On-chain knowledge exhibits that short-term holders of Bitcoin panic-sold $2.6 billion value of Bitcoin within the crash that adopted the all-time excessive.

Quick-term Bitcoin holders inflict large losses on exchanges

As analyst James V. Straten explains in a brand new report postal On X, short-term Bitcoin holders confirmed indicators of capitulation in the course of the newest cryptocurrency worth decline.

“Quick-term holders” (STH) are BTC buyers who bought their tokens throughout the previous 155 days. STH makes up one of many two major segments of the market, the opposite being “long-term holders” (LTH).

Statistically, the longer an investor holds a token, the much less doubtless they’re to promote at any level. Which means that when an asset crash or rally happens, comparatively beginner STH will usually dump rapidly. LTH, then again, usually displays elasticity and solely sells at particular factors.

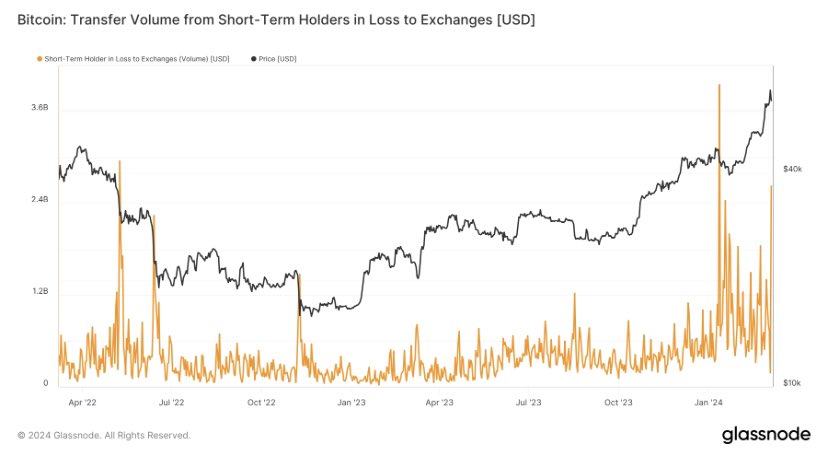

One strategy to monitor whether or not these teams are promoting is thru the quantity of transfers they ship to exchanges. First, right here’s a chart exhibiting the pattern in Bitcoin transaction inflows for STH at a loss:

The worth of the metric seems to have shot up in latest days | Supply: @jvs_btc on X

Because the chart above exhibits, Bitcoin STH has moved round $2.6 billion value of tokens to exchanges prior to now day, which means some members of the group have capitulated.

This time the rise was important, however smaller than the loss-making occasions that occurred in the course of the worth decline following the approval of the BTC spot exchange-traded fund (ETF).

These loss sellers might have been those that participated in BTC’s rally and breached the all-time excessive of $69,000 resulting from FOMO, however their religion was not robust sufficient to resist the sharp collapse that BTC quickly noticed. again.

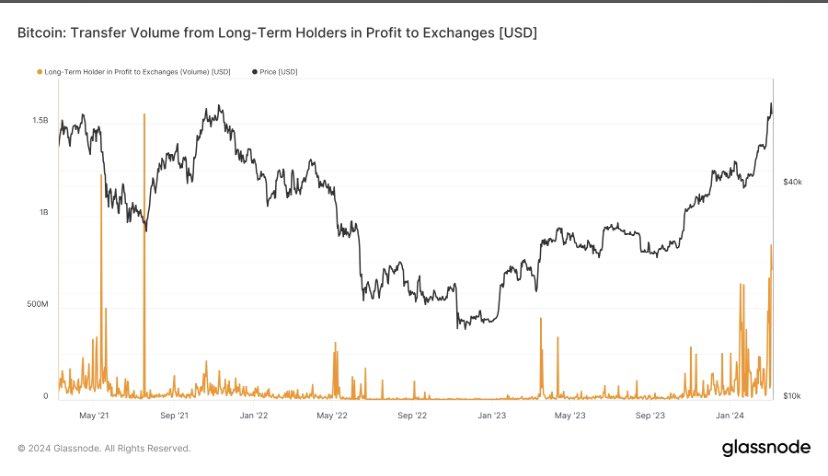

STH isn’t the one group exiting the market in the course of the latest worth swings. LTH additionally seems to be experiencing some promoting. The distinction, nonetheless, is that these holders have already made a revenue.

The chart beneath exhibits the quantity of LTH commerce transfers which have been worthwhile just lately.

Appears like the worth of the metric has registered a pointy spike just lately | Supply: jvs_btc on X

The chart exhibits that Bitcoin LTH participated within the largest profit-taking occasion since July 2021, shifting $1.5 billion value of the token to exchanges.

Subsequently, the latest volatility seems to have shaken the religion of some diamond holders, though these holders are no less than nonetheless reaping income.

bitcoin worth

As of this writing, Bitcoin is buying and selling across the $65,800 mark, up 8% over the previous week.

BTC has gone by a rollercoaster prior to now couple of days | Supply: BTCUSD on TradingView

Featured picture from YuMuHunZhucdd20 on Unsplash.com, Glassnode.com, chart from TradingView.com

Disclaimer: This text is for instructional functions solely. It doesn’t characterize NewsBTC’s opinion on whether or not to purchase, promote or maintain any funding, and funding naturally entails dangers. It is strongly recommended that you simply conduct your individual analysis earlier than making any funding determination. Use of the knowledge offered on this web site is fully at your individual threat.