A shift in technical indicators has sparked predictions of an imminent surge in altcoins, with one analyst at X predicting good points as large as these seen in 2017 and 2021.

This technical indicator simply turned inexperienced

Analyst X explain The optimism follows modifications within the Gaussian Channel, a technical indicator used to evaluate market momentum. On X, merchants notice that the Gaussian channel has modified from purple to inexperienced after a number of weeks.

Taking a look at historic efficiency and indicator modifications, main altcoins like Ethereum, Solana and even Dogecoin might see a bullish flip within the coming days.

Nonetheless, from a technical perspective, this rise will likely be higher confirmed as soon as there’s a full break above present resistance. If this occurs, the altcoin market might expertise a “parabolic” rally.

The broader cryptocurrency market is bullish on the again of an encouraging Bitcoin rally. The world’s most useful coin is buying and selling above $50,000, trending in direction of December 2021 ranges. Supporters are optimistic that Bitcoin is not going to solely see extra good points within the coming days, however might also escape of the November 2021 highs.

Establishments and buyers use spot Bitcoin exchange-traded funds (ETFs) to carry Bitcoin, resulting in elevated demand.

Tokens similar to Solana and Ethereum, in addition to meme tokens similar to BONK, have benefited vastly from the surge in Bitcoin costs, and their development continues. For instance, SOL is at present buying and selling at over $100, regardless of latest community outages which have raised questions concerning the platform’s reliability. In January, SOL peaked at over $125.

However, Ethereum continues to rise however stays beneath $3,000. Elevated decentralized finance (DeFi) exercise and optimism over the U.S. Securities and Change Fee’s (SEC) approval of a spot Ethereum exchange-traded fund (ETF) proceed to gasoline demand. Not too long ago, Franklin Templeton utilized to regulators to affix BlackRock and Constancy in making use of for Ethereum ETF shares.

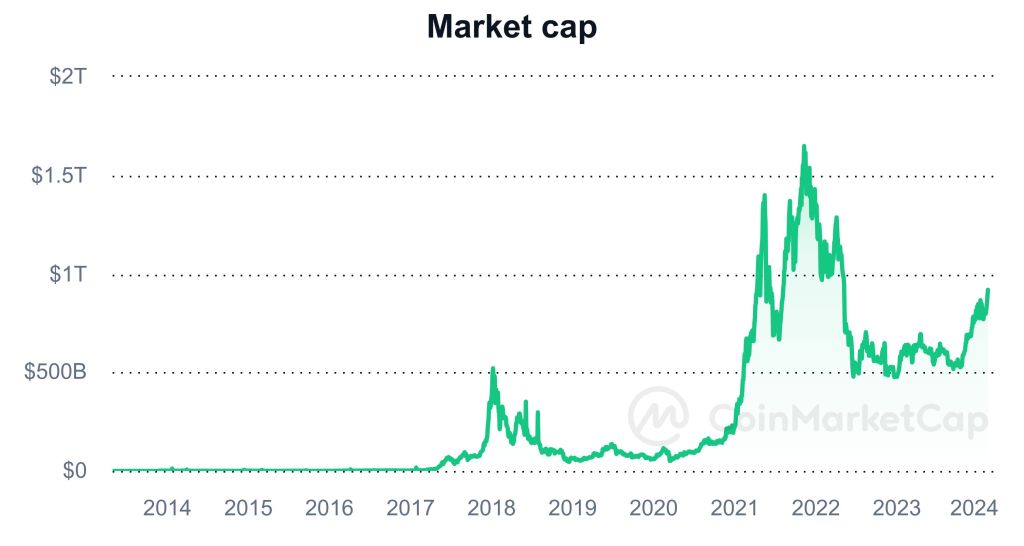

Altcoin market cap approaches $1 trillion

It’s unclear how sturdy the altcoin’s rally can be if consumers took over. Judging from the efficiency of main altcoins similar to Solana and Cardano within the first quarter of 2024, costs are prone to explode, hitting new highs in 2024 and breaking by 2023 resistance.

In response to CoinMarketCap knowledge, altcoin market capitalization has nearly doubled. That quantity has grown from about $475 billion on the finish of 2022 to greater than $910 billion on the time of writing in mid-February. When altcoins peaked in November 2021, their cumulative market capitalization exceeded $1.6 trillion.

Function photos are from DALLE, charts are from TradingView

Disclaimer: This text is for instructional functions solely. It doesn’t signify NewsBTC’s opinion on whether or not to purchase, promote or maintain any funding, and funding naturally entails dangers. It is suggested that you just conduct your individual analysis earlier than making any funding determination. Use of the data offered on this web site is completely at your individual threat.