On-chain knowledge from Glassnode reveals that short-term Bitcoin holders lately participated in an enormous profit-taking occasion price $647 million.

Brief-term Bitcoin holders lately realized big web earnings

Based on knowledge from on-chain analytics corporations glass nodeBrief-term holders reacted strongly to a break above $52,000. “Brief-term holders” (STH) right here confer with Bitcoin buyers who bought Bitcoin throughout the previous 155 days.

Statistically, the longer an investor holds a token, the much less seemingly they’re to promote at any level. STHs are held for comparatively quick intervals of time, making them simple to promote throughout value will increase or crashes.

However, “long-term holders” (LTH) (i.e., customers who’ve held on for greater than 155 days) who make up the remainder of the person base are usually very decided.

Since STH’s ideas are fickle, it is not stunning that they noticed some promoting motion after the asset’s newest rally. One technique to measure this group’s response is thru the Internet Realized Good points and Loss metric.

This indicator tracks the online revenue or loss realized by buyers by means of the Web. The indicator finds this worth by checking the on-chain historical past of every token at present transferred towards its beforehand transferred value.

Assuming that the final switch modified fingers and the present switch undergoes one other such change, the sale of the coin will notice a revenue or loss equal to the distinction between the 2 costs.

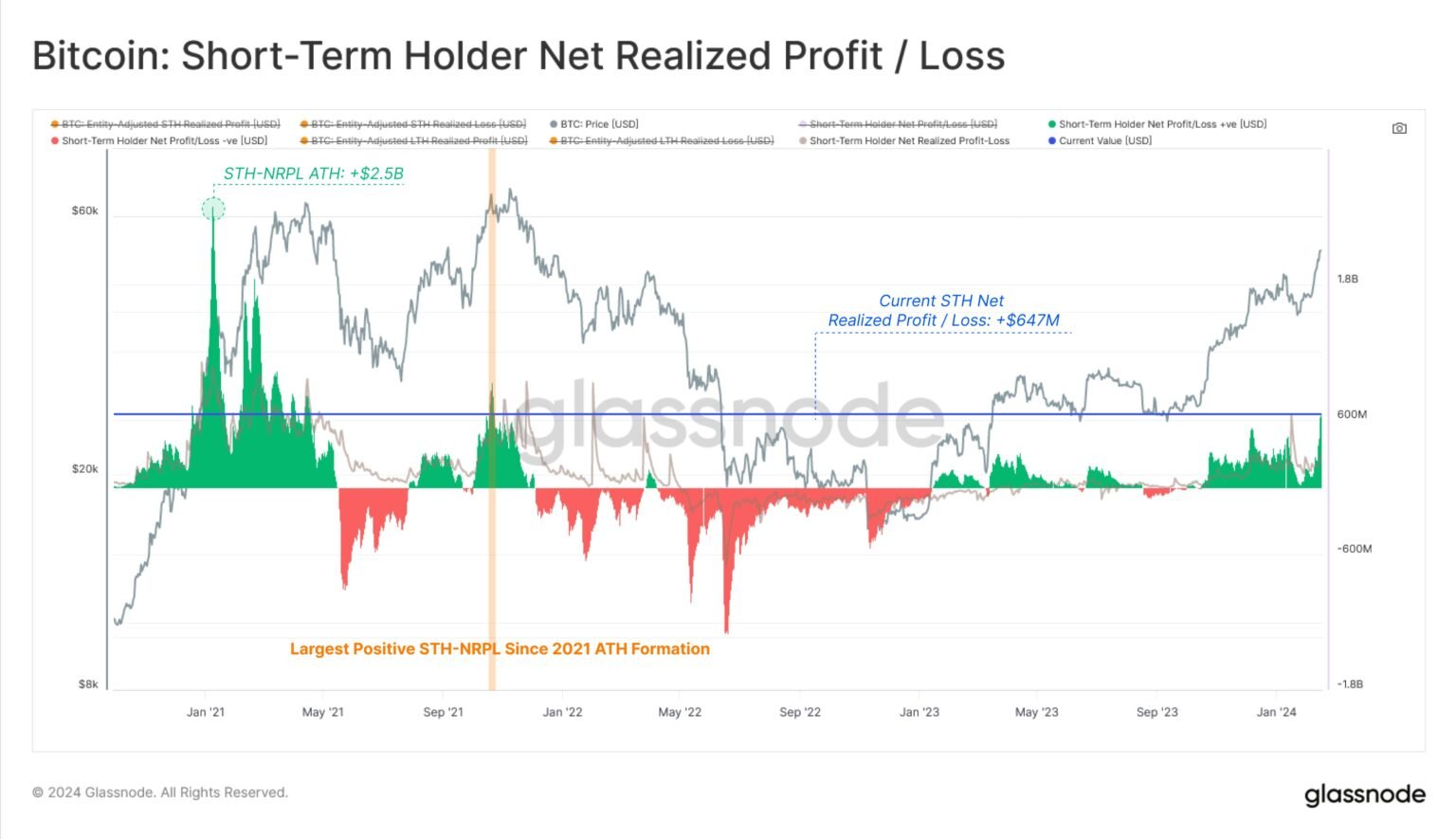

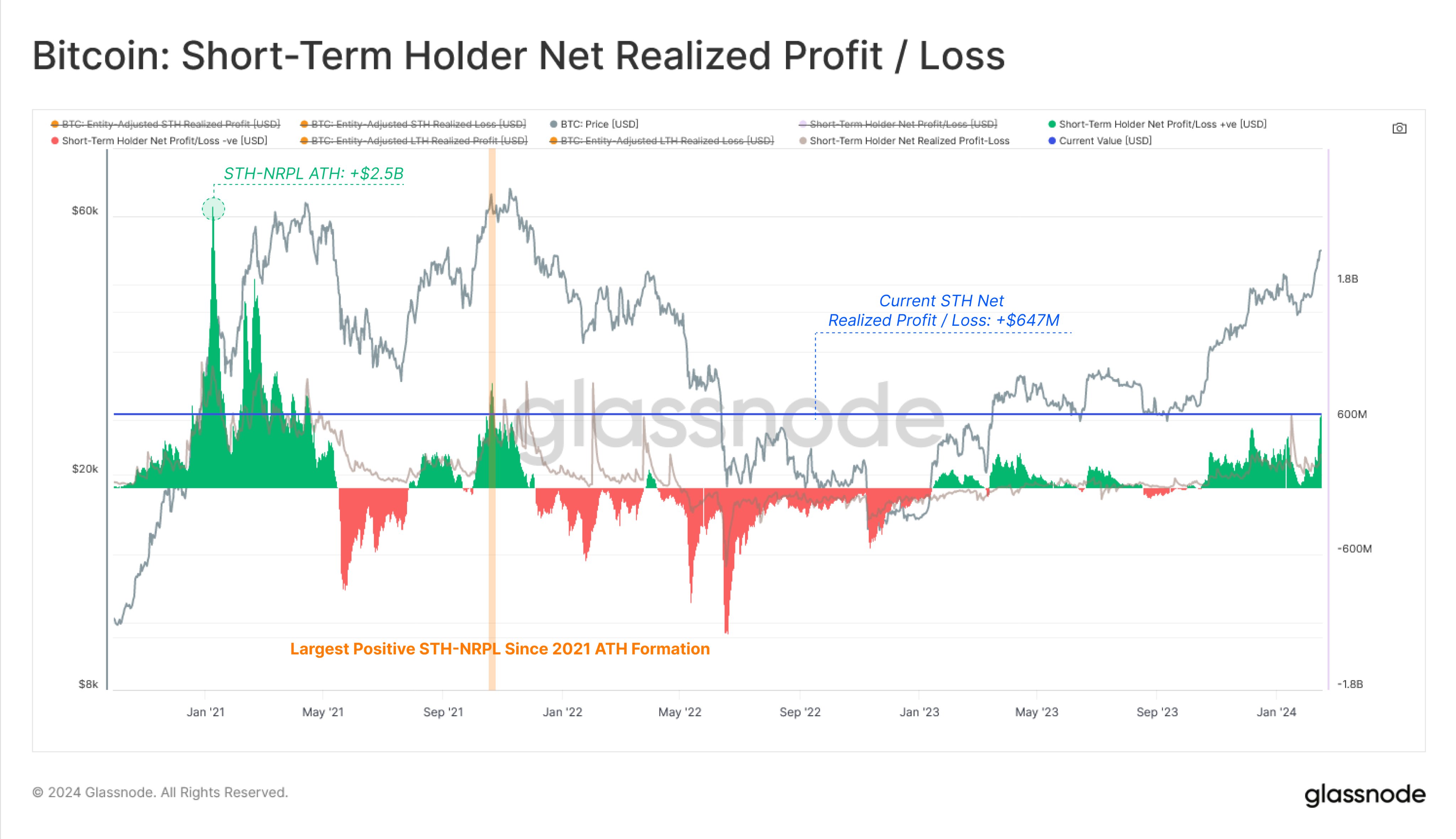

Internet realized good points and losses provides up all such good points and losses and outputs the online worth. Now, the chart beneath reveals the pattern of this indicator particularly for Bitcoin STH over the previous few years:

Seems to be like the worth of the metric has been considerably constructive in current days | Supply: Glassnode on X

As proven within the chart above, Bitcoin STH’s web realized good points and losses have lately surged to very constructive ranges, which means these buyers’ earnings have considerably outweighed their losses.

In the course of the current sell-off, the group posted a web revenue of $647 million. This chart reveals that the final time this indicator was in increased constructive territory was across the formation of the 2021 all-time excessive.

The present worth doesn’t deviate from this commonplace, however it’s nonetheless removed from the online revenue and loss degree of STH that rebounded within the first half of the 2021 bull market. To place issues into perspective, the metric peaked at $2.5 billion, which stays the metric’s all-time excessive.

bitcoin value

Bitcoin has calmed barely in sideways commerce over the previous few days since its fast surge above $52,000. At present, BTC is buying and selling at round $52,500.

The worth of the asset appears to have slowed down within the final two days or so | Supply: BTCUSD on TradingView

Featured photographs from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com

Disclaimer: This text is for instructional functions solely. It doesn’t characterize NewsBTC’s opinion on whether or not to purchase, promote or maintain any funding, and funding naturally entails dangers. It is suggested that you simply conduct your personal analysis earlier than making any funding determination. Use of the knowledge offered on this web site is completely at your personal threat.