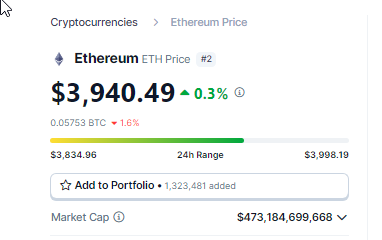

Cryptocurrency fanatics are celebrating a bullish weekend for Ethereum (ETH), the world’s second-largest cryptocurrency by market capitalization. With the worth surging 4.31% within the final day, ETH is slowly approaching a key resistance level: $4,000. The rally was fueled by optimism surrounding the Ethereum community, pushed by a mix of things.

Ethereum whale exercise, on-chain shopping for indicators potential rebound

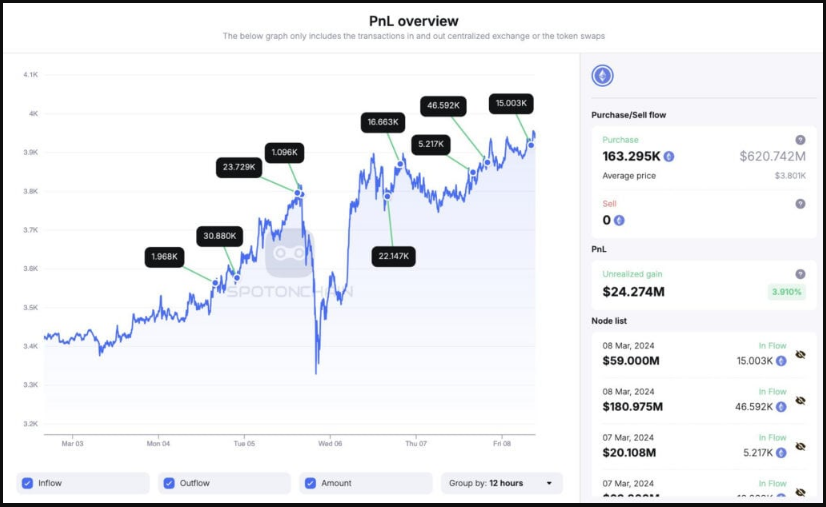

Market analysts attribute the current surge to a big enhance in Ethereum accumulation. In accordance with knowledge from blockchain monitoring agency Spot On Chain, wallets related to PulseChain and PulseX have been actively shopping for ETH, accumulating a staggering 163,295 ETH in simply 4 days. This large shopping for stress totaled practically $621 million in DAI, exhibiting that potential worth will increase have a strong basis.

Moreover, in a single day whale buying and selling quantity exceeded $10 billion, indicating a shift in sentiment amongst main buyers. This big quantity is seen as a bullish signal, indicating that whales are accumulating ETH in anticipation of upper costs.

Ethereum Traders Inspired by Profitability, Nearer to ATH

Including gasoline to the hearth, greater than 94% of ETH addresses are at the moment making income. This implies numerous buyers are holding ETH, inflicting decrease promoting stress and probably paving the best way for a worth enhance.

Knowledge from cryptocurrency analytics platform IntoTheBlock (ITB) exhibits that ETH is at the moment at its highest degree in practically a 12 months, however is considerably lagging behind the upward development following the approval of the Bitcoin spot exchange-traded fund.

Supply: IntoTheBlock

Moreover, the joy surrounding Ethereum is palpable as the worth approaches its all-time excessive (ATH) of $4,890. With little resistance anticipated, a retest of ATH within the close to future appears a practical risk. This prospect is additional amplified by the shrinking variety of addresses holding ETH which can be at breakeven or within the pink.

Dencum improve and ETF hypothesis increase investor confidence

Along with the quick worth motion, the Ethereum group can be trying ahead to the upcoming Dencum improve. This extremely anticipated improve goals to handle scalability points, scale back transaction charges on the layer community, and relieve congestion on the Ethereum community.

Dencum’s profitable improve is predicted to considerably enhance the general consumer expertise and probably entice new buyers, rising confidence within the long-term viability of the Ethereum community.

Complete crypto market cap is at the moment at $2.5 trillion. Chart: TradingView

Ongoing hypothesis surrounding a possible Ethereum ETF additionally provides one other layer of optimism. Though regulatory approval from the U.S. Securities and Change Fee (SEC) remains to be pending, the opportunity of an ETF has boosted investor sentiment. The ETF will enable conventional buyers to realize entry to Ethereum investments with out the complexities of instantly proudly owning and managing the cryptocurrency, which might result in a broader investor base and elevated demand for ETH.

Wanting forward: Ethereum’s route is determined by quite a lot of components

Whereas Ethereum’s future appears to be like vibrant, there are nonetheless some components to think about. The value of ETH remains to be about $1,000 decrease than ATH, and the success of the Dencum improve and the approval of the Ethereum ETF usually are not assured. As with all funding, it’s essential to conduct thorough analysis and train warning.

Nevertheless, the mix of elevated on-chain exercise, accumulation of whales, and a worthwhile investor base paints a promising image for Ethereum. With the Dencum improve coming and the opportunity of an ETF, Ethereum appears poised for potential worth positive aspects within the coming months.

Featured photos from Pexels, charts from TradingView

Disclaimer: This text is for academic functions solely. It doesn’t characterize NewsBTC’s opinion on whether or not to purchase, promote or maintain any funding, and funding naturally entails dangers. It’s endorsed that you just conduct your personal analysis earlier than making any funding determination. Use of the data offered on this web site is completely at your personal threat.