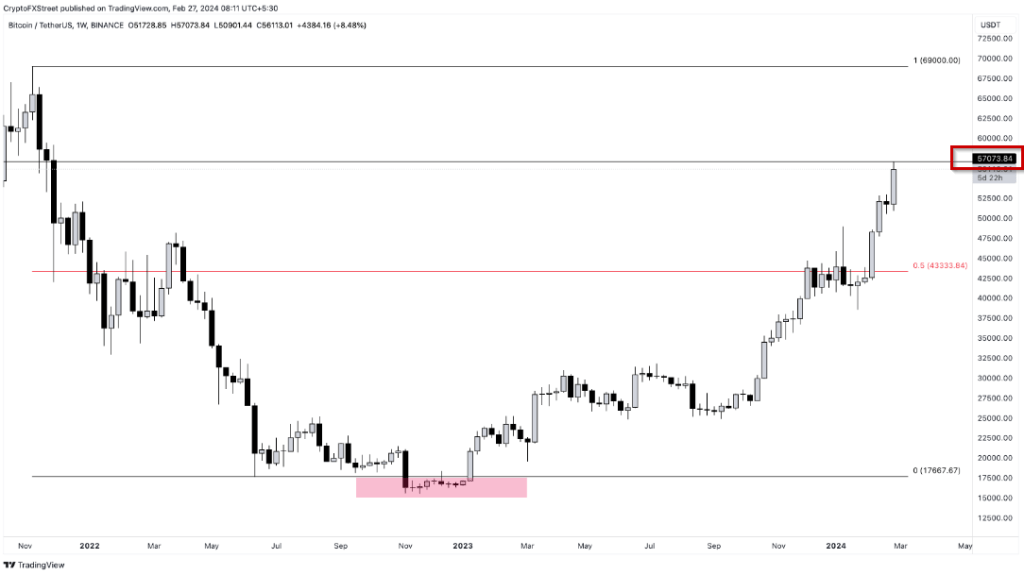

As anticipated, Bitcoin (BTC) surged to new highs, surpassing the $57,000 mark in Asian markets early Tuesday morning. This value degree has not been seen since November 2021 and marks a exceptional restoration for the main cryptocurrency.

Bitcoin ETFs expertise unprecedented exercise

It’s value noting that the surge in Bitcoin costs has triggered quite a lot of exercise in U.S. spot Bitcoin ETFs, excluding Grayscale’s GBTC. In accordance with Bloomberg, buying and selling quantity in these ETFs hit a report excessive of $2.4 billion on Monday. The surge in buying and selling exercise highlights the rising curiosity and participation of institutional buyers within the cryptocurrency market.

As of press time, Bitcoin fell barely to $56,437, however was nonetheless up about 10% from the day prior to this. Bitcoin’s value has elevated by greater than 30% because the begin of the yr, persevering with a surge that has additionally fueled speculator curiosity in smaller currencies equivalent to Ether and Solana.

Demand for Bitcoin isn’t restricted to identify buying and selling; some $5.6 billion poured into the just lately launched U.S. Bitcoin ETF, which started buying and selling on January 11. This inflow of funding indicators increasing curiosity in Bitcoin past the digital asset’s conventional base of fanatics.

It’s official… 9 new Bitcoin ETFs broke all-time buying and selling quantity information in the present day with $240 million, solely barely increased than the primary day’s quantity however roughly double the current common every day quantity. $ go $1.3b of that went loopy, breaking its report by about 30%. pic.twitter.com/MiCs1rzttM

— Eric Balchunas (@EricBalchunas) February 26, 2024

Bitcoin good points greater than conventional property

Surprisingly, Bitcoin has outperformed conventional property equivalent to shares and gold this yr. The ratio of Bitcoin costs to treasured metallic costs has reached its highest degree in additional than two years, signaling a shift in investor desire for digital property.

The full worth of digital property, together with numerous cryptocurrencies, has now reached a staggering $2.2 trillion, a major enhance from the lows in the course of the 2022 bear market, when the market worth fell to round $820 billion. This restoration demonstrates the resilience and rising prominence of digital property within the monetary sector.

BTCUSD buying and selling at $55,799 on the every day chart: TradingView.com

Opposite market indicators fail to halt cryptocurrency’s momentum

Apparently, bullish momentum within the cryptocurrency market stays sturdy regardless of rising U.S. Treasury yields usually signaling expectations of tightening financial coverage. Digital cash like Bitcoin are experiencing vital upward tendencies, defying conventional market indicators.

Sean Farrell, head of digital asset technique at Fundstrat World Advisors, famous in a current assertion that “bullish momentum for cryptocurrencies continues to emerge regardless of rising rates of interest,” highlighting the distinctive dynamics affecting the cryptocurrency market.

MicroStrategy will increase company Bitcoin holdings

Amid the continued rally, MicroStrategy, an enterprise software program firm identified for incorporating Bitcoin into its company technique, introduced a major enhance in its holdings of the cryptocurrency.

The corporate revealed that it had bought an extra 3,000 Bitcoin tokens this month, bringing its whole Bitcoin holdings to roughly $10 billion. This strategic transfer by MicroStrategy highlights the rising acceptance of cryptocurrencies by company entities as precious property.

Featured picture from TradingView Charts

Disclaimer: This text is for academic functions solely. It doesn’t characterize NewsBTC’s opinion on whether or not to purchase, promote or maintain any funding, and funding naturally entails dangers. It’s endorsed that you simply conduct your personal analysis earlier than making any funding choice. Use of the knowledge offered on this web site is fully at your personal threat.