Final week, Bitcoin rode final fall’s bullish wave above the coveted $52,000 degree. Bitcoin has recouped almost all of its losses because the FTX collapse, a big milestone for an business that has struggled to emerge from a bear marketplace for a lot of the previous 12 months.

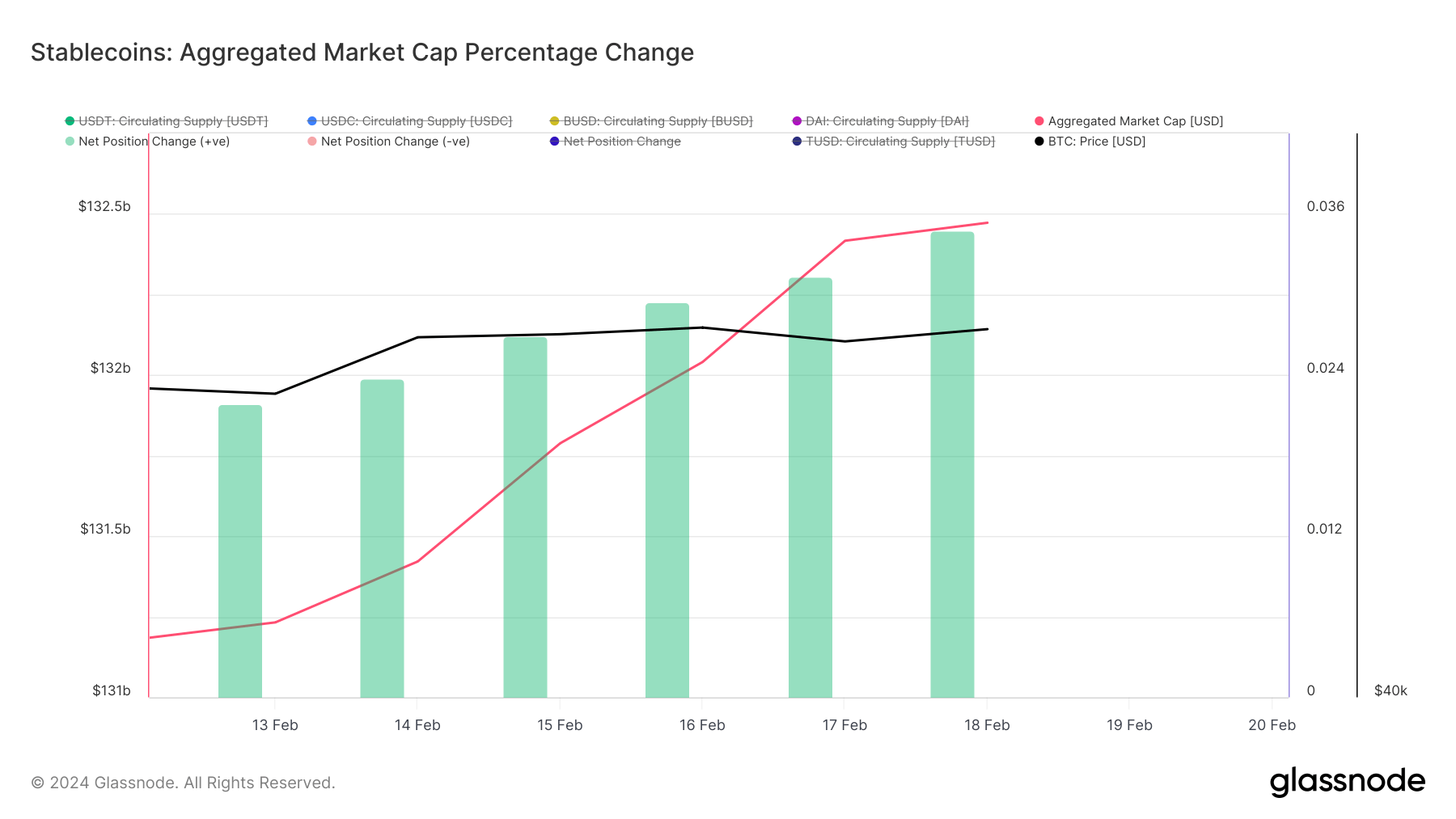

Together with Bitcoin’s upward momentum, the whole market capitalization of main stablecoins has additionally elevated, particularly USDT, USDC, BUSD and DAI. Between February 13 and February 18, the whole market capitalization of the 4 stablecoin giants elevated from US$131.232 billion to US$132.472 billion, demonstrating rising demand.

Stablecoins function a bridge between fiat and cryptocurrency markets, constituting nearly all of cryptocurrency buying and selling pairs and subsequently nearly all of market liquidity. The rise in market capitalization displays larger adoption of stablecoins and reaffirms their standing as the popular medium for interacting with cryptocurrencies.

Zooming out reveals that the availability of the highest 4 stablecoins has elevated by 3.475% prior to now 30 days. The rise in provide could possibly be attributable to quite a lot of elements, however it’s almost definitely the results of a market-wide push to maneuver property, whether or not fiat or crypto, into stablecoins in preparation for buying and selling. This implies that the market is anticipating exercise within the coming weeks and getting ready for a quicker entry into or exit from Bitcoin.

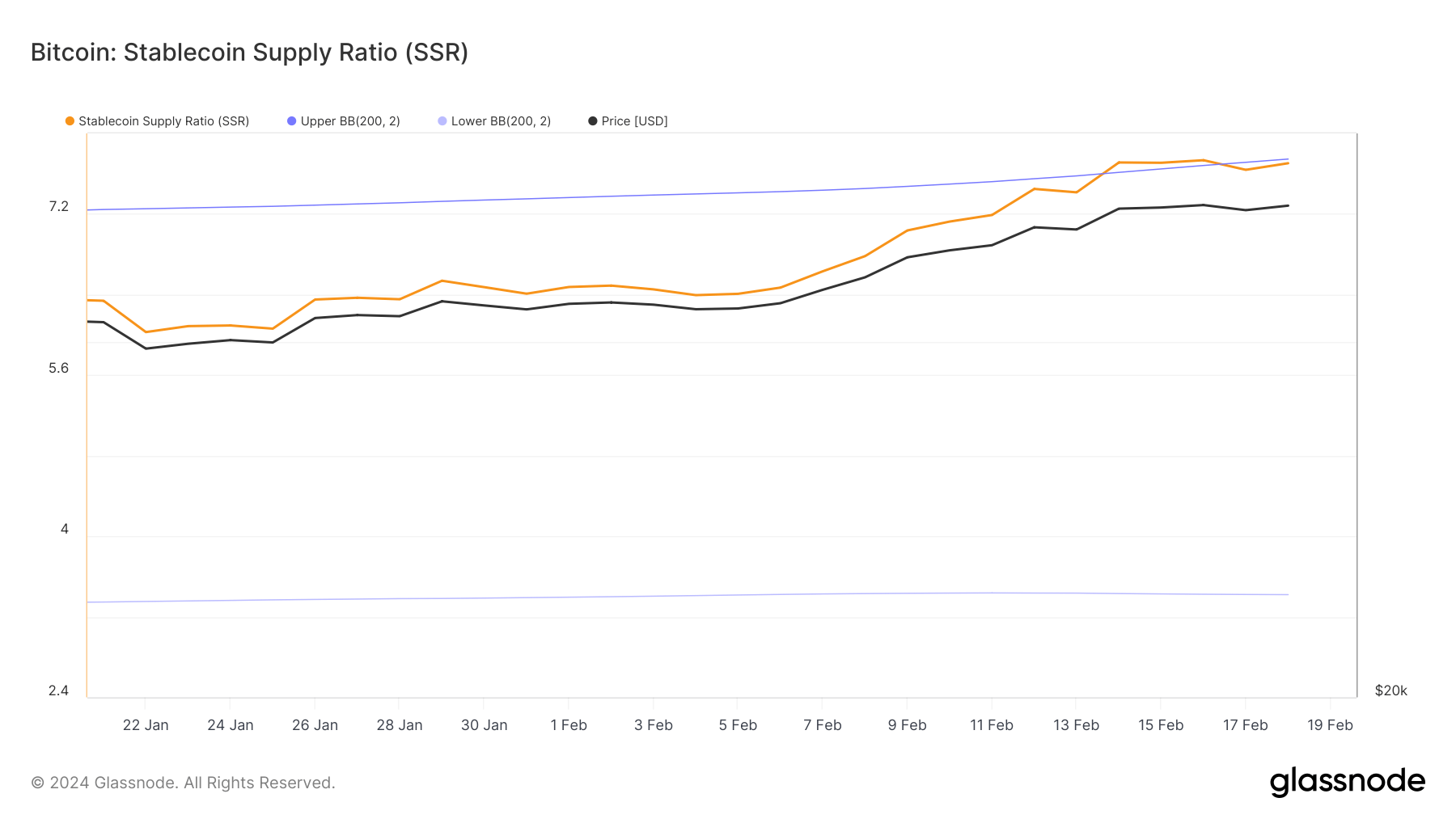

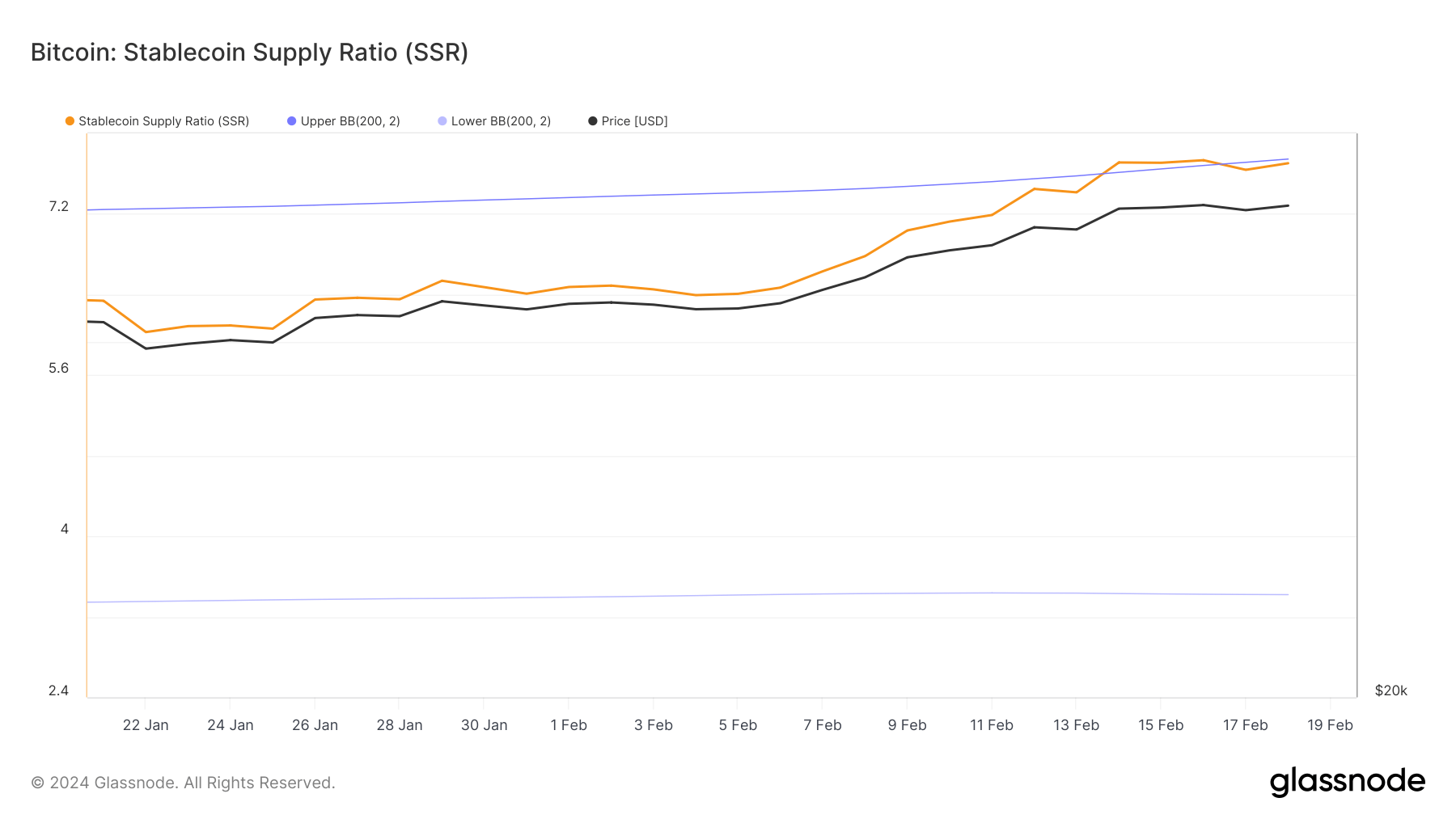

That is additional supported by the numerous improve within the Stablecoin Provide Ratio (SSR). SSR is a key measure of stablecoin provide relative to Bitcoin’s market capitalization, displaying the depth of market liquidity and the market’s potential buying energy. A better SSR signifies that there are extra stablecoins relative to Bitcoin, so if the stablecoin provide is transformed into Bitcoin, the potential buying energy may drive Bitcoin’s value up.

The SSR was above the higher Bollinger Bands between February 14 and February 16, indicating an uncommon improve in underlying buying energy and presumably indicating that traders have been getting ready to maneuver to Bitcoin or different cryptocurrencies, which is according to the Bitcoin value noticed throughout 2019 The rise is constant. this era.

The rising value of Bitcoin, mixed with the rising market capitalization and provide of main stablecoins, reveals capital flooding into the market. For stablecoins, the noticed traits spotlight their crucial function within the ecosystem, not solely serving as a protected haven in periods of volatility but in addition as an vital automobile for capital deployment into Bitcoin.

Final week’s traits confirmed how linked the stablecoin market is to Bitcoin, and the way adjustments in stablecoin provide and market capitalization function indicators of future market exercise.