On-chain information exhibits that Bitcoin has reached an all-time excessive (ATH) because the cryptocurrency’s newest rise in worth has reached a cap.

Bitcoin Realized Cap Simply Hit a New Excessive

As CryptoQuant founder and CEO Ki Younger Ju defined in an article postal On Day X, Bitcoin achieved a brand new report cap. “Realized Cap” is a metric that, merely put, tells us the whole quantity traders have invested in cryptocurrencies.

This capitalization mannequin differs from regular market cap, which calculates the whole valuation of an asset by equaling the worth of every token in circulation to the present spot worth.

As a substitute, a realized cap units the worth of every token to be the identical as its spot worth on the time of its final transfer. The logic behind that is that the final switch was seemingly the final time the token modified fingers, so the worth at the moment can be its present value foundation.

Due to this fact, the sum of the associated fee base of the whole provide will correspond to an estimate of the capital utilized by holders to buy Bitcoin.

Now, the chart under exhibits the development of Bitcoin’s achieved cap over the previous few years:

The worth of the metric appears to have been heading up for some time now | Supply: CryptoQuant

Because the chart above exhibits, with the asset’s newest rise, Bitcoin has skilled a pure surge as it’s being purchased and bought at increased and better costs.

The indicator has now surpassed its earlier all-time excessive and set a brand new report. This exhibits that there’s at the moment extra funds locked in Bitcoin than ever earlier than.

Talking of shopping for, as analyst James Van Straten famous in X postalThe Bitcoin investor group seems to be exhibiting constructive accumulation habits in the mean time.

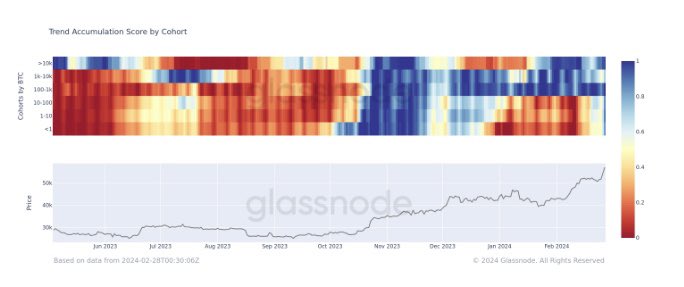

The info of the Accumulation Development Rating by cohort for the asset over the previous 12 months | Supply: @jvs_btc on X

This chart exhibits Glassnode’s Cumulative Development Rating information, which tracks cumulative habits amongst teams of Bitcoin traders divided by pockets dimension.

The chart exhibits that the whole market has simply turned blue, which means the online steadiness change has turned constructive for all group addresses.

Straten famous that since November 2022, the sector has seen a complete of three such aggressive accumulations. The primary was throughout the cycle low in November 2022, and the second began in October 2023 when ETF hypothesis occurred.

With this speedy accumulation occurring, it’s no shock that the cryptocurrency’s actual higher restrict has been on a steep upward trajectory.

bitcoin worth

As of this writing, Bitcoin is buying and selling round $62,900, up greater than 22% prior to now week.

Appears to be like just like the coin has loved a pointy rally just lately | Supply: BTCUSD on TradingView

Featured photos from Shutterstock.com, Glassnode.com, CryptoQuant.com Charts from TradingView.com