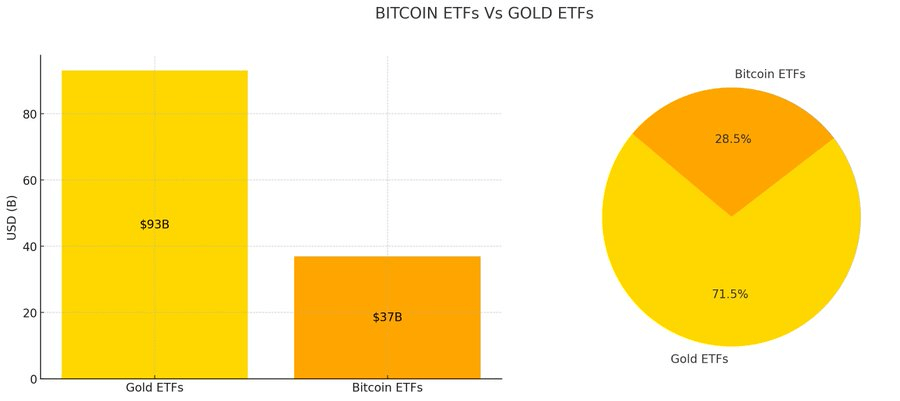

Market information exhibits that U.S. spot Bitcoin ETFs have amassed property underneath administration (AUM) of practically $37 billion within the first 25 days of buying and selling.

By the way in which, in accordance with information shared by Bitcoin Archive, the full AUM of Bitcoin ETFs accounts for a good portion of the full AUM of gold ETFs.

The Bitcoin spot ETF’s $37 billion in property underneath administration is equal to 39.8% of the gold ETF’s $93 billion in property underneath administration, and 28.5% of the 2 varieties of ETFs’ complete property underneath administration of $130 billion.

Bitcoin ETF Could Surpass Gold ETF

Bloomberg ETF analyst Eric Balchunas commented Concerning the ETF’s 25-day development, it was famous:

“Web flows to round $4 billion + rebound = overtaking gold a lot quicker than I anticipated.”

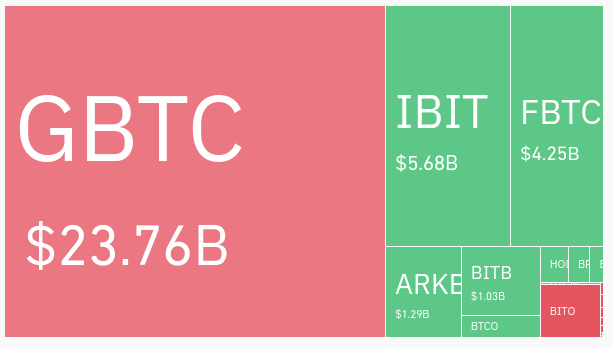

Nonetheless, he famous that the Grayscale Bitcoin Belief (GBTC) contained numerous property earlier than changing to an ETF, which implies the numbers are “not as spectacular as they could appear.”

Actually, the vast majority of spot Bitcoin ETF AUM is held by GBTC, adopted by BlackRock’s iShares Bitcoin Belief (IBIT) and Constancy Smart Bitcoin Belief (FBTC).

Balchunas mentioned an increase in flagship cryptocurrency costs to all-time highs may trigger these ETFs to overhaul gold merchandise quickly. Nonetheless, he admitted that this final result is determined by the worth of Bitcoin as a “big variable” and {that a} downward pattern within the value will imply that it’s going to take “for much longer.”

By different metrics, spot Bitcoin ETFs are at present outperforming gold ETFs.

CryptoSlate evaluation exhibits that gold ETF outflows have reached $3 billion to date this 12 months, and spot Bitcoin ETFs have seen inflows of $4.1 billion since their launch.

It is unclear whether or not these traits could have an enduring impression on AUM.

The publish Spot Bitcoin ETF AUM Reaches $37B About One-Third Gold ETF Belongings appeared first on CryptoSlate.