With Bitcoin value concentrating on 2022 highs forward of the 2024 halving, the cryptocurrency market appears very optimistic. A significant factor was the U.S. Securities and Alternate Fee’s (SEC) approval of a spot Bitcoin ETF in January. Regardless of widespread preliminary skepticism amongst buyers and merchants inside and out of doors the cryptocurrency area, issues have since modified.

This is an in depth evaluation of Bitcoin ETFs to this point, and the important thing classes we will study from the methods of the world’s largest asset managers.

Not an incredible begin, however be affected person

The SEC’s choice is very anticipated within the coming months. The market is trying to Bitcoin spot ETFs to draw U.S. retail buyers by means of an reasonably priced, protected and controlled funding automobile.

Regardless of continued demand, the SEC has constantly rejected such purposes, citing issues a few lack of investor safety attributable to unregulated exchanges figuring out Bitcoin costs. As BlackRock CEO Larry Fink stated in a tweet six months earlier than the choice:

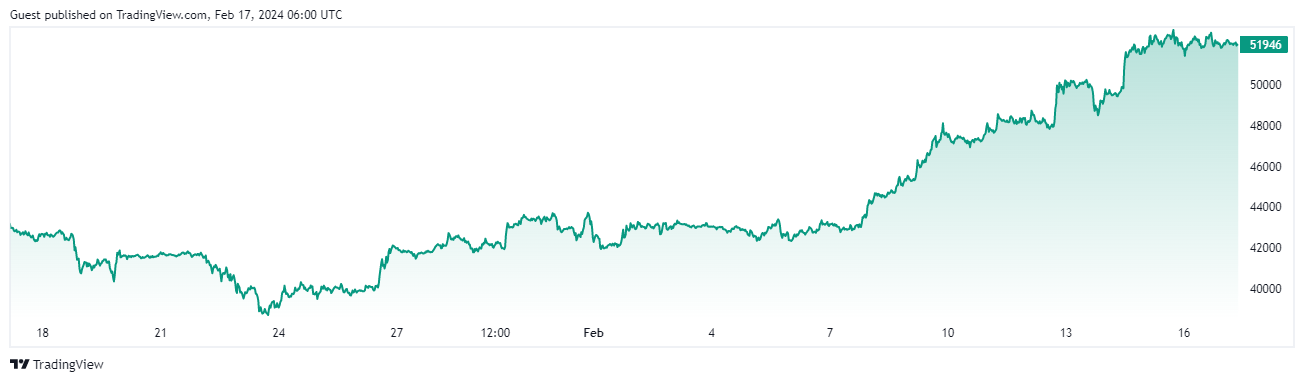

The cryptocurrency’s value initially fell round 15% following the SEC’s approval as main Wall Road gamers together with BlackRock launched a spot Bitcoin ETF. Nevertheless, to this point, there may be proof that BTC ETFs are attracting new capital into the market.

Lately, buyers have been capable of buy Grayscale’s Bitcoin funding fund GBTC at a reduction to its web asset worth attributable to withdrawal restrictions. Nevertheless, GBTC has seen $4.3 billion in outflows for the reason that SEC permitted Grayscale’s conversion to an ETF, seemingly attributable to profit-taking on earlier investments made at a reduction to web asset worth. This places downward stress on Bitcoin costs.

JPMorgan stated a lot of the outflows represented profit-taking slightly than a transfer to cheaper spot Bitcoin ETFs. The remaining $1.3 billion may have been moved to competing low-cost ETFs, nevertheless it’s unsure whether or not buyers have been merely promoting for various property.

Nonetheless, JPMorgan believes that the approval of a U.S. ETF will considerably change the market construction of Bitcoin. The launch of a spot Bitcoin ETF may enhance market depth and liquidity, making the worth discovery course of extra environment friendly.

As well as, Grayscale’s plan to launch a coated name Bitcoin ETF could additional improve market depth and liquidity, and if permitted, could profit GBTC and the Bitcoin derivatives market.

One month later, BTC value surges

The present surge in Bitcoin is pushed by rising curiosity in numerous exchange-traded funds (ETFs) from institutional buyers equivalent to BlackRock (BLK) and Franklin Templeton (BEN), with BlackRock main IBIT Contribution almost US$500 million.

Institutional demand for Bitcoin has been rising, particularly with the stellar debuts of two main spot BTC ETFs from BlackRock and Constancy. In accordance with Bloomberg analyst Eric Balchunas, these ETFs collected greater than $3 billion in property underneath administration within the first month of buying and selling, setting a brand new report for ETF issuance.

The spot Bitcoin ETF as an entire has bought greater than 200,000 BTC, equal to a price of almost $9.5 billion. In accordance with knowledge from Coinbase (COIN), $1.1 billion flowed into spot Bitcoin ETFs final week, marking the biggest weekly influx so far.

James Butterfill, director of analysis at CoinShares, identified that regardless of the lackluster launch of ETFs, continued inflows from newly issued funds point out rising natural demand for Bitcoin.

CoinShares knowledge exhibits that the newly permitted Bitcoin ETF attracted about $3 billion in web flows, though greater than $6 billion has been withdrawn from the product since Grayscale transitioned to the ETF.

present capital influx

Inflows into distinguished Bitcoin exchange-traded fund (ETF) merchandise stay sturdy, with inflows throughout numerous merchandise rising by almost $630 million on Tuesday. BlackRock’s IBIT led the way in which, bringing in almost $500 million, solidifying its place as the highest supplier among the many 11 ETFs. Internet inflows into Bitcoin ETFs have surged, averaging over $500 million since February 8 and totaling over $2 billion over the previous 4 days.

Excluding Grayscale’s Bitcoin Belief (GBTC), these ETFs have collected greater than $11 billion value of Bitcoin. Analysts famous that outflows from GBTC are step by step easing, lowering promoting stress and boosting bullish sentiment. Bitcoin costs climbed above $51,000 on Wednesday, rising 2% previously 24 hours, whereas the CD20 index rose 0.8%.

Some merchants cited technical evaluation and institutional shopping for predicting an increase to $64,000 within the brief time period. Alex Kuptsikevich, senior market analyst at FxPro, highlighted the emergence of a Fibonacci sample, predicting a goal of round $63,700. Whereas this marks an all-time excessive, Kupzikovich expects additional beneficial properties, though a big correction is predicted.

In January 2024, BlackRock’s Spot Bitcoin exchange-traded fund (ETF) surged to $1 billion in property throughout the first 4 days of buying and selling, in accordance with JPMorgan Chase, making it probably the most not too long ago launched to trace spot Bitcoin costs. The primary fund amongst ETFs to succeed in this milestone. The U.S. Securities and Alternate Fee (SEC) final week permitted almost a dozen ETFs tied to the world’s largest cryptocurrencies, marking a serious shift in regulation after years of resistance.

BlackRock and Constancy have attracted the majority of inflows since going public, benefiting from decrease charges and model recognition. BlackRock’s iShares Bitcoin ETF (IBIT.O) had $1.07 billion in property underneath administration as of Jan. 17, in accordance with JPMorgan Chase, adopted intently by the Constancy Sensible Origin Bitcoin ETF with $1.07 billion in property underneath administration. $874.6 million.

A complete of 9 newly launched ETFs attracted $2.9 billion in funding flows within the first 4 days of buying and selling. Nevertheless, the Grayscale Bitcoin Belief, which transformed from a closed-end fund to an ETF, fees greater charges than the not too long ago launched ETF and skilled $1.62 billion in outflows throughout the identical interval.

BlackRock’s (BLK) iShares Bitcoin Belief (IBIT) has shortly amassed greater than $1 billion in Bitcoin, reaching the milestone in simply 5 days after the ETF debuted on January 11. Whereas spectacular, it is nonetheless decrease than the report set by SPDR Gold Belief (GLD) in 2004, which hit $1 billion in simply three days.

Rachel Aguirre, head of U.S. iShares merchandise at BlackRock, famous on Bloomberg TV that IBIT is attracting funds from quite a lot of sources, together with retail and proprietary buyers.

Whereas retail curiosity in spot Bitcoin ETFs stays modest, accessibility performs a job, with some brokerage companies like Vanguard not providing these merchandise or providing solely restricted choices. Nonetheless, analysts count on the spot Bitcoin ETF market to develop considerably, predicting it may attain $100 billion. Mark Yusko, CEO of Morgan Creek Capital, believes that these new merchandise can promote the influx of as much as $300 billion into the Bitcoin market.

Wall Road whales emerge

Wall Road’s embrace of Bitcoin is obvious as main monetary companies race to get into the cryptocurrency market. BlackRock CEO Larry Fink and Cantor Fitzgerald’s Howard Lutnick have each expressed optimism about Bitcoin’s future. Corporations equivalent to Invesco, VanEck and Franklin Templeton are utilizing social media to specific their assist for Bitcoin, with tweets and profile updates reflecting their enthusiasm for the cryptocurrency.

Nevertheless, skeptics see this enthusiasm as a ploy to generate charges slightly than a real perception in Bitcoin’s potential. Vanguard Group and JPMorgan stay cautious, with Vanguard declining to supply a Bitcoin ETF on its platform. On the identical time, regulatory points have grow to be more and more distinguished, with FINRA citing potential violations by brokerage companies concerning encryption-related communications.

This shift in perspective marks a departure from the previous, when Wall Road distanced itself from cryptocurrencies. Now, monetary companies are echoing the cryptocurrency message, emphasizing Bitcoin as a hedge towards authorities intervention and inflation. Because the monetary business more and more embraces cryptocurrencies, questions stay about its position on Wall Road and the potential dangers concerned.

As cryptocurrencies proceed to realize traction in conventional finance, issuers stay optimistic that mainstream buyers will step by step allocate a part of their portfolios to merchandise equivalent to Bitcoin ETFs, along with conventional inventory and bond investments.

Brown Brothers Harriman Managing Director Tim Huver believes that over time, as Bitcoin ETFs construct longer observe data, there can be particular allocations to them . Kathy Kriskey, senior various ETF strategist at Invesco, recommended that buyers may begin by reallocating a small portion of their fairness publicity to Bitcoin, stressing the significance of transferring from zero to a average allocation. .

Regardless of optimism about Bitcoin, some analysts stay cautious about its continued upward momentum. Jim Angell, a college member on the MacDonald Psaros Heart for Monetary Markets and Coverage in Georgetown, highlighted the volatility of Bitcoin costs, which is pushed by each believers and skeptics out there. He identified that on-line discussions lacked give attention to Bitcoin’s basic worth, and that these discussions primarily targeted on short-term technical evaluation.

General, whereas optimism stays about Bitcoin’s future, analysts stress the significance of understanding the alternatives and dangers related to investing in cryptocurrencies.

By no means full retail?

At present, retail buyers primarily purchase cryptocurrencies by means of ETFs that commerce cryptocurrency futures. Nevertheless, the launch of a spot Bitcoin ETF will present buyers, particularly retail buyers, with a direct approach to put money into Bitcoin with out the necessity for a Bitcoin pockets.

Different monetary companies equivalent to JPMorgan Chase & Co. supply comparable portfolio evaluation expertise to advisers, reflecting rising competitors within the wealth administration business. As regulatory adjustments and investor calls for reshape the business, companies are more and more turning to progressive methods to retain advisors and entice buyers.

In accordance with the Wall Road Journal, BlackRock’s CEO stated the corporate has been working with Circle for greater than a yr. BlackRock, which has greater than $9 trillion in property underneath administration, is wanting broadly on the cryptocurrency area, together with stablecoins, digital property, permissioned blockchains and tokenization, pushed by rising shopper curiosity.

in conclusion

The excessive degree of confidence within the Bitcoin spot ETF highlights its significance, and within the monetary world, market sentiment dominates. Regardless of preliminary public skepticism, BlackRock and different distinguished funding establishments have made it clear that the way forward for digital property is intently tied to Wall Road.

As an institutional investor, BlackRock is not simply trying to launch new merchandise for short-term beneficial properties. As an alternative, they validate their long-term digital asset technique by securing the biggest market share within the business. No matter one’s stance on conventional finance versus digital property, it’s crucial to acknowledge Wall Road’s strategic acumen.

Wanting again on the improvement of the cryptocurrency market this yr, a number of fundamental ideas for long-term funding methods emerged:

- Develop a long-term technique primarily based on rationale.

- Keep on with your technique, even when it appears unsuitable at first.

- Assume like a whale.

- Find out how huge cash works.