Fast shot

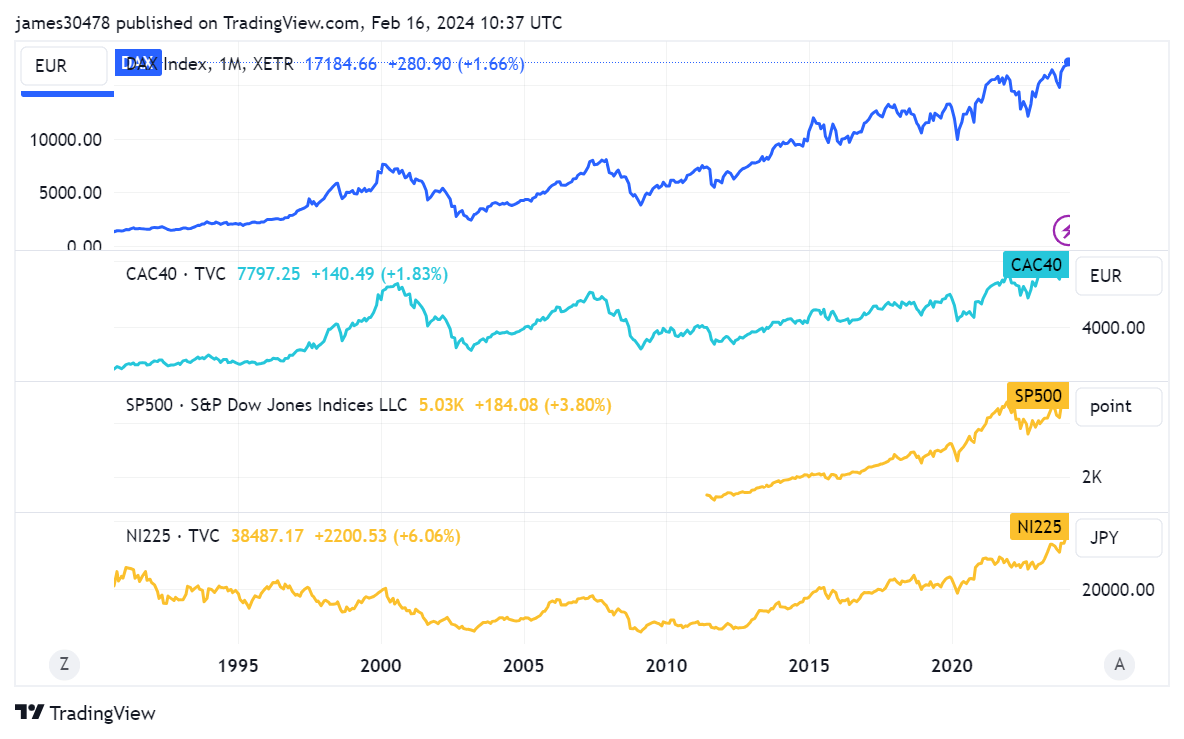

Whereas inventory market highs in main economies such because the US S&P 500, Germany’s DAX, France’s CAC40 and Japan’s Nikkei 225 level to prosperity, contrasting narratives of technical recession and rising inequality are rising.

Notably, the UK and Japan have entered technical recessions – outlined as two consecutive quarters of damaging development – with the latter dropping its standing because the third-largest financial system, based on Bloomberg.

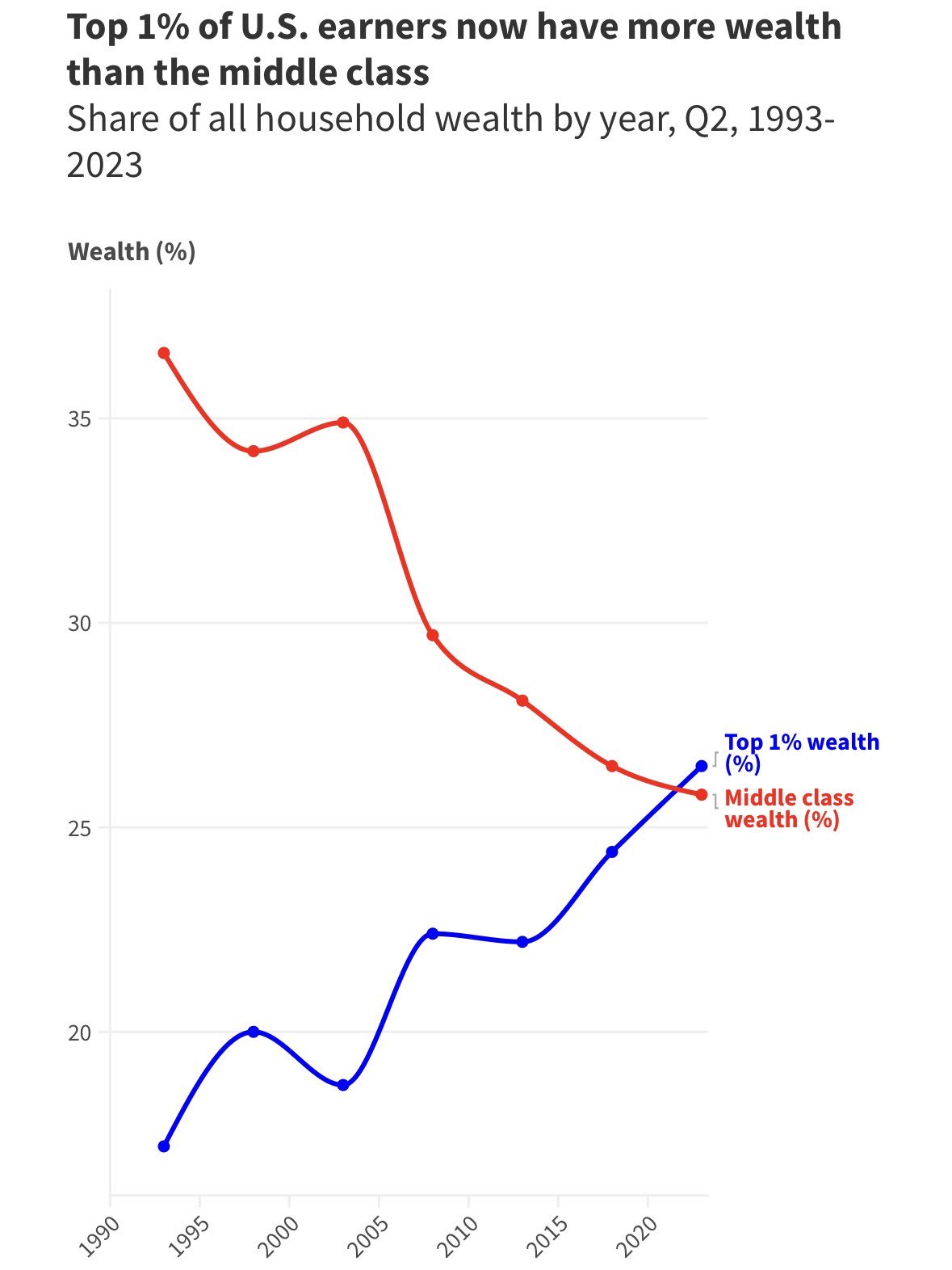

The dichotomy between booming markets and struggling economies may be attributed partly to the focus of wealth. In line with Geiger Capital, the richest 1% now formally personal extra wealth than the whole American center class. This wealth accumulation has been pushed primarily by inventory and actual property investments.

In the meantime, the specter of stagflation looms as most Western economies grapple with low or no development, excessive inflation and probably excessive unemployment. Though rates of interest have returned to traditionally regular ranges, america continues to wrestle with inflation. This altering financial panorama warrants comparability with earlier a long time of stagflation and subsequent gold efficiency. Will Bitcoin, the digital gold, replicate and even surpass this historic development?

The put up Wealth Focus Reaches New Peaks as Main Economies Slip into Recession appeared first on CryptoSlate.