The next is an excerpt from the most recent version of Bitcoin Journal Professional, Bitcoin Journal’s premium market publication. To be among the many first to obtain these insights and different on-chain Bitcoin market evaluation instantly into your inbox, Subscribe now.

Bitcoin has skilled one other interval of large, record-breaking success, pushed by constructive developments in worldwide enterprise and rising dedication within the conventional monetary sector.

Bitcoin’s efficiency within the first quarter of 2024 has been really astounding. Initially of the 12 months, the valuation of Bitcoin exceeded the US$40,000 mark, and on March 1, the valuation of Bitcoin continued to hover round US$60,000. Now, nevertheless, Bitcoin has risen to $72,000, the best valuation in its historical past. Whereas we now have not but reached the purpose the place “digital gold” is extra precious than gold itself, we now have even reached a brand new milestone: Bitcoin is at present a extra precious commodity than silver by market cap. Contemplating the outsize function silver has performed in international currencies over 1000’s of years, that is definitely a milestone value remembering.

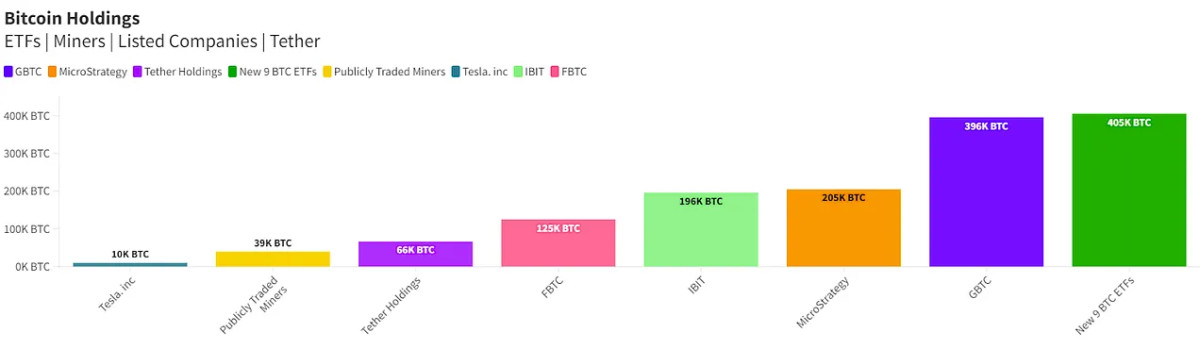

Its success throughout this era is especially noteworthy given its continued belief from a few of the world’s largest monetary establishments. For instance, on March 10, it was reported that BlackRock, the world’s largest asset administration firm and a well known issuer of Bitcoin spot ETFs, lastly acquired sufficient Bitcoin to even exceed MicroStrategy’s holdings. This improvement appears particularly large contemplating that its board chairman, Michael Saylor, is a Bitcoin evangelist. Nevertheless, it was much more stunning when Thaler introduced that he had bought sufficient inventory to regain the lead the subsequent day. Lower than 24 hours handed between the preliminary announcement and MicroStrategy’s buy of 12,000 Bitcoins, a purchase order that occurred at a time when the value of Bitcoin had already exceeded $70,000. The acquisition makes MicroStrategy the chief in practically each different non-public Bitcoin stock, from all publicly traded miners to a number of main exchanges and ETF issuers.

That is a tremendous present of confidence in Bitcoin that anybody is ready to make such a big funding at a time when Bitcoin has by no means been dearer. The sentiment amongst these firms appears to be that immediately’s all-time highs will pale into insignificance in just some years. For instance, analysts at ETF issuer Bitwise are assured of their predictions that company entities representing trillions of {dollars} will begin investing extra, with Bitwise’s chief funding officer releasing an official report. memorandum on this matter. The memo claims to have had “critical due diligence” conversations with everybody from hedge funds to giant firms and predicts bigger inflows within the second quarter than within the first three months of the 12 months. This leaves us with a query: The place does this confidence come from?

On the heart of the problem seems to be the runaway success of Bitcoin ETFs, and particularly BlackRock’s dominance of main issuers. Initially, it fought Grayscale, which had a number of pure benefits: it was a Bitcoin-native firm with a big stock, it was the true chief within the authorized battle to get SEC approval, and its GBTC was a pre-existing Funds, transformed into ETFs, it has different methods up its sleeve. Nonetheless, BlackRock is the quickest ETF in historical past to achieve $10 billion, forward of all different Bitcoin rivals and even all ETFs general. A lot of that income got here from customers fleeing GBTC’s excessive charges, and immediately it seems to be a assured trade chief. Its success has even reached the worldwide stage, as India-based cryptocurrency funding platform Mudrex is opening BlackRock ETF gross sales to institutional and personal traders within the nation of greater than 1 billion individuals.

BlackRock’s success specifically has additionally led a few of its rivals to vary their tactical strategy.For instance, VanEck did a announcement On March 11, they waived all charges on the Bitcoin ETF for a complete 12 months. It will proceed so long as their VanEck Bitcoin Belief is under $1.5 billion, however charges after this window will nonetheless be minimal. Grayscale, for its half, can be seeking to deal with the excessive charges challenge by spinning off a “mini model” of its ETF, providing Bitcoin at a fraction of the charges of GBTC. BlackRock’s rivals seem unwilling to surrender on a market with a lot potential for development.

Nevertheless, whereas the ETF market has been significantly scorching recently, that is not the one purpose to consider Bitcoin is performing so effectively. abc informationFor instance, take into account some constructive developments within the UK as a significant factor within the rise in Bitcoin costs. The UK has beforehand been thought of to have a very unfavorable regulatory surroundings for Bitcoin (particularly ETFs), lagging behind Western Europe and most Anglophone international locations by way of official Bitcoin approvals. Folks have been stunned when the London Inventory Change (LSE) revealed a brand new truth sheet on exchange-traded notes (ETNs) and determined to supply such monetary devices on its platform.

ETNs are certainly very completely different from ETFs, and even ETFs just like the Bitcoin Futures ETF, which don’t have any direct connection to Bitcoin itself. An ETN is a debt safety that doesn’t even embody a situation that the issuer truly holds the underlying Bitcoin. Nonetheless, they’re instantly tied to Bitcoin’s worth and supply traders with a method to acquire publicity to the world’s main digital asset. It’s significantly fascinating that the London Inventory Change has all of the sudden modified its angle in the direction of Bitcoin-related monetary merchandise, on condition that these ETNs are topic to strict securities regulatory guidelines. In different phrases, the ocean change in U.S. authorized Bitcoin spot ETFs appears to undeniably change the calculus of companies all over the world. With billions of {dollars} flowing into Bitcoin ETFs, even an unfriendly regulator just like the UK should be a part of within the wealth if it hopes to take care of its standing as a number one heart for international finance.

These are simply a few of the developments happening on the planet of Bitcoin, because the intersection between decentralized currencies and conventional finance turns into broader and deeper. Trying forward, there are nonetheless loads of upcoming occasions, akin to the expected halving in April, to proceed to drive the hype. It might be tough to foretell precisely the place the subsequent huge developments and value will increase will come from, however now it appears there may be rising confidence from a few of the actual monetary giants. Bitcoin has come extremely far because the days when it was utterly deserted, and is now value over a trillion {dollars} available on the market. With development like this, it is simple to win by persevering with to guess on Bitcoin.