Knowledge reveals that the Bitcoin Coinbase Premium Index has turned destructive once more, an indication which may be destructive for the worth of the asset.

Bitcoin Coinbase Premium Index Has Fallen into the Pink Zone

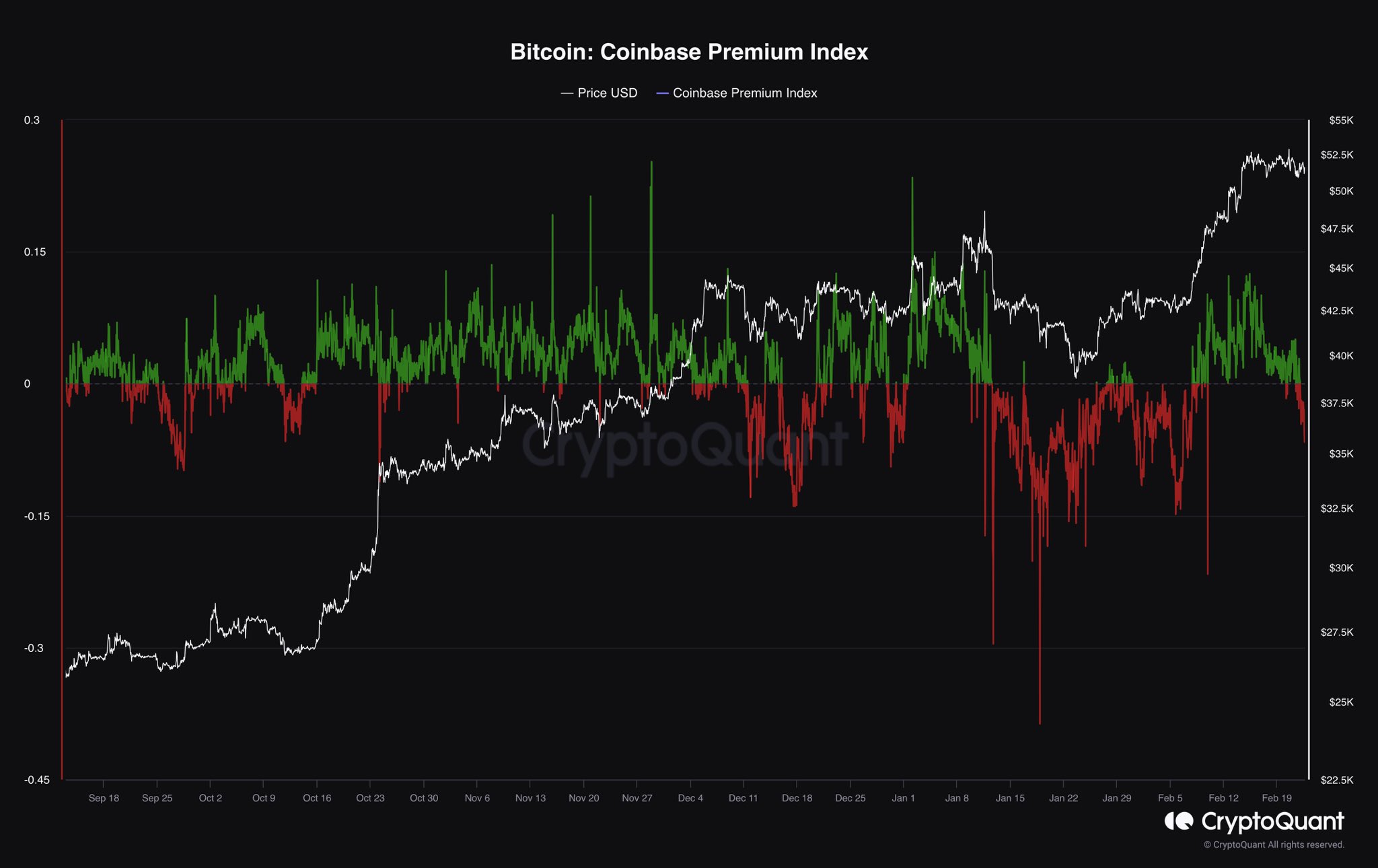

As one analyst identified postal On X, promoting stress on Coinbase has elevated just lately. The metric of curiosity right here is the “Coinbase Premium Index,” which measures the proportion distinction between Bitcoin costs listed on cryptocurrency exchanges Coinbase and Binance.

When the worth of this indicator is constructive, it signifies that the worth on Coinbase is at present larger than the worth on Binance. This pattern means the previous has both larger shopping for stress than the latter, or decrease promoting stress.

However, destructive values imply that Coinbase could also be going through extra promoting stress for the time being, as the worth listed right here is decrease than Binance.

Now, the chart beneath reveals the pattern of the Bitcoin Coinbase Premium Index over the previous few months:

The worth of the metric seems to have simply turned crimson | Supply: @IT_Tech_PL on X

As proven within the chart above, the Bitcoin Coinbase Premium Index has been considerably constructive early on, and along with these excessive values, the cryptocurrency’s value has additionally elevated.

Because of this comparatively excessive shopping for stress on the platform could have contributed to the token’s surge. As soon as the indicator cools right down to low values (however stays constructive), the worth drops to maneuver sideways.

The Coinbase Premium Index just lately turned utterly destructive, that means sellers could also be displaying up on the trade. The final time this indicator turned crimson was throughout the spot ETF sell-off information occasion, which didn’t finish properly for the coin.

Coinbase is thought for use by US institutional traders, so the Premium Index can inform us how the conduct of those giant entities differs from the conduct of Binance’s world consumer base.

The current rally has been pushed by shopping for by institutional entities akin to ETFs, which is why this indicator is constructive. However the shopping for stress from these traders now seems to have exhausted itself as sellers leapt into motion.

If previous precedent is something to go by, this dip into destructive territory may imply that Bitcoin at the very least continues to consolidate, if not outright decline.

Nevertheless, if the Coinbase Premium Index turns again into constructive territory within the coming days, a bearish consequence could also be prevented. It stays to be seen whether or not the promoting stress from US whales is the beginning of a brand new pattern or simply momentary.

bitcoin value

As of this writing, Bitcoin is buying and selling across the $50,900 mark, down 2% over the previous week.

Seems like the worth of the coin has been transferring sideways in the previous few days | Supply: BTCUSD on TradingView

Featured pictures from Shutterstock.com, CryptoQuant.com, charts from TradingView.com