Cryptocurrency investor Fred Krueger believes that Ethereum is overvalued based mostly on spot change charges.Reference X, Kruger Add to That Ethereum supporters are “out of contact with actuality” after the nationwide foreign money ETH not too long ago topped $3,000.

The investor famous {that a} common decline in on-chain exercise, intense competitors from alternate options like Solana and Avalanche, and regulatory uncertainty make holding the token dangerous.

Ethereum is sluggish and utilization is lowering

Kruger believes that on-chain transactions on Ethereum might be sooner and cheaper. Within the present setting marked by scalable and low-fee alternate options, whether or not based mostly on Ethereum or current as a standalone chain, the challenges of the chain now not justify buying and selling ETH at spot charges of round $3,000.

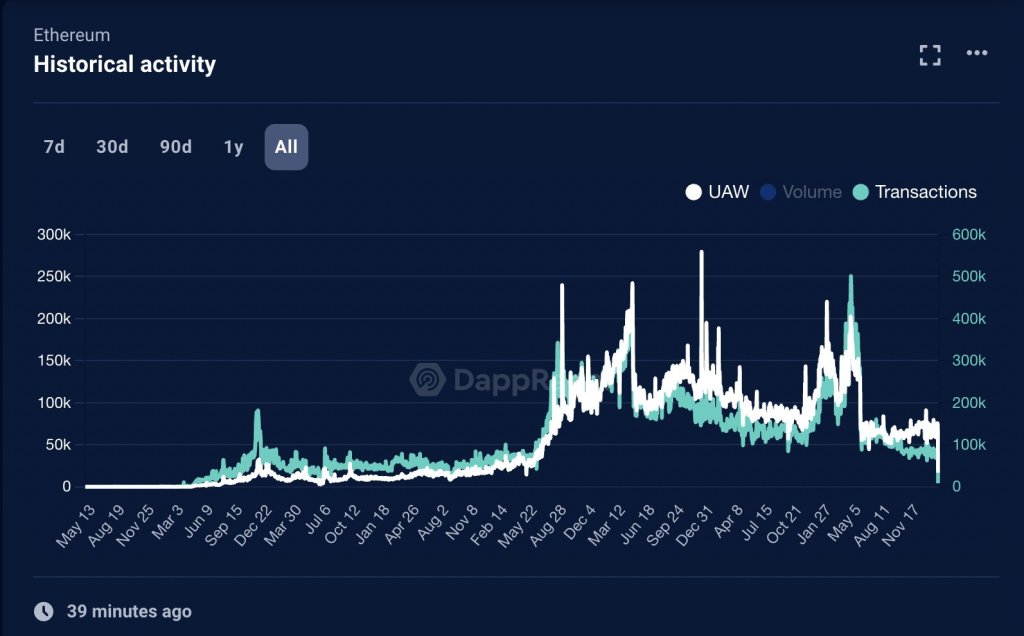

Along with scale and throughput challenges, traders additionally cited a pointy decline in each day energetic customers (DAU) on mainnet. Since 2021, Ethereum and altcoin costs have peaked, with energetic DAU falling from round 120,000 to round 66,000 in February 2024.

Whereas community proponents say there was development in second-layer platforms like Arbitrum putting safety on Ethereum, Krueger famous that even probably the most energetic and largest protocols by whole worth locked (TVL) are There was consumer churn.

For instance, Uniswap V3, the third model of Uniswap, one of many largest decentralized exchanges on Ethereum, presently has about 16,000 each day energetic customers, which is considerably decrease than in earlier years.

Alternate options like Solana provide higher providers: Is ETH costly?

The investor believes that the decline in each day energetic customers signifies energetic utilization, which contrasts with Ethereum’s rising market cap and spot fee. Based on Krueger, this rising state of affairs is why Ethereum has develop into a “bloated meme coin like a Shiba Inu” attributable to its excessive market capitalization.

Traders assess that sooner, cheaper alternate options equivalent to Solana, Avalanche and Close to Protocol provide higher worth for particular use instances equivalent to decentralized finance (DeFi) and gaming.

Kruger additionally questioned the dearth of regulatory readability on Ethereum. The U.S. Securities and Trade Fee (SEC) not too long ago accredited the primary spot Bitcoin exchange-traded funds (ETFs). That is largely as a result of SEC officers acknowledge that Bitcoin is a commodity.

Gary Gensler and the SEC didn’t classify ETH into the identical class as BTC. So whereas the broader crypto neighborhood is optimistic in regards to the eventual authorization of an Ethereum ETF spot, Krueger believes it’s unlikely.

Nonetheless, time can solely inform how Ethereum and its market valuation will evolve within the coming months. Regardless of the criticism, supporters stay optimistic that elevated adoption and the deflationary nature of ETH will push the value towards highs of $5,000 in 2021.

Function footage are from DALLE, charts are from TradingView

Disclaimer: This text is for instructional functions solely. It doesn’t signify NewsBTC’s opinion on whether or not to purchase, promote or maintain any funding, and funding naturally includes dangers. It’s endorsed that you just conduct your individual analysis earlier than making any funding determination. Use of the data offered on this web site is fully at your individual threat.