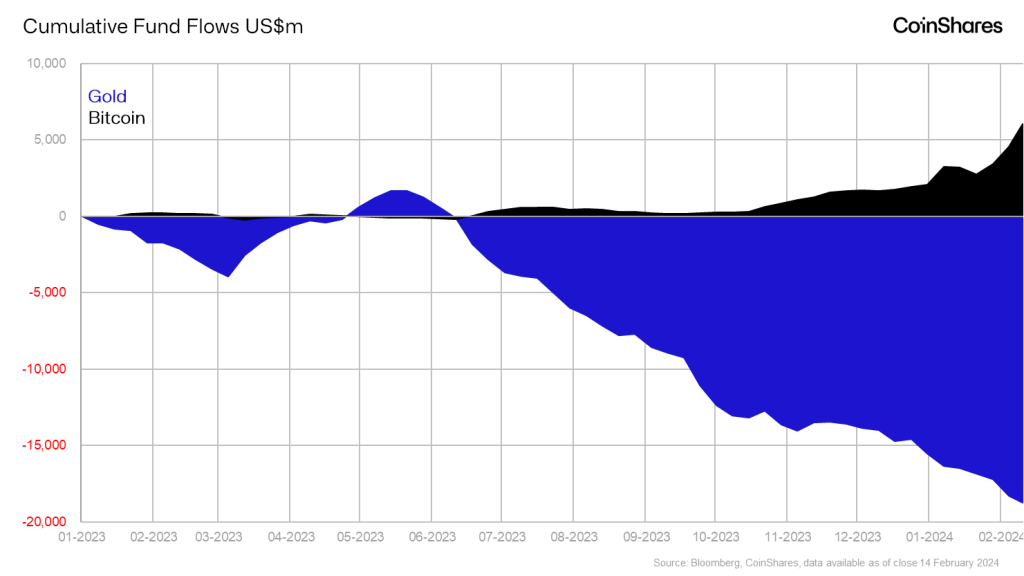

The funding panorama is altering dramatically as Bitcoin-focused exchange-traded funds (ETFs) obtain unprecedented inflows, in stark distinction to the large outflows from gold ETFs. The development highlights investor curiosity in digital belongings over conventional safe-haven belongings, marking a important second for asset allocation methods.

Gold is out, Bitcoin is in

Farside knowledge reveals that because the approval of 10 spot Bitcoin ETFs on January 11, cumulative capital inflows have reached US$4.115 billion, and transaction quantity has reached a document excessive. Simply yesterday, all ETFs noticed internet inflows of over 12,000, with BlackRock alone seeing a internet influx of 10,000 BTC. It’s price noting that each one spot Bitcoin ETFs have skilled internet inflows of greater than 10,000 BTC for 3 consecutive days.

In stark distinction, 14 main gold ETFs skilled a mixed $2.4 billion in outflows in 2024, with Bloomberg Intelligence analyst Eric Balchunas noting that the most important outflows have been from BlackRock’s iShares Gold Belief Micro and iShares Gold Belief, with quantities of US$230.4 million and US$423.6 million respectively. , respectively.

James Butterfill, Head of Analysis at CoinShares, if Perception into the altering dynamics states: “Regardless of the constructive value motion, gold ETP flows have underperformed. The information does recommend that a few of these outflows are going into Bitcoin ETPs.” This commentary means that the decline in gold funding is said to BTC There’s a direct correlation between elevated attractiveness to ETF buyers.

Bitcoin portfolio supervisor Monger additionally joined the dialog commented Relating to the most important switch of belongings, he mentioned: “Not solely is Bitcoin absorbing funds, however many ETFs are additionally shedding gold belongings below administration at an alarming fee. Bitcoin will drink gold’s milkshake, and will probably be sudden.”

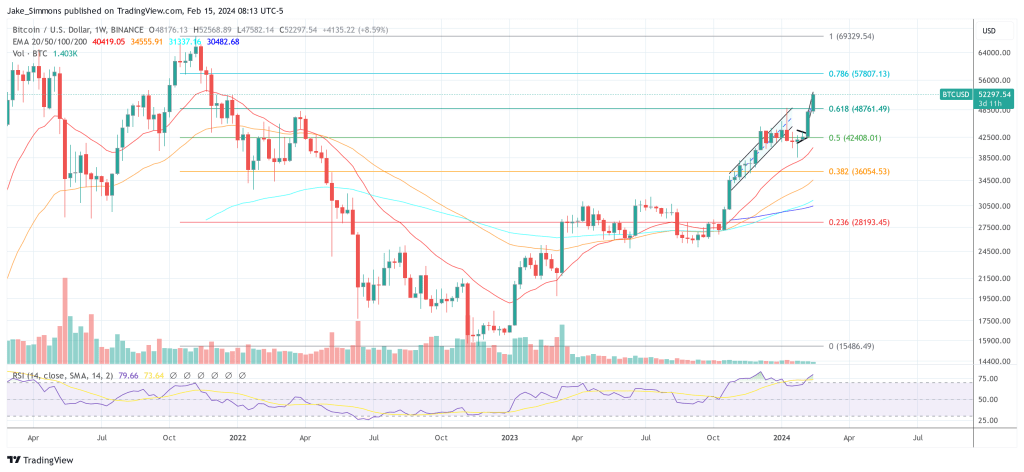

This shift is additional evidenced by BTC’s spectacular efficiency, up 22% because the begin of the yr and reaching a two-year excessive of $52,519 in the present day (Binance). In distinction, gold fell 3.3% over the identical interval, hitting a two-month low of $1,988 an oz yesterday.

Nonetheless, Bloomberg Intelligence’s Eric Balchunas supplied a extra dovish view, arguing that the development in gold ETFs could not fully shift in direction of Bitcoin.

“On the similar time, issues are fairly dangerous within the gold ETF class proper now… I don’t suppose these individuals are shifting to Bitcoin ETFs (possibly a bit of), however simply US fairness FMOs, though given the brand new ecological knowledge, that could be the case “Will reverse,” Balchunas mentioned, indicating that the broader funding development is because of worry of lacking out on U.S. shares slightly than a direct shift to BTC ETFs.

Goldbug continues to be in disbelief

This altering funding panorama includes not solely a shift in belongings but additionally a change in mindset.Bitcoin pioneer Jameson Lopp is provocative ask Joking concerning the well-being of gold investor Peter Schiff highlights the rising debate between conventional and digital asset buyers. McAlfred commented:

Bitcoin is rising sharply, up 4% on the final day and 25% within the final month. As anticipated, gold was within the pink on the day, down 3.3% yr so far. I am ready for the subsequent silly tweet from Peter Schiff who says one thing silly about Bitcoin’s imminent collapse because it has risen a lot.

In reality, Schiff nonetheless denies Bitcoin’s rise.Simply three days in the past, he claim”, “It seems to be like Bitcoin and ETFs are in for one more traditional pump and dump. The four-day convention begins with Tremendous Bowl Sunday and ends on Valentine’s Day. There may be a number of hype surrounding the newly listed Bitcoin ETF. I ponder when the bloodbath will start. “

At press time, BTC was buying and selling at $52,297.

Featured picture created with DALL·E, chart from TradingView.com