Information from on-chain indicators suggests that the majority altcoins have now fallen into the historic “hazard zone,” which could possibly be a bearish signal.

Altcoins could also be overbought proper now as merchants’ income soar

in a brand new postal On X, on-chain analytics agency Santiment mentioned how altcoins as an entire have lately noticed excessive income primarily based on the MVRV ratio.

Market Cap to Realized Worth (MVRV) Ratio is a metric that tracks the ratio of market cap to realized market cap for any given cryptocurrency.

The “realized cap” right here refers to a capitalization mannequin that assumes that the precise worth of any token in circulation isn’t the present spot worth of the asset, however the worth of its final transfer on the blockchain.

Since any token’s earlier transaction was seemingly the final time it modified fingers, the earlier worth will function its present value foundation. Subsequently, the realized worth principally illustrates the associated fee foundation of each investor available in the market.

As a result of the MVRV ratio compares an asset’s market capitalization (i.e., the entire worth buyers at present maintain) to its realized cap (the worth holders have put into the token as an entire), it may well inform us one thing about cryptocurrencies usually. Traders’ profitability.

Traditionally, buyers holding massive income (i.e. a excessive MVRV ratio) have been an indication that the asset is overheated, whereas buyers holding losses have indicated that the asset is underbought. Primarily based on this historic sample, Santiment defines “alternative” and “hazard” areas for the market.

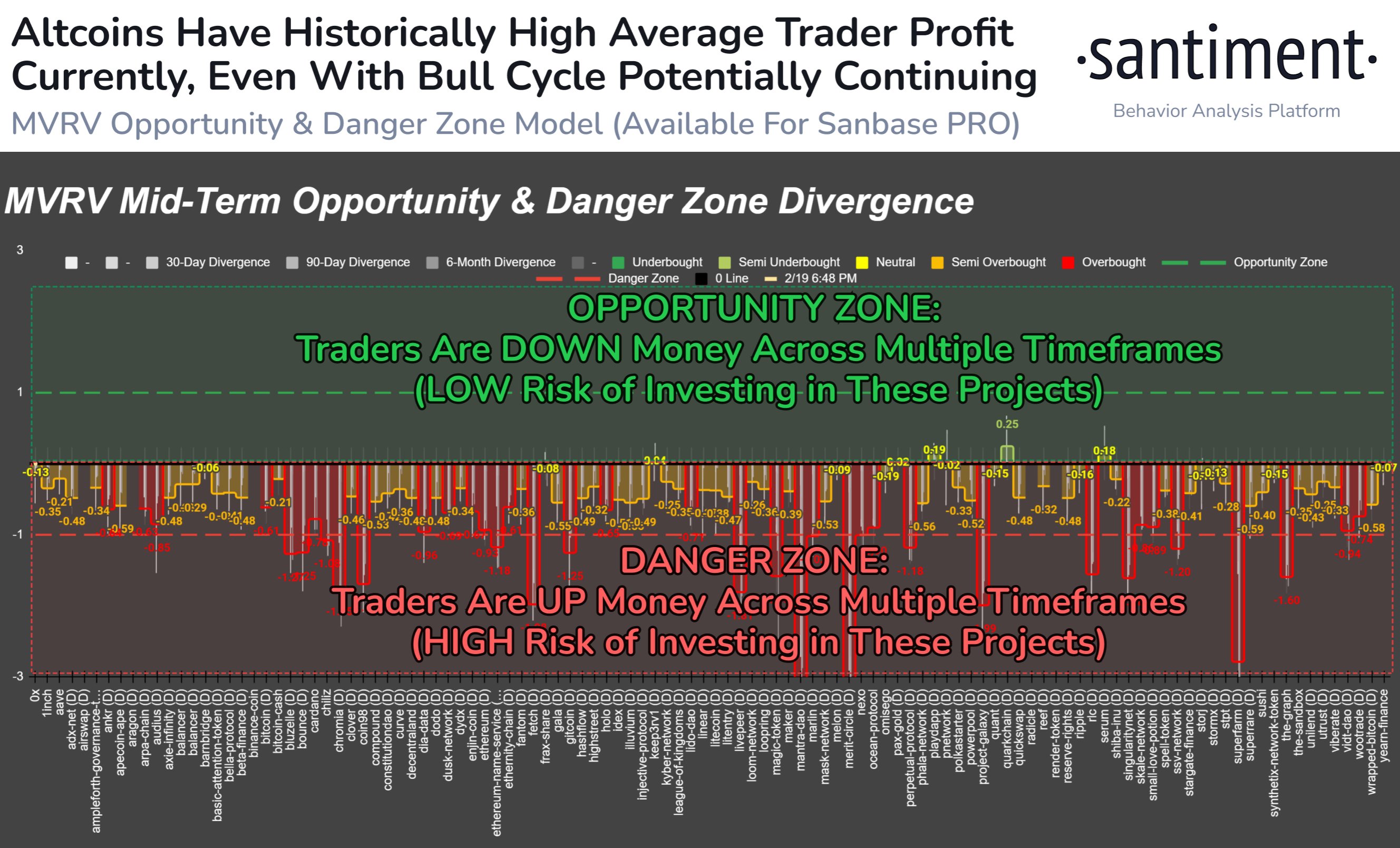

The chart under exhibits a measure of the distinction in MVRV ratios throughout totally different timeframes and varied altcoins:

The worth of the metric appears to have been detrimental for all of those altcoins | Supply: Santiment on X

In keeping with Santiment’s mannequin, a deviation of the MVRV ratio to the -1 mark (from the conventional 0% worth) signifies that the underlying asset is in a harmful zone the place merchants could make excessive income. As you’ll be able to see from the chart, most altcoins are at present situated inside this zone.

“Except for just a few laggard altcoins, the overwhelming majority of crypto tasks carry income to abnormal wallets within the medium to long run,” Santiment defined. “This implies our mannequin is displaying fairly just a few ‘overbought’ alerts.”

Much like the hazard zone, however reverse to it’s the alternative zone, the place the divergence of the indicator reaches the 1 stage. On this space, few buyers are in a position to obtain excessive income, so tokens inside this space could provide ripe accumulation alternatives. However there are at present no belongings within the space.

“This definitely doesn’t imply cryptocurrencies are on the verge of a large correction,” the analytics agency mentioned. “However traditionally, the respected MVRV indicator has proven that when markets are within the midst of a 4-month-plus surge, shopping for or The chance of opening a brand new place is larger than common.”

Ethereum worth

Ethereum lately decoupled from Bitcoin, which as soon as once more broke above the $2,900 mark, whereas the unique cryptocurrency traded sideways decrease.

Seems to be like the value of the asset has surged lately | Supply: ETHUSD on TradingView

Featured photos from Shutterstock.com, charts from TradingView.com, Santiment.web