Amid the dramatic modifications within the cryptocurrency market, the funding recreation is present process an enormous transformation. Spot Bitcoin ETFs exist already, marking Bitcoin’s leap into mainstream finance and bringing it nearer to conventional funding buildings. We’ll take a look at the tip of the iceberg and attempt to think about its true depth and the present correlation between Bitcoin, shares, and gold. We’ll attempt to determine if conventional markets are literally main Bitcoin out of its decentralized standing, or if there’s nonetheless hope that it may possibly keep its distinctive path.

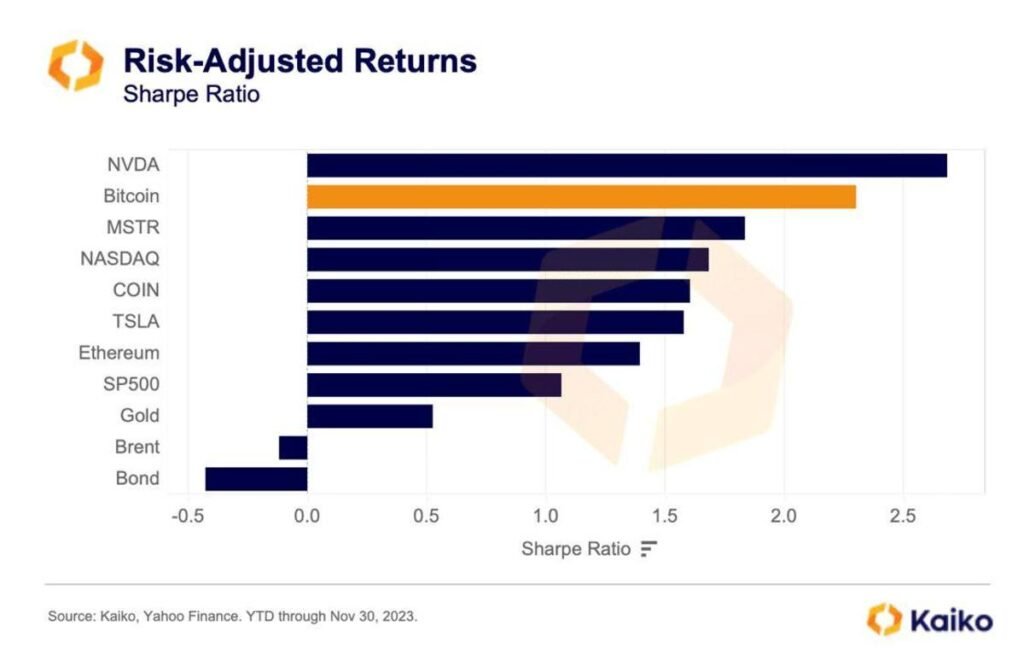

Based on information from Kaiko, Bitcoin’s risk-adjusted returns are higher than these of conventional property. Nvidia leads the way in which with the best risk-adjusted returns, whereas Bitcoin just isn’t far behind, outperforming main conventional property such because the S&P 500 and gold, with its risk-adjusted worth hovering by greater than 160%.

In the meantime, 80% of modifications in cryptocurrency costs and their rising correlation with inventory markets coincide with the entry of institutional traders into the cryptocurrency market since 2020, in response to the Worldwide Financial Fund’s Crypto Cycle and U.S. Financial Coverage Examine. Particularly, cryptocurrency institutional buying and selling volumes grew by greater than 1,700% between Q2 2020 and Q2 2021 on exchanges (from roughly $25 billion to over $450 billion). Analysis reveals that U.S. financial coverage impacts cryptocurrency cycles, similar to world inventory cycles. However surprisingly, solely the Fed’s financial coverage issues, and never different main central banks — seemingly as a result of the crypto market is extremely depending on the U.S. greenback.

Moreover, the 2023 Institutional Investor Digital Asset Outlook Survey reveals that 64% of traders plan to extend their holdings within the cryptocurrency house inside three years, allocating as much as 5% of their AUM to cryptocurrencies. Some establishments made investments for the primary time up to now yr, whereas others elevated current investments, the report stated. Whereas the examine highlights a surge in dedication to cryptocurrencies amongst 41% of asset managers, solely 27% of asset house owners seem like rising their holdings.

Though Bitcoin was born out of the idea of spreading energy amongst equals, latest analysis reveals that it’s slowly turning into dominated by just a few large gamers.

Adjustments associated to the state of affairs

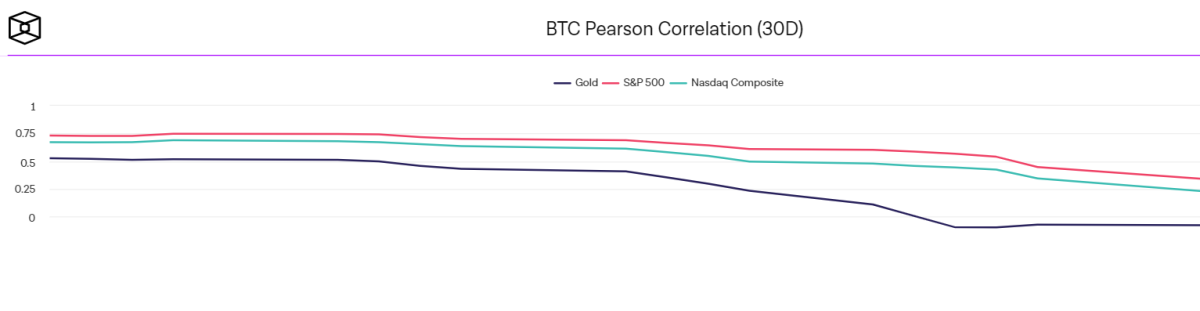

Apparently, Bitcoin’s actions are in sync with the S&P 500 and Nasdaq, displaying a formidable correlation. On the similar time, the correlation between Bitcoin and gold has fallen sharply lately, which contrasts with traders’ views of cryptocurrencies as a protected haven or hedge in opposition to inflation, the function that gold has historically performed.

Notably, Bitcoin’s correlation with gold was 0.83 on November 7, 2023, however dropped to -0.1 on January 10, 2024, earlier than rebounding to a barely increased optimistic correlation on February 9, 2024 Intercourse 0.14. The S&P 500 had a destructive correlation of -0.76 on November 11, 2023, after which reached a optimistic correlation of 0.57 in January 2024. This shift from destructive to optimistic correlation signifies a change in investor sentiment in the direction of Bitcoin.

The Nasdaq, identified for its tech and development shares, has additionally proven a variable correlation with Bitcoin. The destructive correlation on October 30, 2023 was -0.69, which became a optimistic correlation of 0.44 in January. Merchants seem like linking the rhythms of Bitcoin to the heart beat of the tech business, hinting at a brand new kinship in funding methods.

When Bitcoin’s correlation with conventional inventory markets just like the S&P 500 and the Nasdaq will increase, whereas its correlation with gold decreases, it means that Bitcoin is performing extra like a threat asset reasonably than a hedge. dangerous property. When traders really feel adventurous, they usually flip to shares and digital currencies for larger income.

If institutional and retail traders more and more take part within the inventory and cryptocurrency markets, their simultaneous purchase and promote choices might trigger the worth actions of those property to align.

The approval of a spot Bitcoin ETF seems to be rising its attraction to giant traders, a big portion of whom are already planning to step up their Bitcoin recreation. Bitcoin’s entry into ETFs might trigger it to behave extra like shares, as these funds are important gamers within the inventory world.

In these developments, the very nature of Bitcoin and different cryptocurrencies, which aren’t constrained by the standard monetary system, might be undermined. Moreover, these shifts might expose Bitcoin to the very systemic dangers it was designed to keep away from.

Conclusion

As we take a look at how a spot Bitcoin ETF may change Bitcoin’s place out there and its present connection to shares, we’ll must control the thrill and doable development forward of extra giant gamers becoming a member of in with a stay-at-heart Bitcoin Core To strike a steadiness between the ideas of non-centralized management. Bitcoin’s transfer towards a extra concentrated funding scene might roil the market, providing vivid alternatives but in addition severe challenges.

This can be a visitor publish by Maria Carola. The views expressed are solely their very own and don’t essentially replicate the views of BTC Inc or Bitcoin Journal.