The continued Bitcoin surge is proving worthwhile for crypto whales.In response to Lookonchain reviews data On March 13, a big BTC handle made a $217 million revenue after the worth rose above $73,000 earlier in the present day. Income could be even greater as a result of previously, whales have been promoting giant quantities of their funds by Binance, the world’s largest cryptocurrency trade.

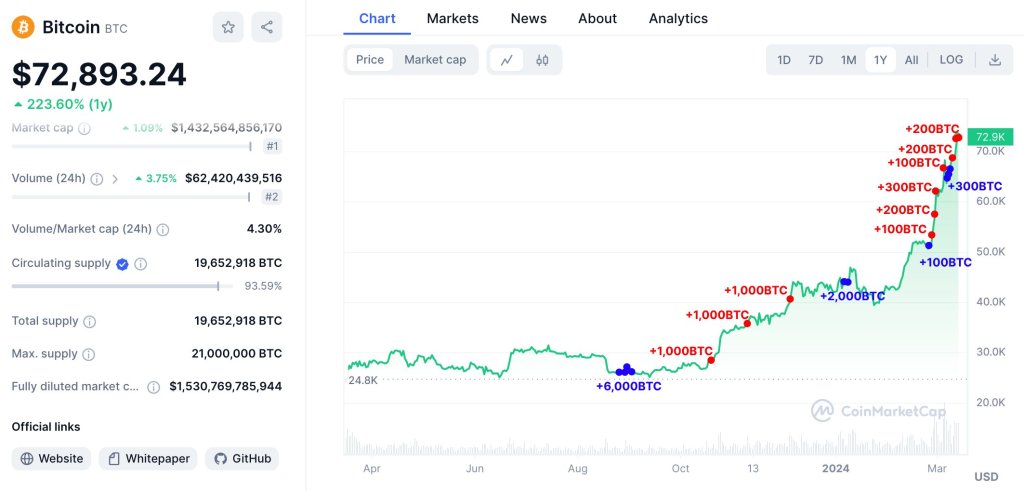

This improvement comes on the heels of strong progress for Bitcoin. Bitcoin has been rising steadily since October 2023, pushed by supportive elementary occasions, together with the Federal Reserve’s rate of interest expectations and the U.S. Securities and Trade Fee’s (SEC) approval of a spot Bitcoin exchange-traded fund (ETF) )).

BTC rises, Whale income $217 million

Coupled with bullish holders anticipating extra features sooner or later and post-halving, the coin rapidly rallied, exceeding expectations. On March 13, the coin broke by an all-time excessive of round $72,800 and rebounded above $73,000.

The enlargement adopted a pointy worth correction throughout the New York session on March 12. Nevertheless, as market confidence remained, costs rebounded strongly throughout the Asian session, pushing costs above $72,800 and as excessive as $73,700.

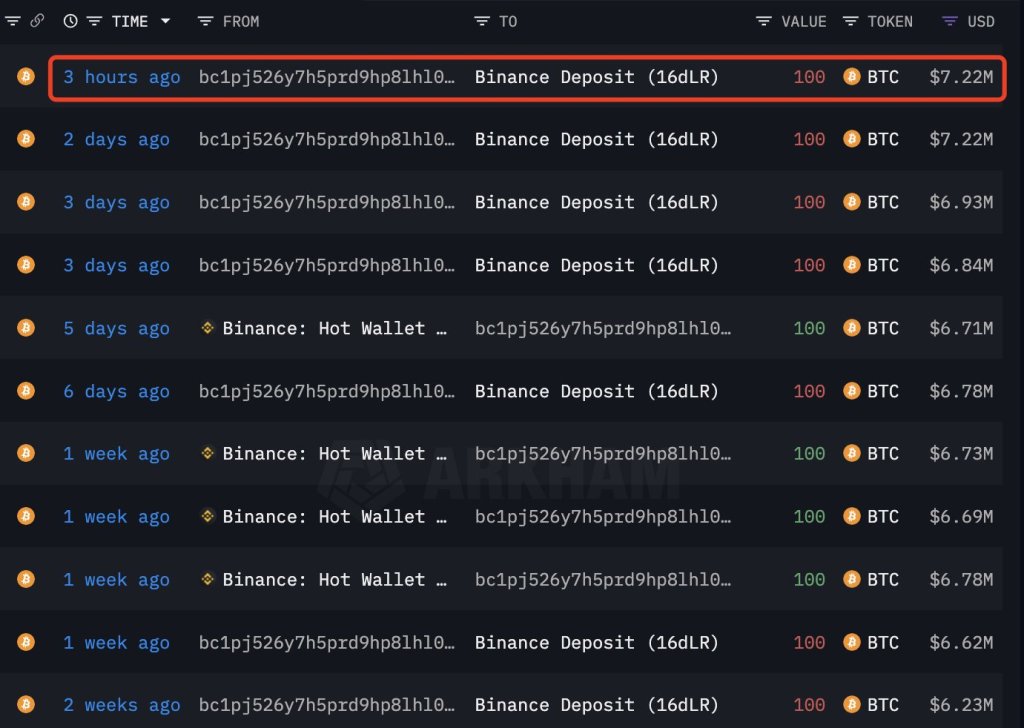

Whereas merchants lower volatility, nameless whales took full benefit of the rebound after months of accumulation. Lookonchain information exhibits that the whale started accumulating Bitcoin on August 24, 2023, at a median worth of $32,854, earlier than withdrawing and depositing 4,300 BTC at a median worth of $3,534.

The handle presently controls 4,300 Bitcoins price over $313 million, with income of $217 million. On March 13, the whale withdrew 100 BTC by way of Binance, price $7.22 million, and will have made a revenue.

BlackRock and Wall Road drive Bitcoin demand

It stays to be seen whether or not whales will pull out extra and consolidate income. Nevertheless, given the general optimism throughout the market, the handle might stand to realize extra.

The cryptocurrency group expects important funding from establishments to proceed within the coming weeks. Up to now, BlackRock controls greater than 205,000 Bitcoins by its IBIT spot Bitcoin exchange-traded fund (ETF) product. Different issuers comparable to Constancy and Ark Investments have additionally seen elevated demand.

On prime of this, rising demand from retirement funds (primarily within the US) will additional drive up costs, thereby rising valuations for holders. This week, enterprise intelligence agency MicroStrategy stated it might purchase extra tokens after elevating $800 million from traders.

Function footage are from DALLE, charts are from TradingView

Disclaimer: This text is for instructional functions solely. It doesn’t characterize NewsBTC’s opinion on whether or not to purchase, promote or maintain any funding, and funding naturally entails dangers. It is suggested that you just conduct your personal analysis earlier than making any funding choice. Use of the data offered on this web site is fully at your personal danger.