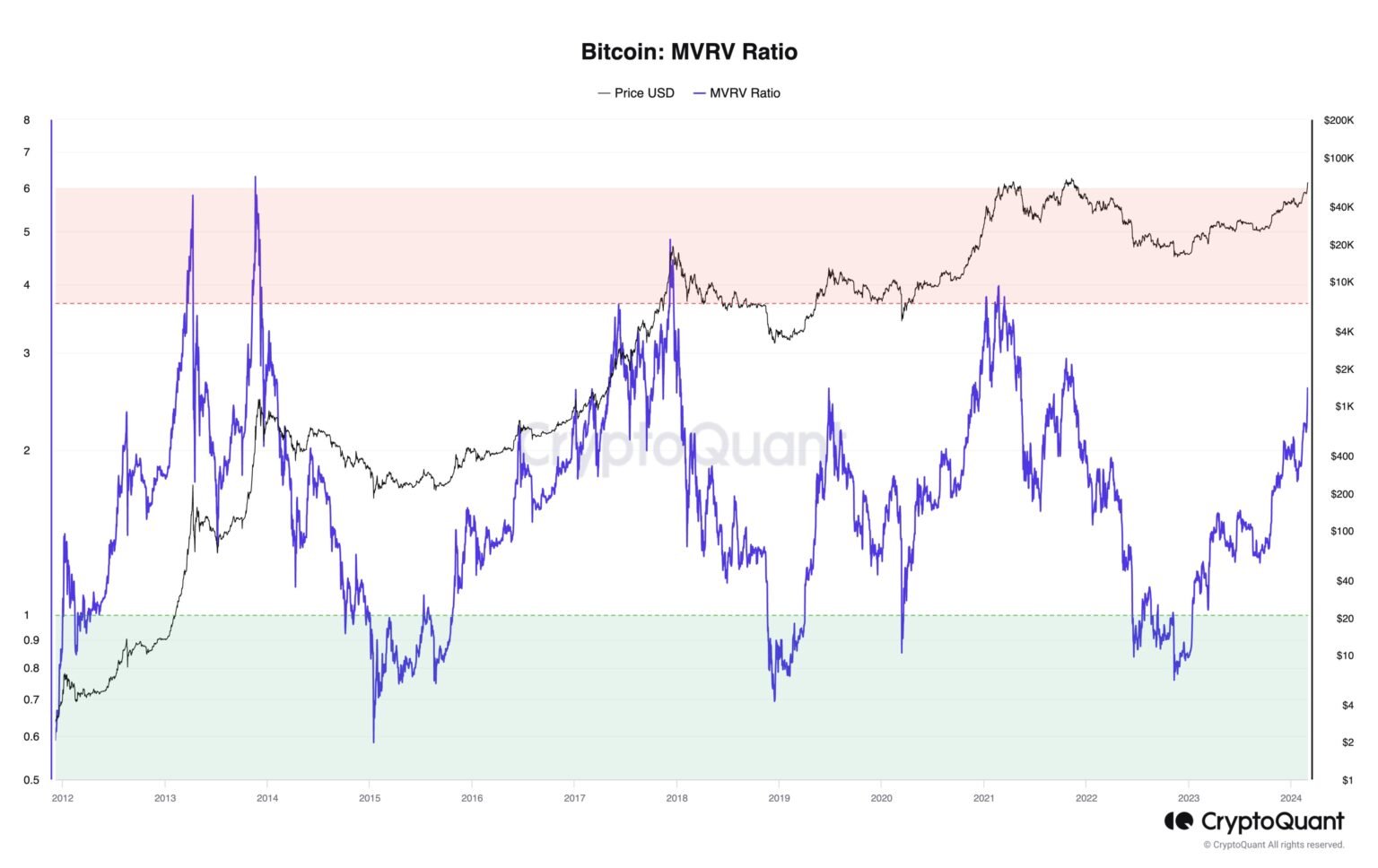

On-chain knowledge reveals that the Bitcoin MVRV ratio is at the moment on the identical excessive degree because the 2020 parabolic bull market.

Bitcoin MVRV ratio surges as newest rally takes place

As CryptoQuant founder and CEO Ki Younger Ju famous in an article postal On X, the MVRV ratio simply reaches a worth of two.5. The Market Cap to Realized Worth (MVRV) Ratio is a well-liked on-chain metric that tracks the ratio of Bitcoin’s market cap to its realized market cap.

The “realized cap” right here refers to BTC’s capitalization mannequin, which assumes that the precise worth of any token in circulation is just not its present spot value (as market capitalization assumes), however the worth of the token. Lastly transmitted on the community.

Any coin’s earlier transaction could be thought-about the final time it modified fingers, which means the value at the moment can be its present value foundation. Due to this fact, the realized cap provides as much as the price foundation of each token in circulation.

Which means the realized cap basically tracks the quantity of capital utilized by buyers to buy Bitcoin. As a result of the MVRV ratio compares the market capitalization (i.e., the worth of an investor’s present holdings) to the preliminary funding, its worth can inform us how a lot revenue or loss buyers as an entire are making from their present holdings.

Now, the chart beneath reveals how the Bitcoin MVRV ratio has trended all through the cryptocurrency’s historical past:

Seems to be like the worth of the metric has been capturing up in latest days | Supply: @ki_young_ju on X

Because the chart reveals, the Bitcoin MVRV ratio has climbed quickly because the asset value has skilled its latest rally. Throughout this surge, the indicator has managed to interrupt above the two.5 degree.

When the ratio is bigger than 1, it implies that the market capitalization is larger than the at the moment realized market capitalization, and subsequently, your complete market is holding its tokens with a purpose to get hold of a sure revenue. A worth of two.5 implies that the pockets’s present common return is 150%.

“November 2020, MVRV was 2.5, value was $18,000, and there was an all-time excessive and a parabolic bull run,” Ju defined. Wanting again at that bull run, the height within the first half of 2021 was not reached till the MVRV ratio broke by way of the three.7 mark, as The earlier two bull markets had been the identical.

Nevertheless, the November 2021 high didn’t comply with this sample because it fashioned close to the three.0 degree. If Bitcoin is something like both of those, it now stays to be seen which path Bitcoin will tackle its present rally.

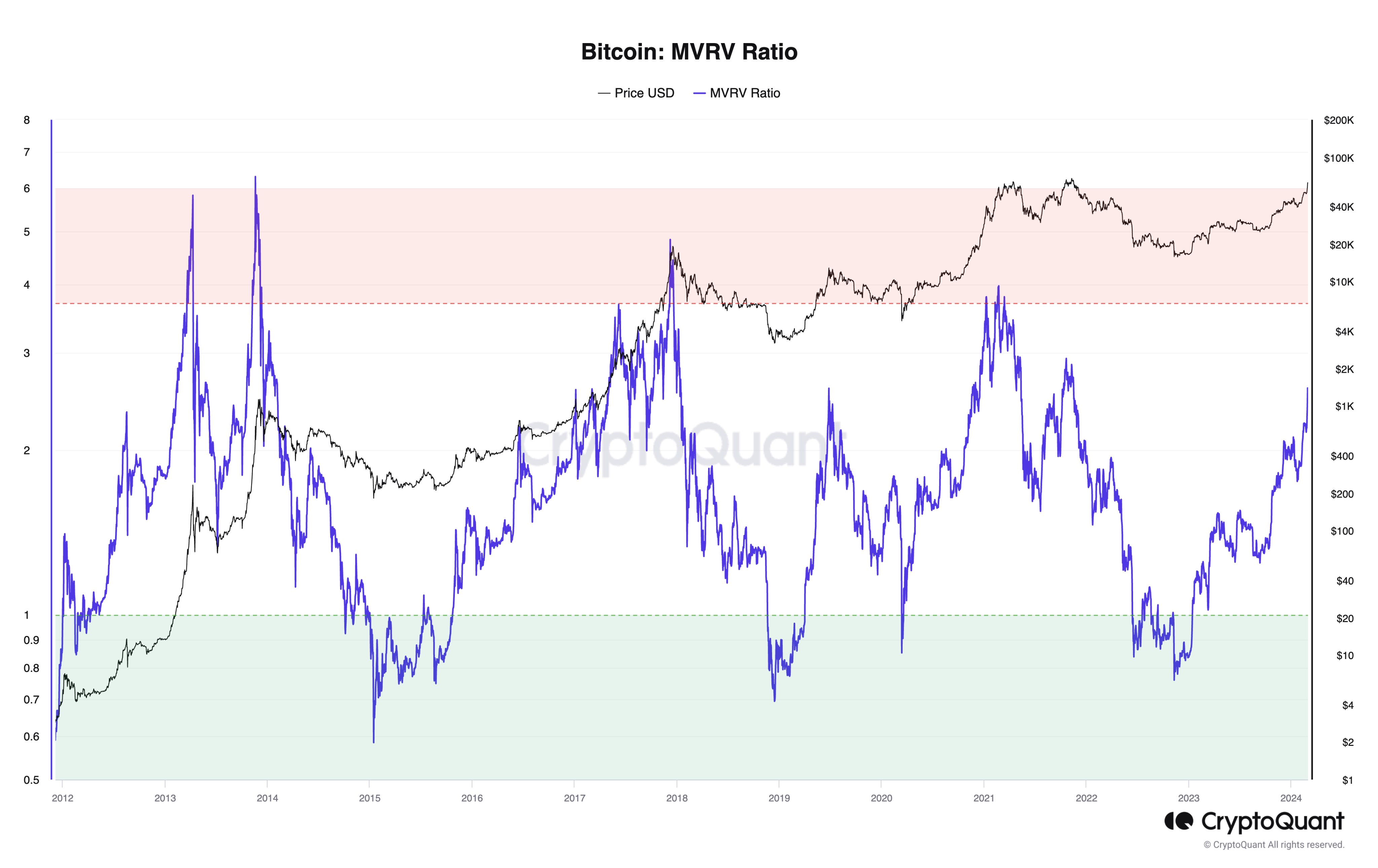

bitcoin value

Following Bitcoin’s spectacular 22% rise over the previous week, the asset’s value is at the moment buying and selling round $62,800, not distant from hitting a brand new all-time excessive.

The worth of the asset has gone by way of speedy progress over the previous few days | Supply: BTCUSD on TradingView

Featured photographs from Unsplash.com, Kanchanara on CryptoQuant.com, charts from TradingView.com

Disclaimer: This text is for instructional functions solely. It doesn’t characterize NewsBTC’s opinion on whether or not to purchase, promote or maintain any funding, and funding naturally entails dangers. It is strongly recommended that you just conduct your personal analysis earlier than making any funding selections. Use of the data offered on this web site is completely at your personal threat.