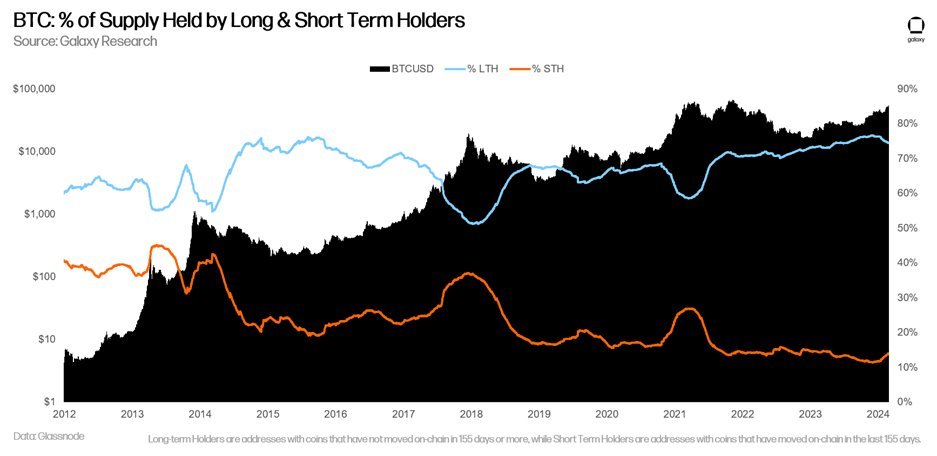

A key side of Thorn’s evaluation is the steadfastness of Bitcoin’s long-term holder base, which he estimates holds round 75% of the entire Bitcoin provide. “Lengthy-term holders are largely nonetheless holding robust,” Thorne famous, emphasizing the group’s resilience and confidence in Bitcoin’s long-term worth proposition. Characterised by “diamond arms,” this group performs a significant position in stabilizing the market and buffering volatility within the cryptocurrency house.

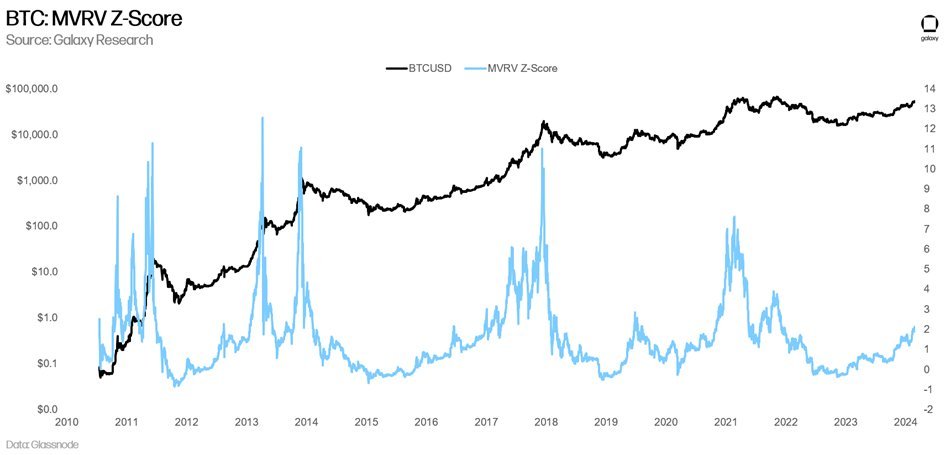

Thorne additional elaborated on analytical instruments and indicators that may present perception into Bitcoin market habits. He launched the MVRV Z-score, a novel strategy to understanding the cyclical nature of Bitcoin’s value habits by evaluating its market worth to its realized worth. This indicator offers a window into how overvalued or undervalued Bitcoin is at any given level. Presently, the MVRV Z-score is near 2, whereas at earlier cycle tops the metric surged to eight (in 2021) and even exceeded 12 (in earlier halving cycles).

Addressing hypothesis about an accelerating Bitcoin cycle, Thorne firmly dismissed issues that the market would peak prematurely. He rejects the concept we’re “accelerating the ‘cycle’” and as an alternative asserts that the emergence of Bitcoin ETFs in the US represents a transformative shift with far-reaching penalties. “This time is completely different,” Thorne asserted, citing the disruption of ETFs to the normal Bitcoin value cycle and its affect on investor habits and the interior dynamics of the cryptocurrency.

Spot Bitcoin ETF Impact

Thorn highlighted the transformative affect of Bitcoin ETFs and argued that we’re solely originally of a serious shift in how Bitcoin is accessed and invested, notably by the institutional sector. “Regardless of the unbelievable quantity and circulate, now we have each motive to imagine that the Bitcoin ETF story is simply starting,” he stated, pointing to untapped potential within the wealth administration house.

Galaxy made a compelling case for the long run development of Bitcoin ETFs in its October 2023 report titled “Resizing the Bitcoin ETF Market.” The report highlights that wealth managers and monetary advisors symbolize a serious internet new marketplace for these devices, offering beforehand unavailable avenues for allocating consumer capital to Bitcoin publicity.

This untapped market is large. In line with Galaxy analysis, banks and dealer/sellers have roughly $40 trillion in property below administration (AUM) which have but to launch a spot BTC ETF. This consists of US$27.1 trillion managed by broker-dealers, US$11.9 trillion managed by banks, and US$9.3 trillion managed by registered funding advisers. As of October 2023, the entire scale of U.S. wealth administration property below administration reached US$48.3 trillion. These knowledge spotlight the massive potential for Bitcoin ETFs to penetrate deeper into the monetary ecosystem and catalyze a brand new wave of funding into Bitcoin.

Thorn additional speculated on the upcoming 13F filings following the launch of ETFs in April, suggesting that the filings might reveal vital Bitcoin allocations from a number of the largest firms within the funding world. “In April, we will even obtain the primary spherical of 13F functions following the launch of the ETF, and (I am simply guessing right here…) we may even see some massive names already allotted to Bitcoin,” Thorn predicted. He believes this improvement might create a suggestions loop, with new platforms and investments driving up costs, which in flip attracts extra funding.

The affect of this suggestions loop is profound. As extra wealth administration platforms start to supply Bitcoin ETF companies, the inflow of recent capital might have a big affect on BTC’s value dynamics, liquidity, and total market construction. This transition represents a important second within the maturation of Bitcoin as an asset class, shifting from a speculative funding to a serious element of diversified portfolios managed by monetary advisors and wealth managers.

we’re nonetheless early

Thorne’s optimism extends past direct market indicators to the broader implications of Bitcoin’s integration into the monetary mainstream. He expects Bitcoin to succeed in new all-time highs within the close to time period, pushed by quite a lot of components, together with momentum in ETFs, Bitcoin’s rising acceptance as a reliable asset class, and the anticipated buzz surrounding the upcoming halving occasion. “That’s my reply to the burning query – the place are we within the cycle? – and we haven’t even begun to succeed in the heights we’re more likely to attain,” he concluded.

Thorne’s evaluation in the end resulted in a bullish prediction for Bitcoin. Because the group is on the cusp of Bitcoin’s fourth halving, Thorne’s insights provide a compelling imaginative and prescient of how markets will obtain unprecedented ranges, pushed by a mix of technological innovation, regulatory evolution, and altering world financial tides rising up. “Bitcoin is in its golden age proper now, and whereas it might be laborious to imagine, issues are simply beginning to get thrilling,” Thorne declared, capturing the essence of the approaching new period for the market.

At press time, BTC was buying and selling at $62,065.

Featured picture created with DALL·E, chart from TradingView.com

Disclaimer: This text is for instructional functions solely. It doesn’t symbolize NewsBTC’s opinion on whether or not to purchase, promote or maintain any funding, and funding naturally includes dangers. It’s endorsed that you just conduct your personal analysis earlier than making any funding determination. Use of the knowledge supplied on this web site is completely at your personal danger.