This text seems in Bitcoin Journal’s “The inscription drawback”.Click on right here Get an annual Bitcoin Journal subscription.

Click on right here to obtain a PDF model of this text.

Ordinal numbers have all the time been a polarizing phenomenon for many sub-communities of Bitcoin – apart from miners.

The fast rise of recent Bitcoin-native NFT requirements has dominated discussions for months, as Ordinals flood block area and push transaction charges to multi-year highs. Critics argue that these transactions are, at worst, an assault on Bitcoin, tarnishing the sanctity of scarce block area; at greatest, they’re junkcoins, playthings for gamblers belonging to on line casino chains like Ethereum.

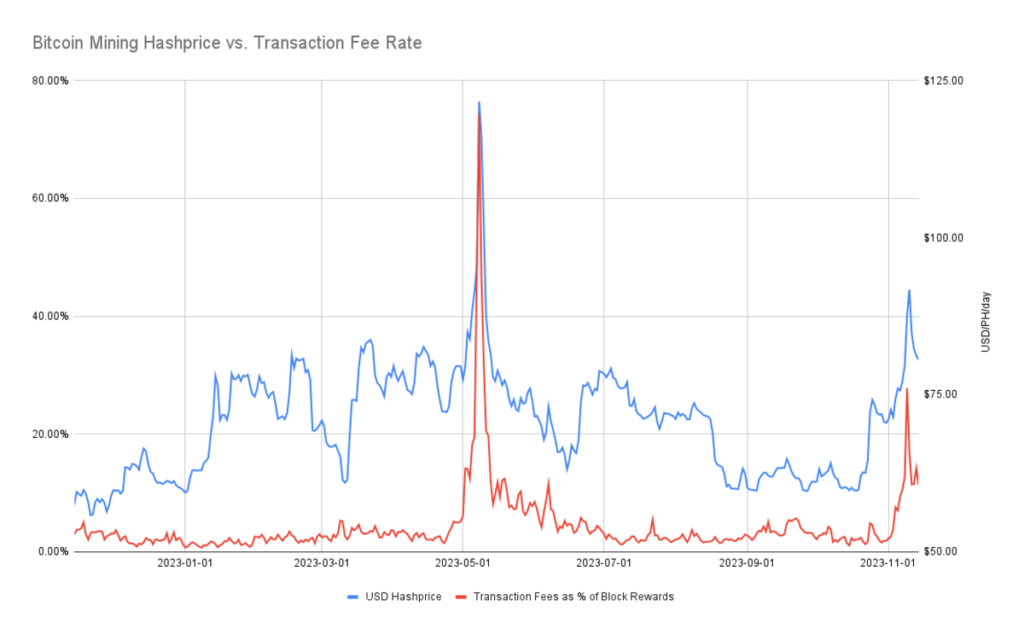

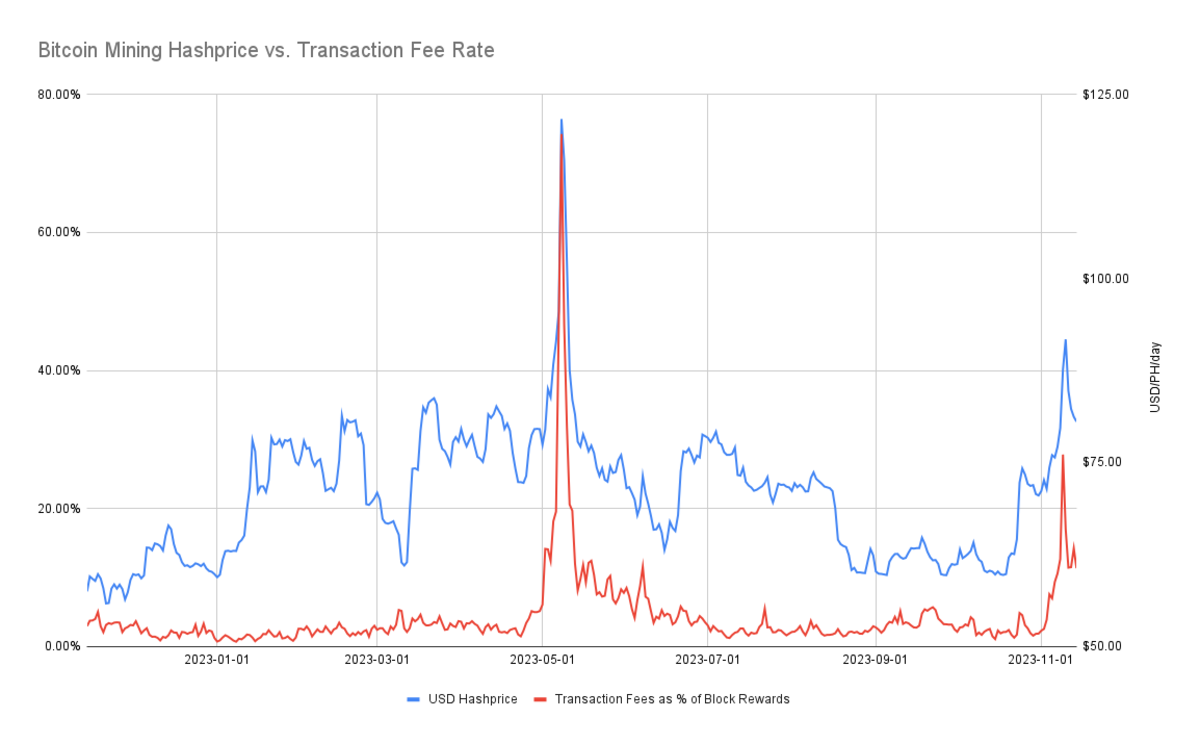

Effectively, the miners do not care if they’re rubbish cash. They do not care in any respect about making a living, and at a time when mining income is at one in every of its all-time lows, Ordinals is growing their income. Many miners have embraced serialization/inscription, or are at the least ambivalent about it, as they acquired a much-needed increase in Bitcoin mining profitability at a time when many miners had been almost breaking even or unprofitable.

Hash worth is a measure of the quantity of USD (or Bitcoin) {that a} miner can anticipate to earn per unit of hash price (e.g. a miner with a 1 petahash miner at $80/PH/day – roughly 10 new Era ASIC, for instance, S19j Professional — can earn $80 per day).

Given Ordinals’ optimistic influence on hash costs, a darkish horse technological development that few might have predicted final yr, it has grow to be the middle of discussions concerning the economics of Bitcoin mining which might be extra intently tied to every block, making us extra Bitcoin’s fourth block subsidy halving approaches.

I’m not scripting this to persuade anybody to grow to be an informal medal fanatic. On the one hand, I don’t fairly perceive the enchantment. However I do suppose they’re essential within the context of Bitcoin’s ever-dwindling block subsidy, so it’s value learning them to grasp how they influence the block area and mining economics — and the way developments like them will help miners survive on their very own. What the longer term may imply concerning transaction charges.

WTF is an ordinal quantity anyway?

In NFT terminology, folks use serial numbers and inscriptions interchangeably, however every time period refers to 2 completely different features of the NFT normal.

An inscription is a chunk of artwork or digital media, and a serial quantity is technically a quantity assigned to an inscription that marks its place within the grand scheme of all different inscriptions. One other approach to have a look at it’s that the inscriptions themselves are NFTs, and the serial quantity is the quantity used to establish a single inscription.

The data for every inscription is positioned within the SegWit portion of the transaction. Subsequently, in contrast to different NFT requirements, the precise art work, digital media or supplies are uploaded on to Bitcoin’s blockchain. Since inscriptions are totally on-chain, you would argue that they’re the purest type of NFT obtainable, as they profit from the immutability of the blockchain.

Not all inscriptions are created equal

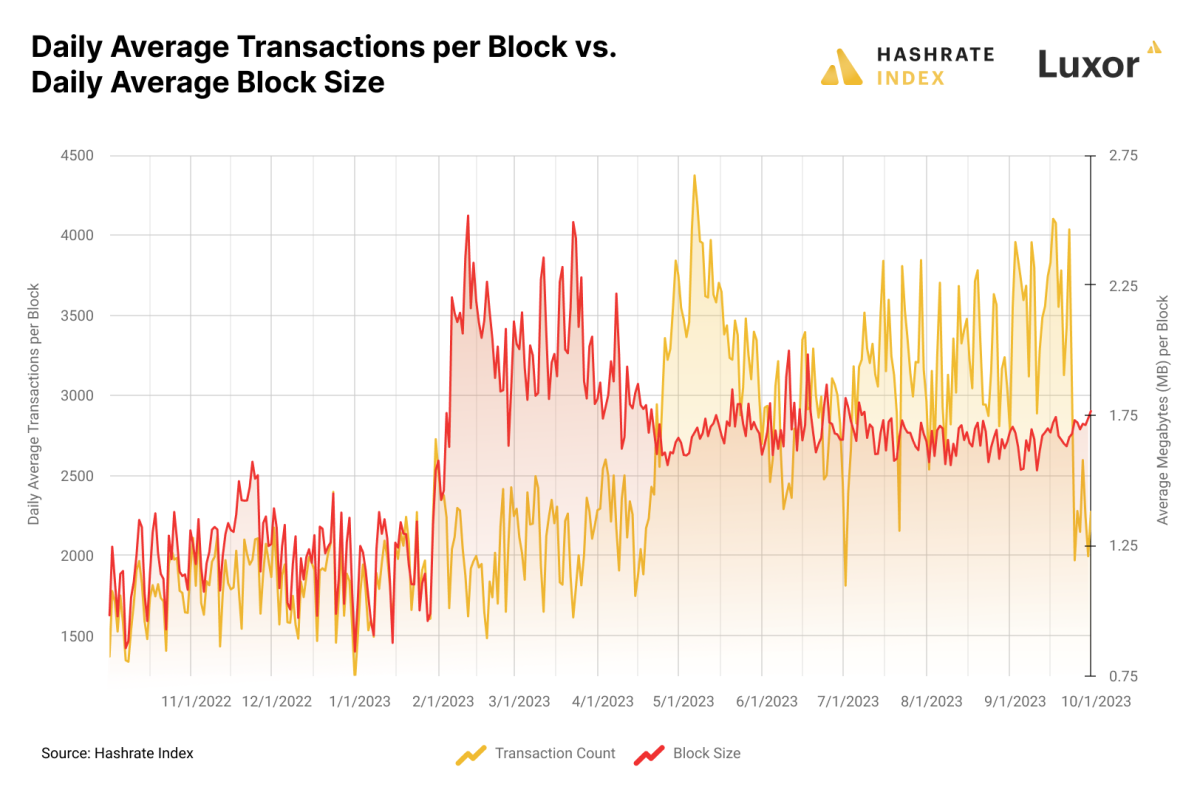

You may perceive a few of the critics’ criticisms and considerations while you perceive that the inscriptions are precise on-chain materials; if a bunch of NFT degens had been monkey-inscribing JPEGs and dickbutts and god is aware of what else on-chain, then that may crowd out Financial (and doubtless vital) transactions.

This concern is exacerbated by the truth that every inscription’s arbitrary information advantages from a transaction payment low cost. As a scalability measure, Bitcoin’s Segwit improve modified the transaction construction in order that the personal key signature and public key witness information had been moved from the transaction hash area to a different a part of the block. Bitcoin reductions SegWit information so fewer satoshis are required per tuple transaction charges. Any information of the inscription is current within the SegWit area of the transaction, so it’s entitled to the SegWit low cost. Cue Pitchfork.

This low cost is why regardless of the primary wave of image-based inscriptions clogging up the block area in February/March/April, transaction charges didn’t enhance considerably; when the trend-setting inscribers used hundreds within the blockchain The block measurement swells as every JPEG refreshes the primary set of inscriptions, however this all advantages from SegWit’s 4 to 1 information low cost in comparison with regular transactions. Maybe intuitively, it wasn’t till BRC-20 tokens’ data-heavy, text-based inscriptions turned the most well-liked inscription sort that transaction charges skyrocketed.

The so-called BRC-20 (a recognition of Ethereum’s personal ERC-20 token normal) is a free token. I say loosely as a result of they’re actually only a collection of ordinal numbers outlined by Bitcoin’s OP_CODE perform, the place every “token” is itself an OP_CODE transaction, which defines the token’s place in a particular BRC-20 collection. It goes like this: Somebody (God solely is aware of who) publishes an OP_CODE transaction that defines the utmost provide of the token collection, the ticker, and the minting restrict per transaction. As soon as public, anybody with the technical information can mint tokens of the collection.

These OP_CODE transactions can not profit from SegWit’s profile reductions, so their value is way increased than image-based inscriptions. However additionally they have a perform that picture inscriptions shouldn’t have: a minting perform, which brings Ethereum NFT-style incentives to amassing these inscriptions. Ethereum NFT collection usually have minting contracts, and anybody can create new NFTs within the collection by interacting with the contract. That is a part of the enchantment—if not all of it. Minting an NFT is like opening a digital pack of Pokémon/Baseball/Magic: The Gathering playing cards – possibly there is a uncommon card within the subsequent one!

Whereas there is not essentially a chance to mint uncommon BRC-20s (since they’re all the identical), there is a chance to mint a bunch of NFTs within the scorching new collection. I do not know why anybody would care about ORDI/CUMY/RATS #1 or #100 or no matter. Maybe that is the best manifestation of the Idiot’s Idea but in Bitcoin. However the reality is, they did, and BRC-20’s minting incentives triggered the biggest Bitcoin buying and selling exercise ever.

By means of the payment warfare and the truth that these NFTs can not profit from SegWit reductions, BRC-20 gives Bitcoin miners with a veritable payment fest, however not fairly in the best way you may think.

Quantifying Transaction Charge Collateral Injury

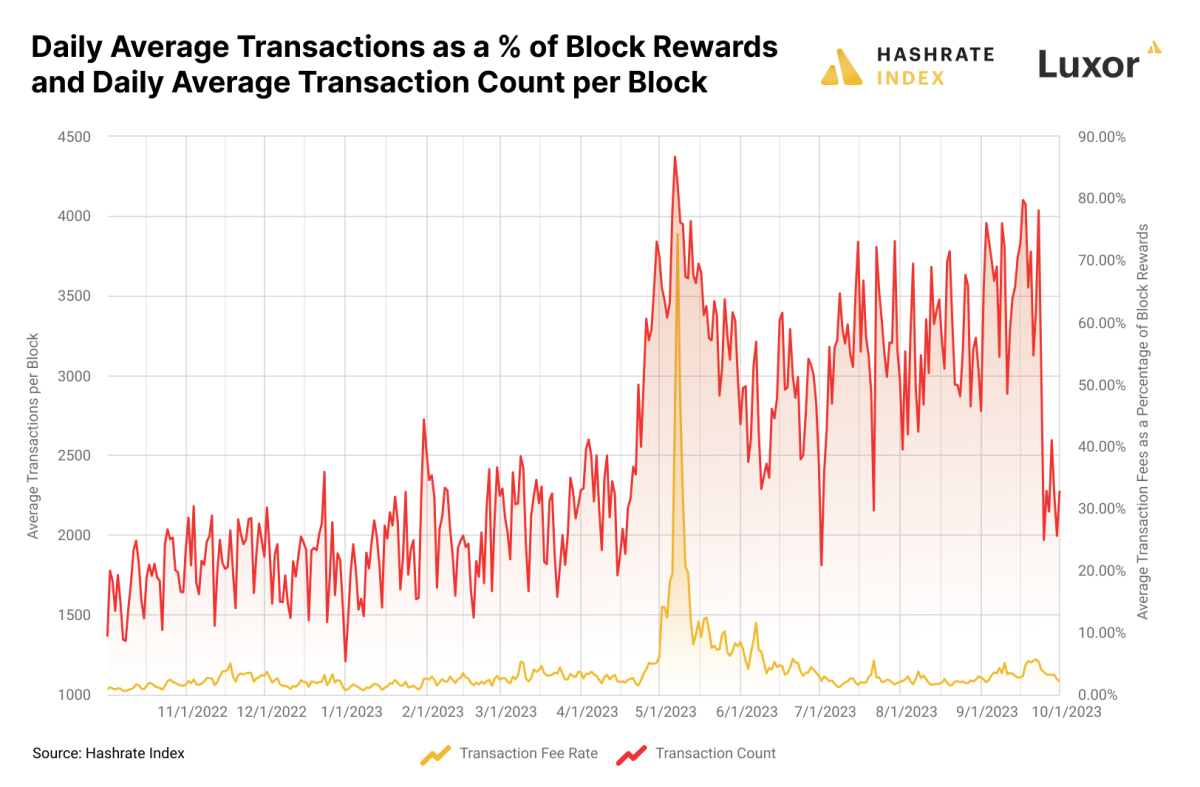

A lot of the expansion in transaction charges in 2023 doesn’t come instantly from charges associated to Ordinals; it comes from overhead payment stress from different transactions.

As of November 12, 2023, miners have earned $70.3 million in charges from Ordinals, based on information from impartial analyst Knowledge All the time’s Dune dashboard. It appears large, however that’s solely 19.4% of the $368.2 million in transaction charges miners have earned in whole since Inscription launched on December 14, 2022. To place it into additional perspective, there have been 40.2 million Inscription transactions, equal to 30% since December 14, with Inscription accounting for one-third of all transaction quantity. Consequently, Inscription accounted for one-third of final yr’s transaction quantity however solely one-fifth of all charges.

As for different charges, a lot of them are the results of overhead payment stress from Inscription – that’s, the charges don’t come instantly from Inscription itself, however from the stress that Inscription places on the typical transaction charges required to clear a Bitcoin transaction at an affordable time throughout the vary.

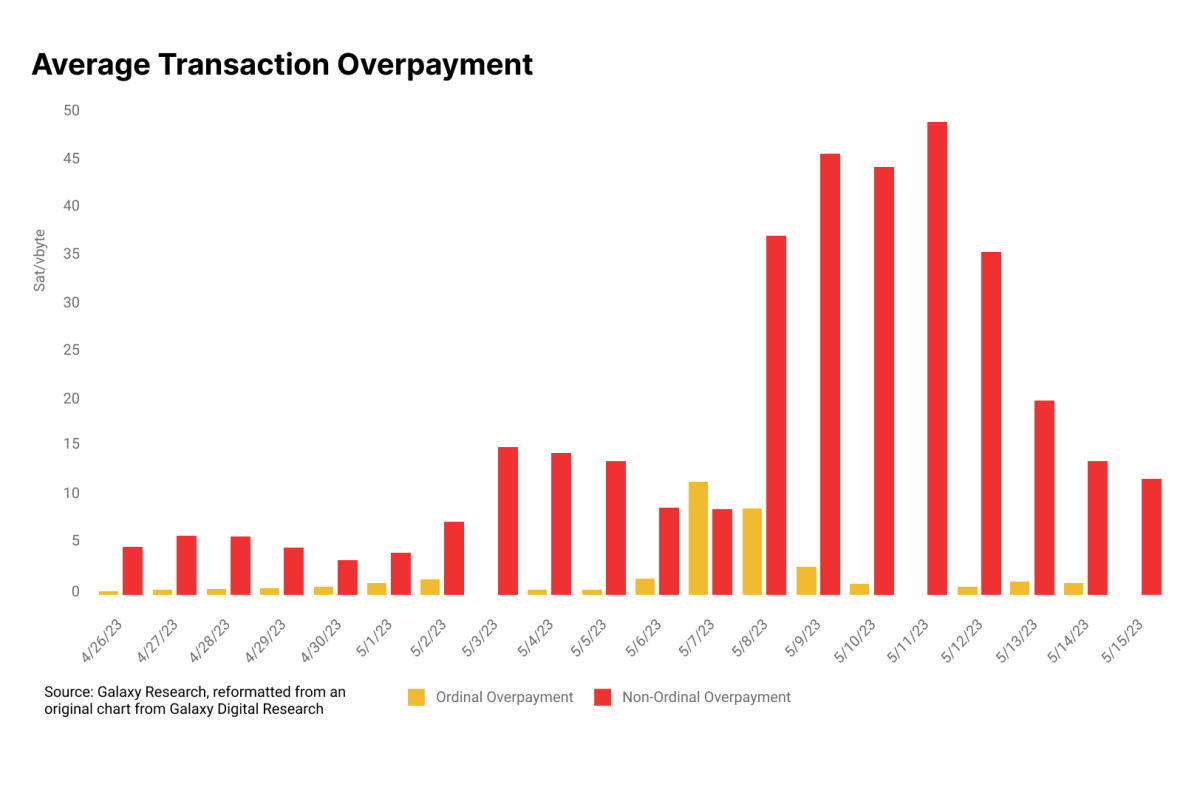

Galaxy Digital Analysis examined this growth in a report titled “Bitcoin Inscriptions and Serial Numbers: A Mature Ecosystem.” Rampant inscription exercise congests the reminiscence pool. That is very true in the course of the BRC-20 minting occasion, as first-come, first-served minting stimulates bidding wars because the inscriber turns into the primary to mint the collection. As Galaxy Digital Analysis factors out, this raises the ground on common transaction charges and causes particular person merchants to “overpay” for transaction charges. They outline an overpayment as any payment in a block that’s increased than the median transaction payment for that block. For regular transactions, this overpayment might come from the pockets or alternate’s transaction payment estimator, or from the typical consumer’s ignorance of the transaction payment construction and dynamics. Some customers may additionally have to expedite transactions for a wide range of causes, leading to overpayments. Concerning inscription transactions, Galaxy Digital Analysis acknowledged that “voluntary overpayments” are widespread during times when inscription minting actions are frequent and fashionable.

This chart quantifies overpayments on the Inscription transaction and all different transactions as an instance the dynamics Galaxy Digital Analysis outlines in its report. When Bitcoin’s mempool backlogged in April and Might (by far the most well liked time for Inscription exercise), many of the transaction charges throughout that interval really got here from extra charges paid by customers for monetary transactions, not from Inscription itself. These customers might be able to make it simpler on themselves by not utilizing the buying and selling payment estimators constructed into wallets and exchanges.

blessings and curses

The inscription is a blessing and a curse. For miners, they’re a godsend, however for different Bitcoin fanatics, particularly those that need to ship transactions throughout the community day by day, they could be a ache.

In different phrases, the block area is an open market. So I haven’t got to comprehend, because the Cardinal did, that it is not my job to police different folks’s spending. I’m additionally not certified to assessment transactions for paid block area on the free market. In any case, that is a part of the purpose of permissionless blockchains: making transactions that nobody else needs you to make.

This text seems in Bitcoin Journal’s “The inscription drawback”.Click on right here Get an annual Bitcoin Journal subscription.

Click on right here to obtain a PDF model of this text.