11 permitted Bitcoin ETFs give the groundbreaking cryptocurrency a brand new veneer of legitimacy. By acquiring formal approval from the U.S. Securities and Trade Fee (SEC), institutional funding limitations have been lifted.

With this barrier eliminated, monetary advisors, mutual funds, retirement funds, insurance coverage firms, and retail buyers can now obtain Bitcoin publicity with out the necessity for direct custody. What’s extra, the taint in Bitcoin that was beforehand known as “tulip mania,” “rat poison,” or “cash laundering index” has been eliminated.

After an unprecedented domino of cryptocurrency bankruptcies in 2022, Bitcoin costs recovered to November 2020 ranges of $15,700 by the tip of the yr. After the massive FUD reserves had been depleted, Bitcoin slowly recovered in 2023, coming into 2024 reaching ranges of $45,000, first seen in February 2021.

With the fourth Bitcoin halving in April and ETFs setting new market dynamics, what ought to Bitcoin buyers count on subsequent? To find out this, we should perceive how Bitcoin ETFs improve BTC buying and selling quantity, thereby successfully stabilizing Bitcoin’s value fluctuations.

Find out about Bitcoin ETFs and market dynamics

Bitcoin itself represents the democratization of cash. Bitcoin just isn’t influenced by central businesses such because the Federal Reserve, and its decentralized miner community and algorithm-determined financial coverage be certain that its restricted provide of 21 million cash can’t be tampered with.

For Bitcoin buyers, this implies they’ve entry to an asset that isn’t on an inherent depreciation trajectory, in distinction to the entire world’s present fiat currencies. That is the premise of Bitcoin’s worth notion.

Trade-traded funds (ETFs) supply one other avenue for democratization. In contrast to energetic mutual funds, ETFs are designed to trace the worth of belongings represented by shares and commerce all through the day. The passive value monitoring of ETFs ensures low charges, making them an easy-to-use funding car.

After all, Bitcoin custodians like Coinbase must have sufficient cloud safety measures in place to extend investor confidence.

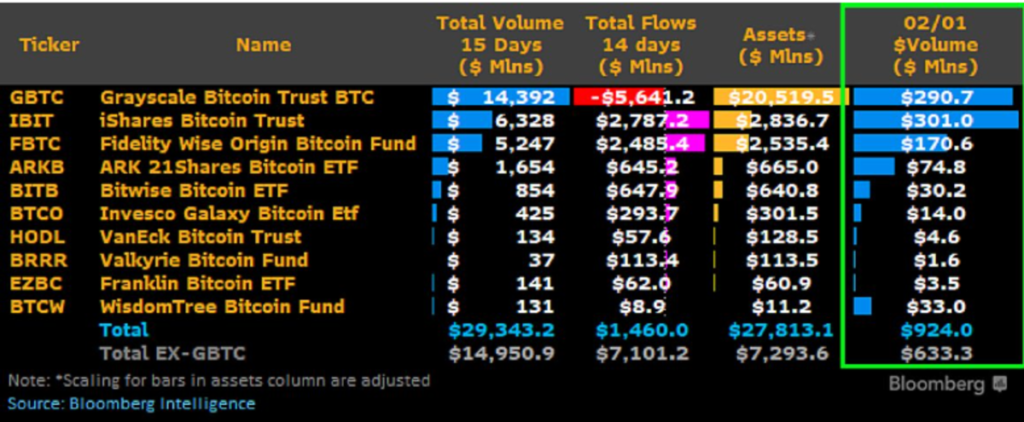

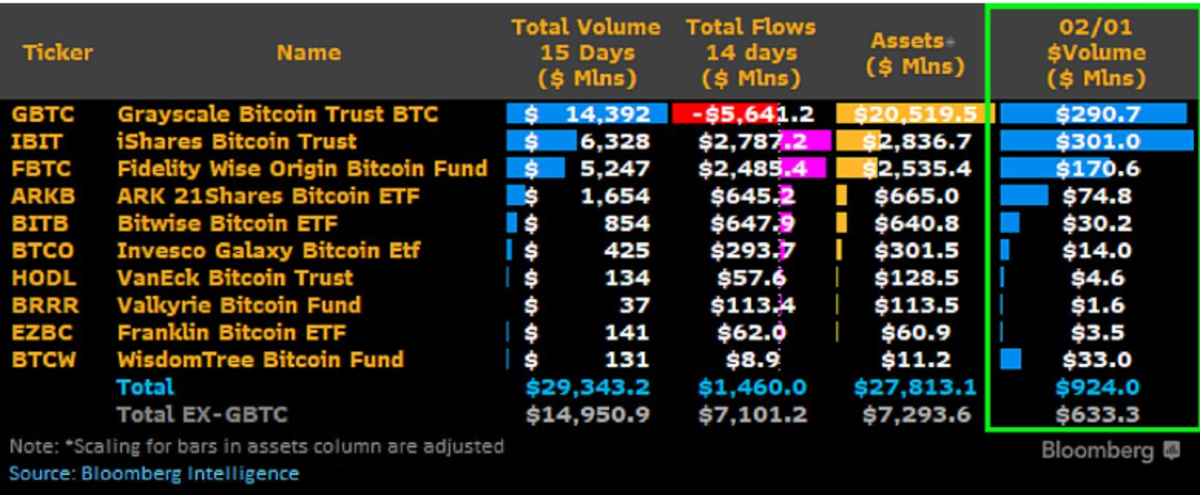

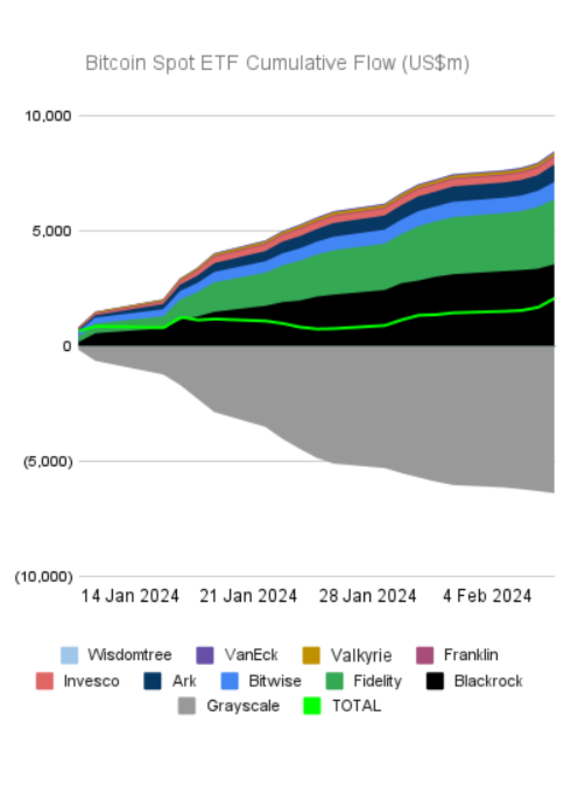

Within the ETF area, Bitcoin ETFs have proven excessive demand for decentralized belongings in opposition to concentrated dilution. Their buying and selling quantity totaled $29.3 billion over the previous 15 days, whereas Grayscale Bitcoin Belief BTC (GBTC) was below strain of $14.9 billion.

This isn’t stunning. With the hype of Bitcoin ETF, the worth of Bitcoin rose. In December 2023, 88% of Bitcoin holders entered the revenue zone, ultimately reaching 90% in February. In flip, GBTC buyers cashed out, placing $5.6 billion value of downward strain on Bitcoin costs.

Moreover, GBTC buyers took benefit of the newly permitted Bitcoin ETF’s decrease charges to shift funds away from GBTC’s comparatively excessive 1.50% payment. Finally, BlackRock’s iShares Bitcoin Belief (IBIT) was the amount winner with a 0.12% payment, which can rise to 0.25% after a 12-month exemption interval.

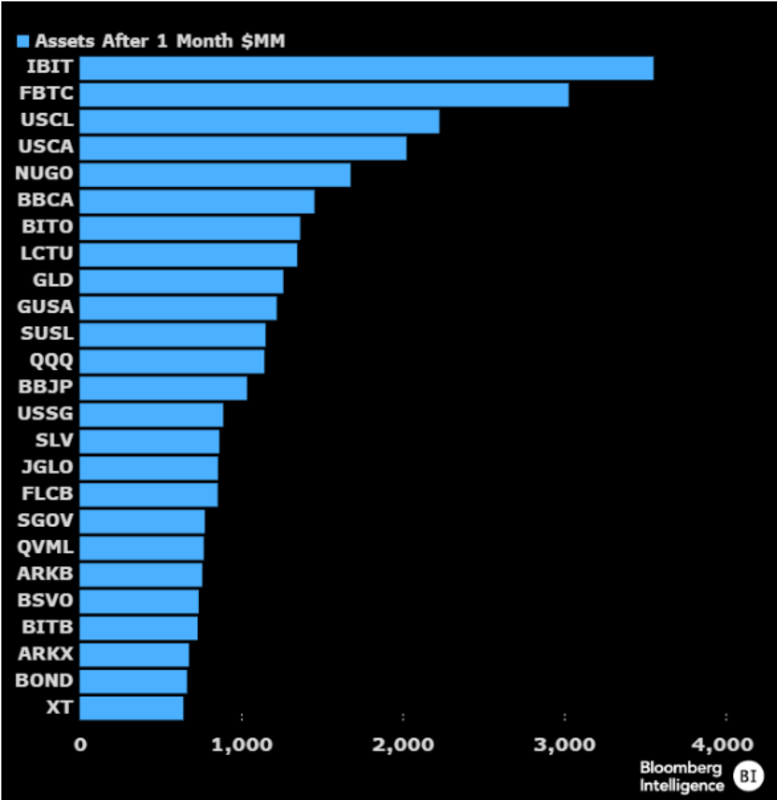

Trying on the broader ETF universe, IBIT and FBTC managed to overhaul the iShares Local weather Aware & Transition MSCI USA ETF (USCL), which launched in June 2023, inside a month of buying and selling.

That is notably consultant provided that Bitcoin’s historical past is one in every of assaults from a perpetuity course.It’s value reminding that the worth of Bitcoin fell by 12% in Could 2021, and shortly after Elon Musk tweets It’s exactly due to ecological points that Tesla now not accepts Bitcoin funds.

In response to the Morningstar report, in January, IBIT and FBTC ranked eighth and tenth respectively because the ETFs with the most important web asset inflows, with iShares Core S&P 500 ETF (IVV) main the best way. Roughly 10,000 BTC flows into the ETF each day, which signifies that the demand for BTC mined per day is tremendously imbalanced, exceeding 900 BTC.

Trying ahead to the long run, because the outflow strain of GBTC weakens and the influx pattern strengthens, funds will proceed to circulation into Bitcoin ETF, which is anticipated to stabilize the worth of BTC.

stabilization mechanism

With 90% of Bitcoin holders coming into the revenue zone, the very best degree since October 2021, promoting strain is more likely to come from quite a lot of sources together with establishments, miners, and retail. The pattern of upper inflows into the Bitcoin ETF is a bulwark in opposition to it, particularly heading into one other hyped occasion – the fourth Bitcoin halving.

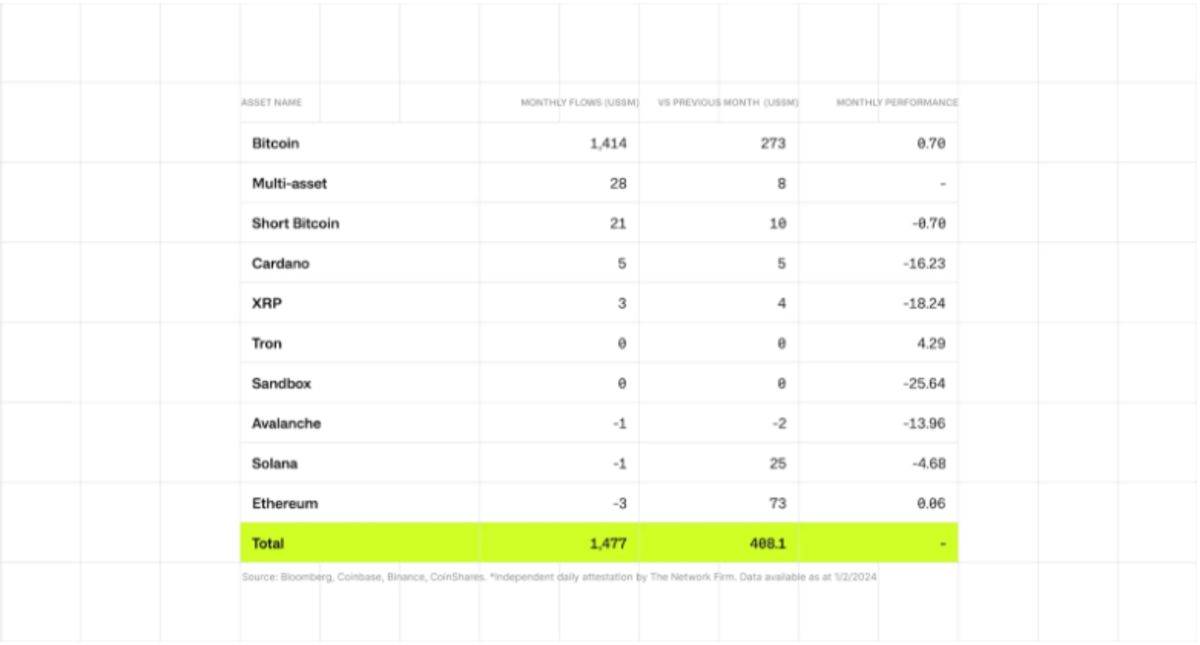

Greater buying and selling quantity creates greater liquidity, which smoothes value fluctuations. It is because elevated buying and selling quantity between consumers and sellers can take in non permanent imbalances. In January, CoinShares reported $1.4 billion in Bitcoin inflows, plus $7.2 billion from U.S. new difficulty funds, whereas GBTC noticed $5.6 billion in outflows.

On the identical time, massive monetary establishments are setting new liquidity benchmarks. As of February 6, Constancy Canada established a 1% allocation to Bitcoin in its All-in-One Conservative ETF fund. Given its “conservative” moniker, this indicators the next allocation to non-conservative funds sooner or later.

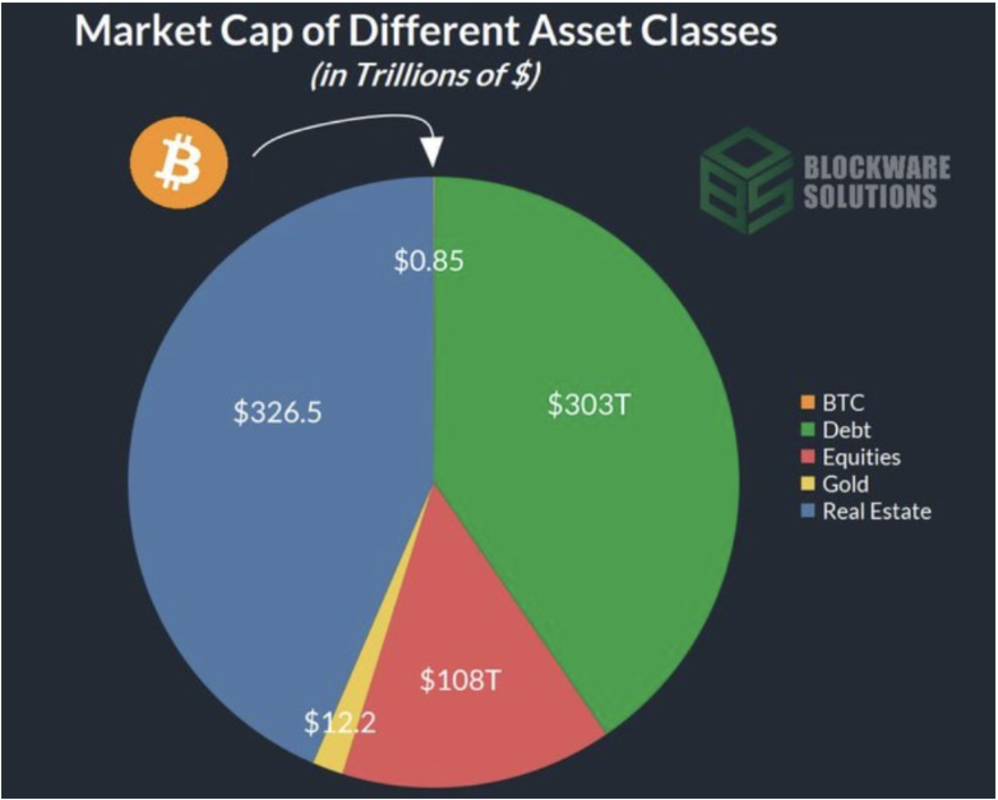

Finally, if Bitcoin captured 1% of the $749.2 trillion market pool throughout varied asset lessons, Bitcoin’s market cap might develop to $7.4 trillion, bringing the Bitcoin value to $400,000.

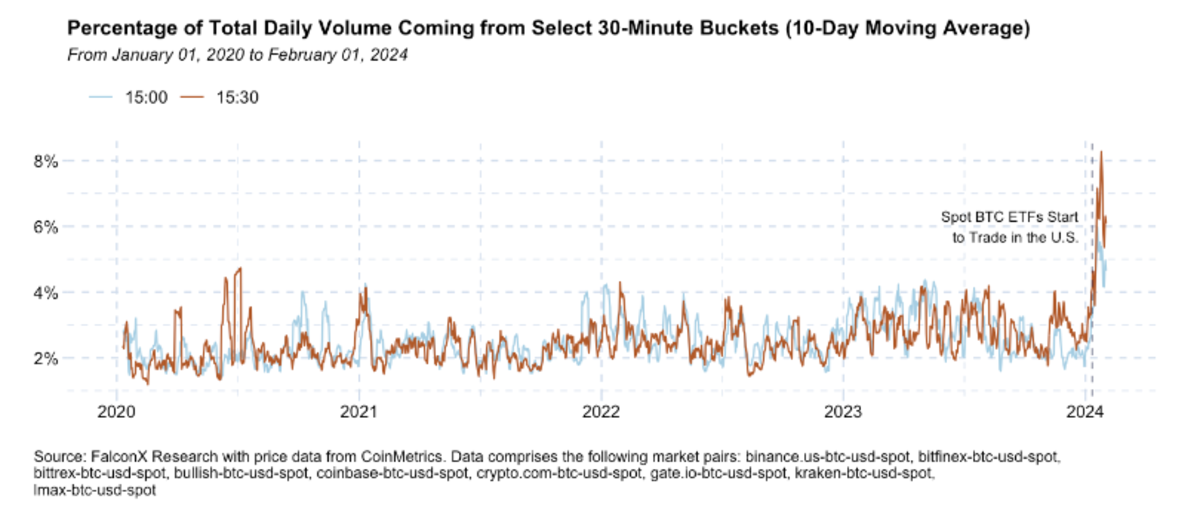

Provided that Bitcoin ETFs present a constant and clear reference level for market costs, massive aggregation transactions scale back the market’s affect on potential miner sell-offs. This may be seen from FalconX Analysis, which reveals that whole day by day buying and selling quantity has elevated considerably, from the earlier common of 5% to the vary of 10 – 13%.

In different phrases, the market mechanisms triggered by the brand new Bitcoin ETF are decreasing total market volatility. Thus far, Bitcoin miners have been the primary driver of decrease costs on the opposite aspect of the liquidity equation. In Bitfinex’s newest weekly on-chain report, miner wallets triggered an outflow of 10,200 BTC.

This matches the beforehand talked about influx of roughly 10,000 BTC into the Bitcoin ETF, leading to comparatively steady value ranges. As miners reinvest and improve their rigs forward of the fourth halving, one other stabilization mechanism could come into play – choices.

Though the SEC has not but permitted the choice to identify commerce a BTC ETF, this improvement will additional increase the ETF’s liquidity. In any case, broader funding methods round hedging improve liquidity on either side of the transaction.

As a forward-looking indicator, implied volatility on choices trades can gauge market sentiment. However with the launch of the BTC ETF, we’ll inevitably see the market mature extra, and we usually tend to see the pricing of choices and derivatives contracts be extra steady total.

Analyze capital inflows and market sentiment

As of February 9, the Grayscale Bitcoin Belief ETF (GBTC) held 468,786 BTC. Final week, BTC value rose 8.6% to $46,200. In step with earlier predictions, which means that the BTC sell-off is more likely to unfold via a number of rallies main as much as the fourth halving and past.

In response to the most recent information supplied by Farside Traders, as of February 8, Bitcoin ETFs have collected inflows of US$403 million, for a complete of US$2.1 billion. GBTC outflows totaled $6.3 billion.

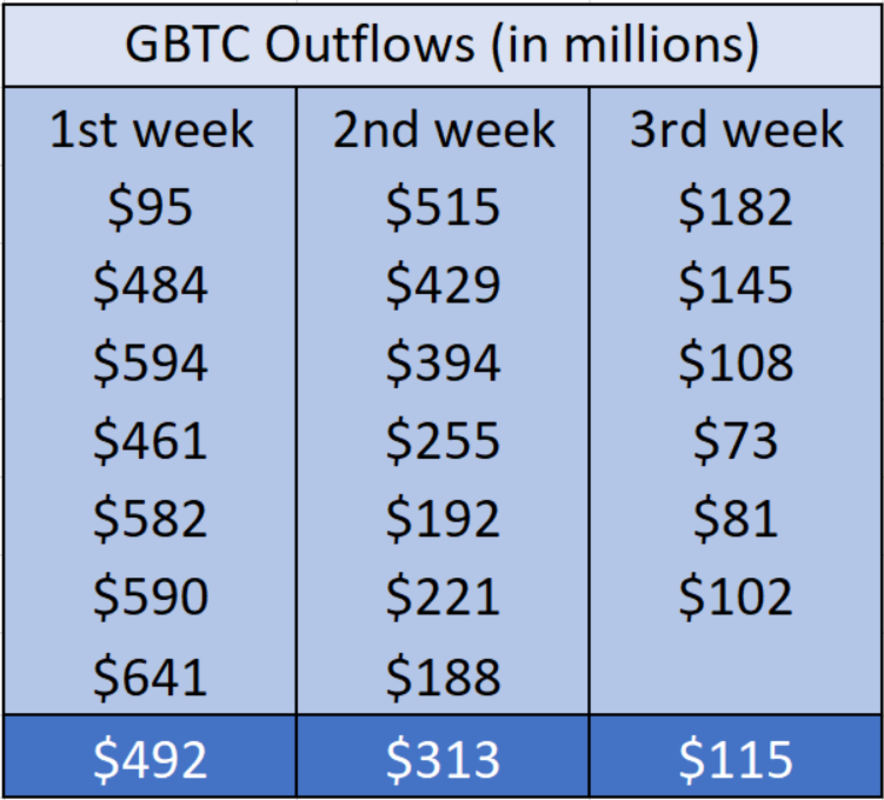

From January 11 to February 8, GBTC outflows declined steadily. Within the first week, their common income was $492 million. Within the second week, the common GBTC outflow was $313 million, and within the third week, the common outflow was $115 million.

On a weekly foundation, this implies a 36% discount in promoting strain from week one to week two, and a 63% discount in promoting strain from week two to week three.

As of February 9, because the GBTC FUD unfolded, the Cryptocurrency Worry and Greed Index rose to “grasping” to 72 factors. This represents a glance again to January 12, when the worth was at 71 factors, simply days after the Bitcoin ETF was permitted.

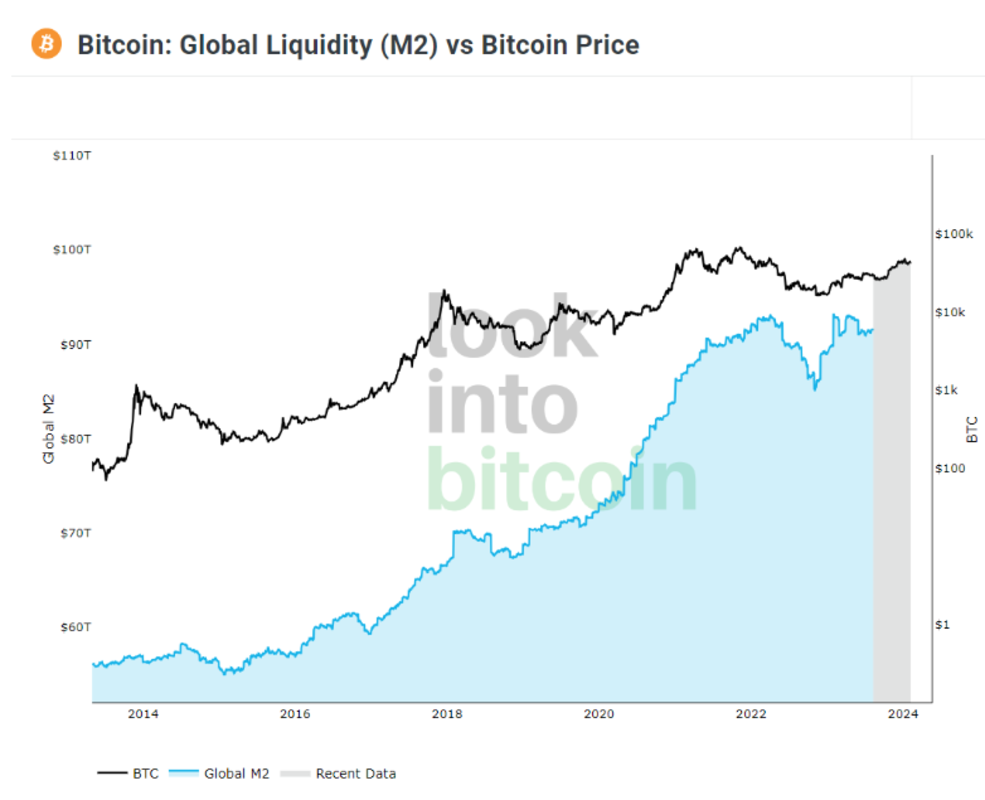

Trying forward, it’s value noting that Bitcoin value depends on world liquidity. In any case, it was the Fed’s March 2022 rate of interest hike cycle that triggered huge cryptocurrency bankruptcies, finally resulting in the collapse of FTX. Present fed funds futures predict the cycle will finish in Could or June.

Moreover, the Fed is unlikely to alter course on cash printing. On this case, Bitcoin value will observe swimsuit.

Bitcoin is positioning itself as a safe-haven asset given the insurmountable nationwide debt of $34 trillion and federal spending persevering with to exceed income. A forex ready for capital to circulation into its restricted provide of 21 million cash.

Historic background and future affect

As an identical safe-haven asset, Gold Bullion Securities (GBS) was launched on the Australian Securities Trade (ASX) in March 2003 as the primary gold ETF. Subsequent yr, SPDR Gold Shares (GLD) will listing on the New York Inventory Trade (NYSE).

Within the week since November 18, 2004, GLD’s whole web belongings rose from $114,920,000 to $1,456,602,906. By the tip of December, that quantity had decreased to $1,327,960,347. GLD had till November 22, 2005 to finish in an effort to deliver BlackRock’s IBIT market capitalization to $3.5 billion.

Though not adjusted for inflation, this reveals market sentiment for Bitcoin is best than gold. Bitcoin is digital, however it’s based mostly on a proof-of-work mining community unfold the world over. Its digital nature interprets into portability, which might’t be mentioned to be golden.

The U.S. authorities demonstrated this in 1933 when President Roosevelt issued Government Order 6102, requiring residents to promote gold bullion. Likewise, new veins of gold are found continuously, undermining its restricted provide profile in comparison with Bitcoin.

Past these fundamentals, Bitcoin ETF choices have but to materialize. Nonetheless, analysts at Normal Chartered Financial institution count on the dimensions of Bitcoin ETFs to succeed in $500-100 billion by the tip of 2024. Moreover, main firms have but to observe MicroStrategy’s lead and successfully convert inventory gross sales into depreciating belongings.

Even a 1% BTC allocation in a mutual fund might trigger BTC costs to surge. For instance, Advisors Most popular Belief allocates 15% of its protection to oblique Bitcoin publicity via futures contracts and BTC ETFs.

in conclusion

After 15 years of skepticism and slander, Bitcoin has reached the top of credibility. The primary wave of sound cash believers ensured that its blockchain model wouldn’t disappear into the dustbin of coded historical past.

Using on the arrogance, Bitcoin buyers have up to now constituted the second wave. The Bitcoin ETF milestone represents the third wave of publicity milestones. Central banks world wide proceed to erode confidence in currencies as governments can’t management themselves and take pleasure in spending.

With a lot noise launched into the alternate of worth, Bitcoin represents a return to the roots of sound cash. Its saving grace is digital, but in addition as a bodily proof of labor for vitality. Until the U.S. authorities takes excessive motion to undermine institutional danger publicity, Bitcoin could even substitute gold as the standard safe-haven asset.

It is a visitor submit by Shane Neagle. The views expressed are totally their very own and don’t essentially replicate the views of BTC Inc or Bitcoin Journal.