in ADA additionally hit a file excessive, peaking at simply over 700 million ADA.

Based on the report, Cardano’s TVL development is primarily pushed by the introduction of recent stablecoins in early 2023, specifically iUSD and DJED. Stablecoins stay a key indicator of the well being of decentralized finance (DeFi), as the full worth locked in steady property grew 36.8% to $21.5 million. Cardano’s stablecoin market capitalization additionally rose from 54th to thirty second amongst different networks.

Nonetheless, Non-fungible tokens (NFT) exercise declined within the fourth quarter. The transaction quantity and transaction quantity within the NFT subject decreased by 8.0% and 33.8% respectively in contrast with the identical interval final yr. Yearly, NFT transaction quantity and transaction quantity have dropped considerably by 58.3% and 68.3% respectively.

The one indicator exhibiting development in 2023 is the variety of unbiased sellers, which elevated by 213.2% year-on-year, with a median of 270 unbiased sellers per day.

ultimately, Ada worth It soared 127.2% month-on-month, outperforming the general cryptocurrency market’s 53.8% improve. The surge within the fourth quarter resulted in ADA rising 145.2% yr over yr.

As of now, ADA continues to indicate important good points and is presently buying and selling at $0.5724. This displays a big improve of 5.5% over the previous 24 hours and a big improve of 8% over the previous 30 days. These numbers additional solidify the coin’s bullish momentum because the market heads into the center of Q1 2024.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: This text is for instructional functions solely. It doesn’t characterize NewsBTC’s opinion on whether or not to purchase, promote or maintain any funding, and funding naturally includes dangers. It is strongly recommended that you simply conduct your individual analysis earlier than making any funding choice. Use of the data offered on this web site is completely at your individual threat.