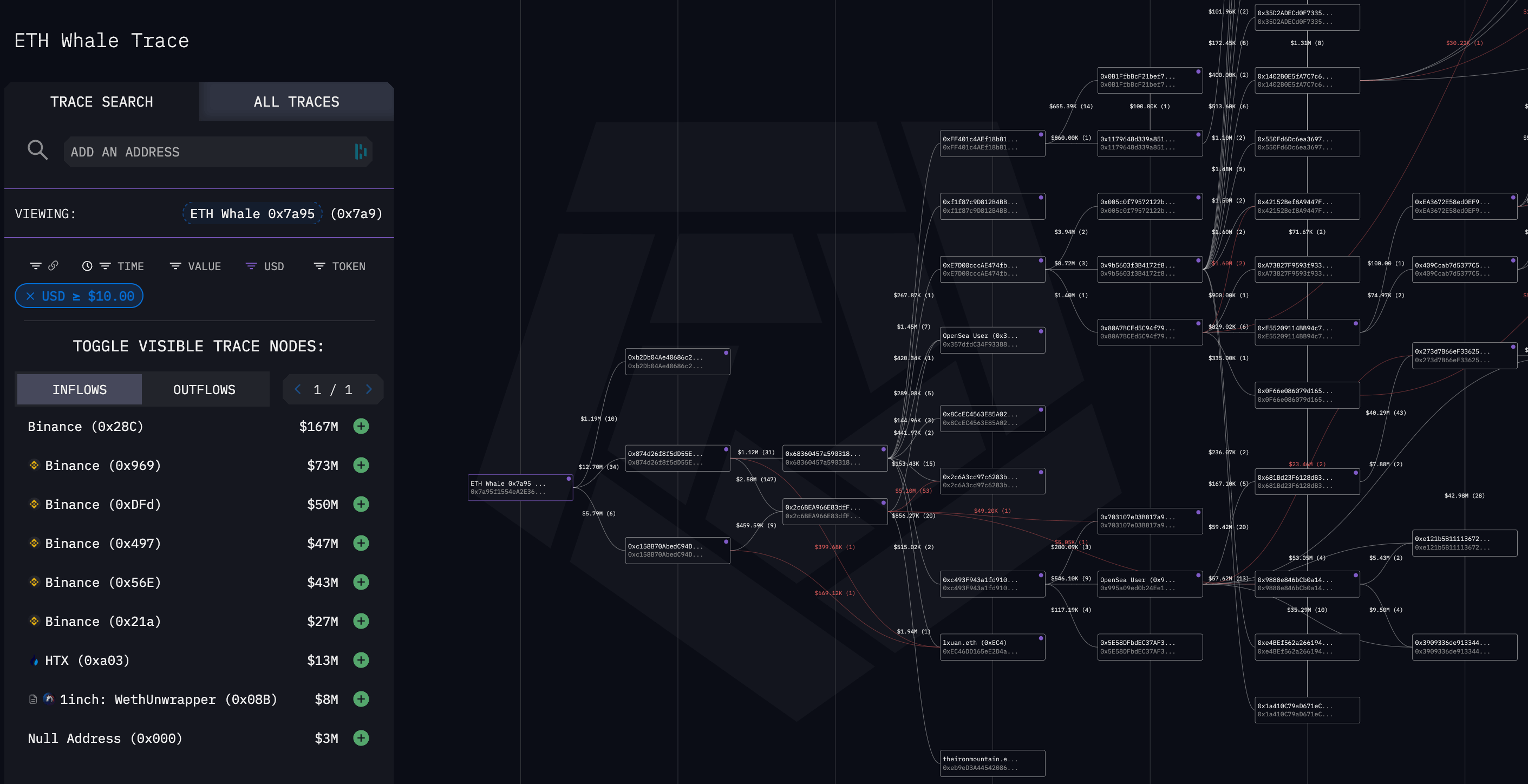

An unknown Ethereum whale has been accumulating ETH at a speedy tempo since early February. Over the previous 23 days, pockets 0x7a95c has acquired $411 million value of ETH and stETH, largely from Binance.

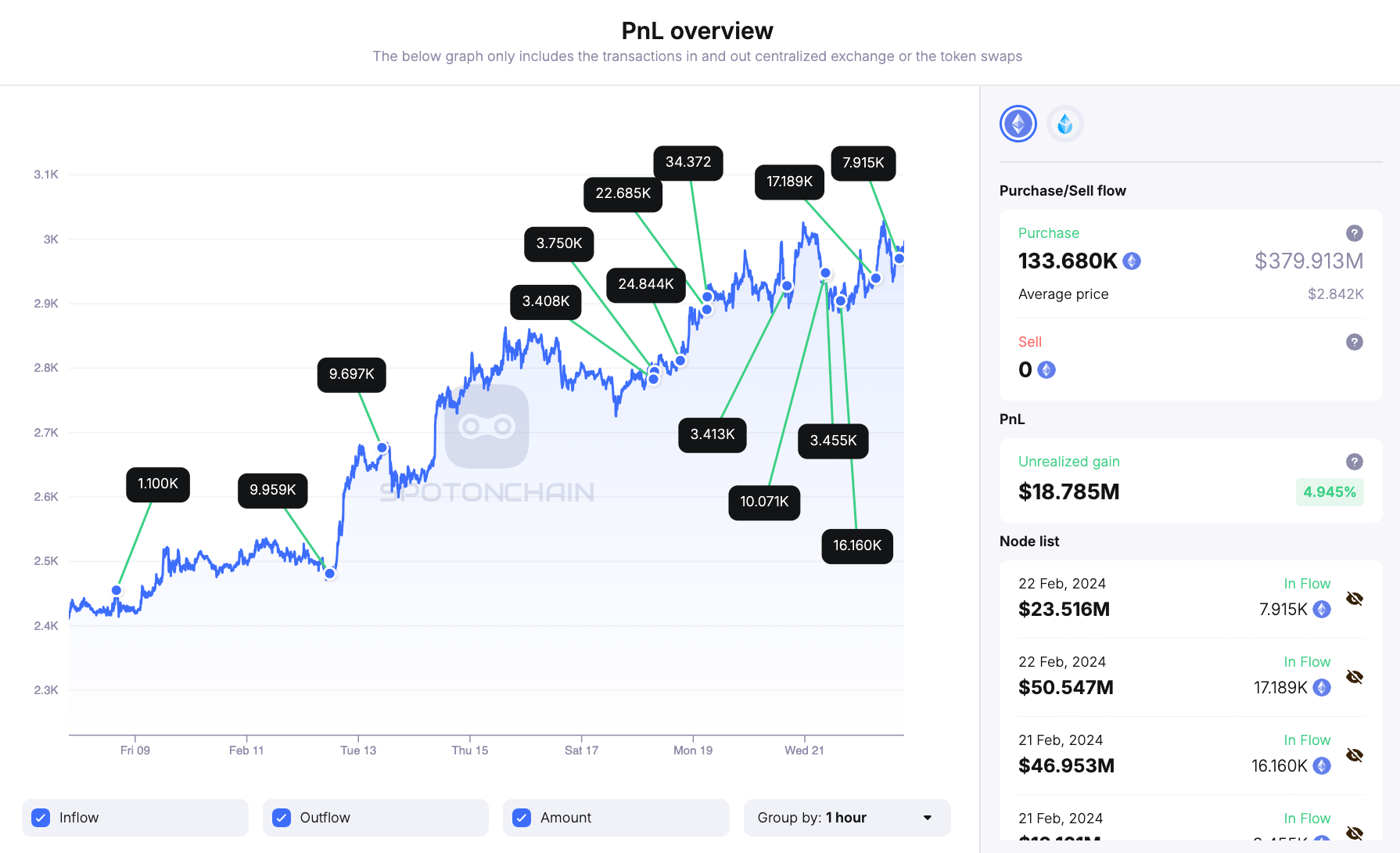

knowledge sharer Encryption Slate Knowledge from Spotonchain, which tracks ETH flows into wallets all through the month, reveals constant purchases of between 3,000 and 34,000 ETH.

Encryption Slate Evaluation monitoring pockets inflows and outflows reveals connections to a number of totally different exchanges and DEXs. Nearly all of the funds within the pockets come from Binance, with $21 million in HTX and 1inch. Nonetheless, in relation to outflows, the vary of linked addresses is huge, together with Wintermute, Uniswap, 1inch, AlphaLab Capital, Native Pool, Paraswap, and extra.

By mining the transaction particulars on Spotonchain, the whales transferred a considerable amount of 7,915 ETH (value roughly $23.52 million) from Binance to their wallets. The commerce was recorded on February 22 at 16:38, marking the entity’s continuation of a major accumulation sample. Particulars of the transaction present whales intending to extend their holdings in Ethereum.

In response to reviews, prior to now 4 days, whales bought a complete of 112,923 ETH by Binance and 1inch. The common buy price of every ETH was US$2,892, equal to an funding of US$326.5 million. Following the completion of those transactions, whales’ holdings of Ethereum now attain 132,585 ETH and 5,485 STETH, with a cumulative worth of $411 million. The portfolio at the moment has unrealized earnings of $21.13 million, highlighting the monetary advantages of those strategic strikes.

The buildup sample additionally contains a number of different important trades. Notably, 17,198 ETH was withdrawn from Binance in a earlier transaction, contributing to the whale’s rising Ethereum reserves.

Moreover, whale exercise extends past Ethereum purchases, as evidenced by the $40 million USDT withdrawal from Binance. This reveals a broader technique, which can embrace leveraging stablecoin reserves to additional improve Ethereum holdings. Whales’ buying and selling and holdings, notably the strategic use of ETH and STETH, mirror a classy method to digital asset investing that emphasizes diversification and timing to make the most of market traits.

Rumors of SEC approval of a possible Ethereum ETF spot have helped Ethereum return to the $3,000 mark twice this month. Considerations have been raised over theoretical points with bets on Ethereum centralization in spot ETFs, however any potential approval is unclear right now.

Unconfirmed rumors of Justin Solar’s relationship

Earlier this month, Lookonchain prompt the whale could possibly be Justin Solar based mostly on an evaluation of comparable transactions from wallets suspected to belong to buyers. Nonetheless, all info appears to be circumstantial and the pockets doesn’t have an equal energetic handle on the Tron blockchain. Curiously, nonetheless, the 0x7a95 pockets has by no means interacted with USDC and seems to solely use USDT for stablecoin transactions. Circle stated in a 2023 letter to Sen. Elizabeth Warren that Justin Solar didn’t have an account with them, however Arkham Intelligence recognized a pockets belonging to Solar as not too long ago as February twenty second. USDC was traded.

The one identifiable connection to Justin Solar Encryption Slate is a 1-inch settlement contract with two related wallets. Addresses 0x874d and 0x158B obtained US$21 million from 0x7a95, and each transferred the funds to the 1-inch settlement contract 0xA888. A yr in the past, Justin Solar-tagged pockets 0x1387 obtained $58 million from the identical 1inch contract. Nonetheless, all transactions from 0x7a95 are current.

Encryption Slate Wallets and related addresses are being monitored in case additional info turns into obvious.