Cryptocurrency derivatives speculators suffered important losses over the previous day, totaling roughly $774 million, marking the very best single-day losses this yr amid unstable market volatility.

Digital asset chief Bitcoin surged to its highest stage since November 2021, surpassing the $63,000 mark in a surprising leap. Nonetheless, the thrill was short-lived as the worth rapidly fell under $60,000, partly attributable to fears brought on by technical glitches at main exchanges similar to Coinbase and Binance.

Observers famous that volatility was fueled by giant Bitcoin transfers from wallets linked to funds seized by U.S. authorities within the Bitfinex hack. Almost $1 billion flowed to undisclosed addresses, fueling hypothesis that the authority may make the most of the market surge to unload its holdings. Nonetheless, Encryption Slate Evaluation exhibits that the motion is probably going UTXO administration.

Regardless of the turmoil, Bitcoin has regained floor, rebounding to $62,530 on the time of the report, up 7% from the day gone by.

In the meantime, different outstanding cryptocurrencies have adopted go well with and posted spectacular positive factors. Ethereum, for instance, surged 5% to just about $3,500, reaching its highest worth since April 2022. Solana additionally skilled a restoration, reaching round $130, its highest stage in 22 months Encryption Slate information.

Among the many high ten cryptocurrencies by market capitalization, Cardano and Dogecoin stand out with double-digit positive factors, 11.78% and 39.16% respectively.

Almost 190,000 merchants have been liquidated, with losses reaching $774 million

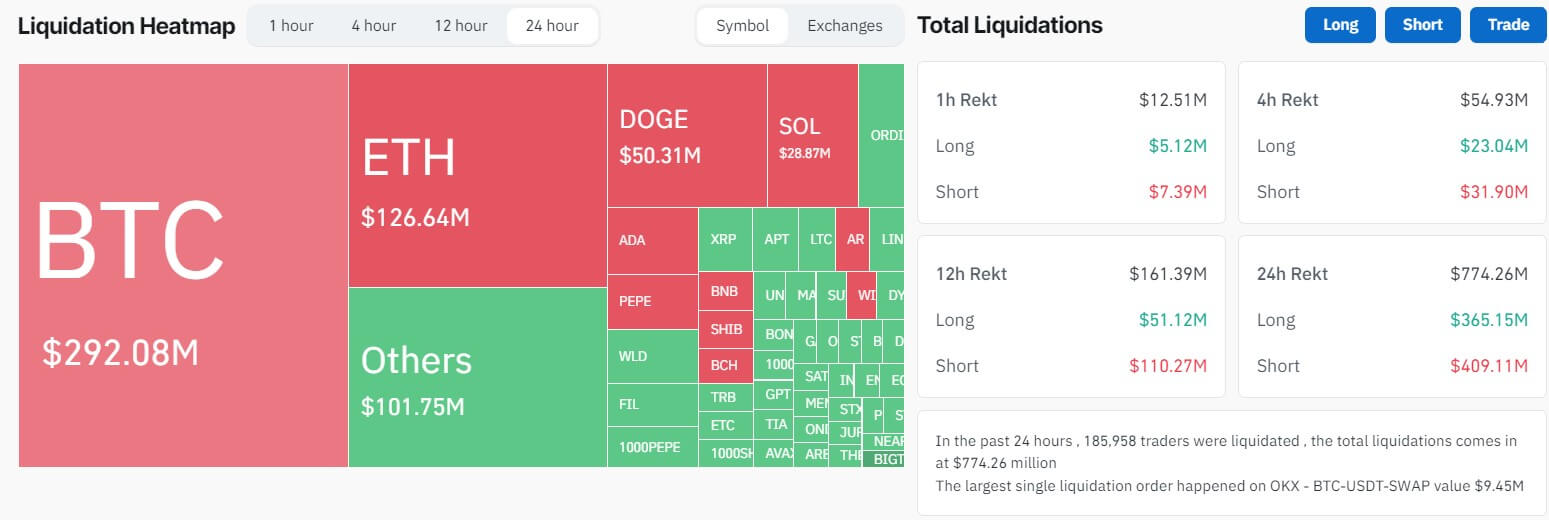

In keeping with information from Coinglass, the inexperienced market’s sturdy efficiency resulted within the liquidation of 189,679 merchants up to now 24 hours, amounting to $774 million.

Brief merchants dominate the present liquidation panorama, accounting for a big portion of complete losses. These merchants who guess on larger costs confronted collective losses of $409 million, whereas lengthy merchants who anticipated larger costs suffered losses totaling about $365.48 million.

Throughout this era, Bitcoin merchants bore the brunt, with losses as excessive as $292.09 million. Brief merchants misplaced $187.83 million and lengthy merchants misplaced $104.26 million.

Likewise, Ethereum losses totaled $126.64 million, whereas DOGE and Solana merchants misplaced $50.3 million and roughly $29 million, respectively.

On the similar time, probably the most important particular person liquidation occurred on OKX, with BTC-USDT-SWAP totaling $9.45 million.

From the angle of exchanges, Binance and OKX have the very best liquidation quantity, accounting for 35.57% and 35.31% of the whole liquidation quantity respectively. In keeping with Coinglass, these losses have been $275.46 million and $275.43 million respectively. Quite the opposite, the liquidation quantities of Huobi, Bybit and Bitmex have been $79.4 million, $72.21 million and $51.75 million respectively.