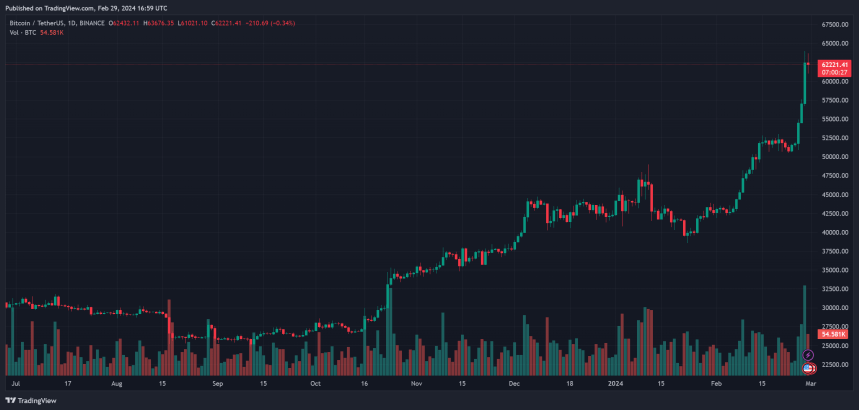

Bitcoin’s worth seems to be on the verge of breaking out to an all-time excessive (ATH) on the highs of present ranges. The cryptocurrency has been within the midst of a bull run due to the launch of a spot Bitcoin exchange-traded fund (ETF), which formally lets establishments be a part of the nascent area.

On the time of writing, Bitcoin (BTC) is buying and selling at round $62,900, with a revenue of three% over the previous 24 hours. Final week, the cryptocurrency recorded a crucial revenue of twenty-two%. It is among the three cryptocurrencies with the most important acquire within the prime 10 when it comes to market capitalization, behind Solana (25%) and Dogecoin (57%).

Bitcoin-based derivatives trace at additional good points

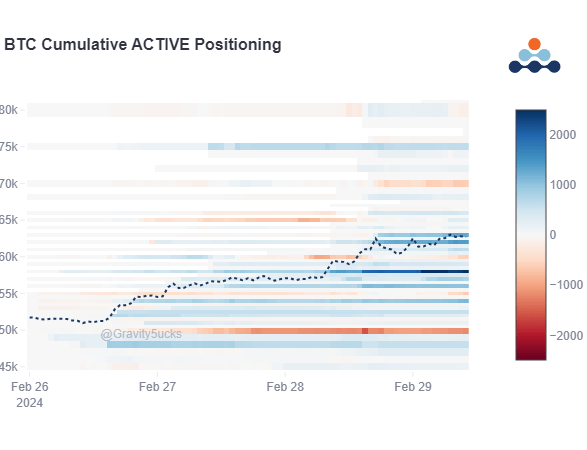

Knowledge from derivatives platform Deribit confirmed a surge in lengthy positions amongst choices gamers. Since early February, these merchants have gathered vital name (purchase) contracts with strike costs in extra of $65,000.

Because the report reveals, initially, the rise in bullish positions was thought of a part of Bitcoin’s “halving” technique. Nonetheless, BTC ETF flows seem like a key part behind the rally.

Because the cryptocurrency entered the $60,000 space, a number of operators rushed to build up bullish contracts, inflicting the “missed out alternative” (FOMO) rebound to present ranges. The chart under reveals that FOMO shopping for began when BTC broke above the $57,000 stage.

Yesterday’s surge in buying and selling exercise resulted in a pointy improve in Implied Volatility (IV). Deribit stated overleveraged positions additional drove the indicator:

The surge from 62k to 64k was so quick and the entire system was extremely leveraged that when the sale hit the market BTC dropped to 59k in quarter-hour with some Alts (additionally extremely leveraged) on some exchanges After a fast 50% drop, the worth rebounded as BTC jumped to 61.5k.

Because the market continues to expertise sudden fluctuations on account of excessive IVs, there was little change out there construction within the derivatives area. In different phrases, Deribit continues to be recording numerous bullish positions within the coming months, which reveals the optimistic perception of those gamers.

BTC worth within the quick time period

Regardless of the bull run, Bitcoin costs might fall as optimism sweeps the market.Economist Alex Krüeger stated transaction volumes surged The entire derivatives industry demonstrates Kind a “native prime layer”.

The analyst believes that retail traders are returning to the market pushed by FOMO, which frequently implies short-term difficulties for lengthy merchants. Krüger, through his official X account, is predicting additional good points to the $70,000 space earlier than falling to the $55,000 space.

The analyst stated:

ATH is just inches away. That is the realm of worth discovery. So issues might simply get crazier. This isn’t the place for individuals to construct new longs. It’s too straightforward to all of the sudden expertise a fast flush. Ideally, we might see funds settle down and worth consolidate under ATH, adopted by a breakout.

Cowl picture from Dall-E, chart from Tradingview

Disclaimer: This text is for instructional functions solely. It doesn’t signify NewsBTC’s opinion on whether or not to purchase, promote or maintain any funding, and funding naturally includes dangers. It’s endorsed that you just conduct your personal analysis earlier than making any funding determination. Use of the data supplied on this web site is completely at your personal danger.