The next is an excerpt from the most recent version of Bitcoin Journal Professional, Bitcoin Journal’s premium market publication. To be among the many first to obtain these insights and different on-chain Bitcoin market evaluation immediately into your inbox, Subscribe now.

With Bitcoin’s subsequent halving set to happen this month, miners are profiting from document income to adapt their enterprise fashions to benefit from the disruption.

The halving is coming. As the whole Bitcoin world waits with bated breath for the halving of mining rewards, the potential for brand spanking new income streams has us questioning how the house will reply to new market situations. Up to now, halvings have usually been related to Bitcoin exuberance, however they’re additionally recognized to shake up earlier assumptions to a fantastic extent. We’ve already seen some examples of those market adjustments; to call only one, bigger miners have been modernizing their gear to make sure that the effectivity of the {hardware} is maximized. This has led to those corporations promoting outdated gear at a reduction, with hundreds of mining rigs discovering their approach to aspiring miners in Africa and Latin America. Ethiopia’s low-cost hydropower has attracted worldwide capital because it turns into a brand new mining hub, with a big proportion of drilling rigs priced low.

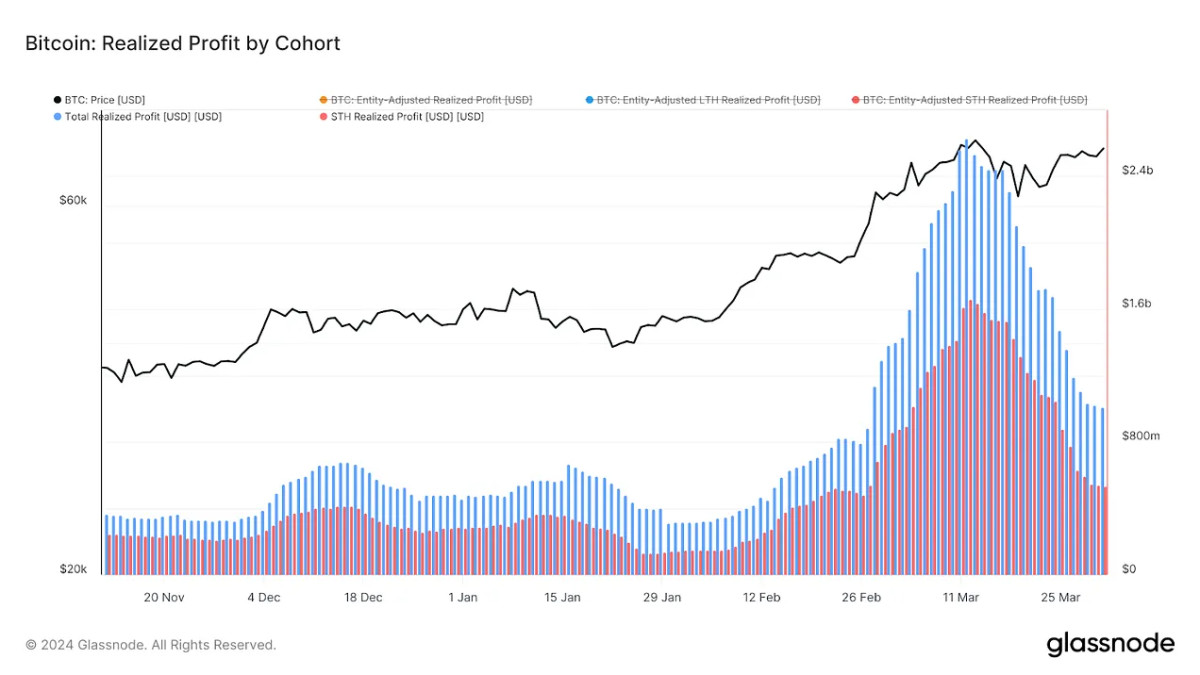

In different phrases, miners count on much less manufacturing within the close to future, however this nonetheless spurs the creation of recent mining corporations world wide and web development within the {industry}. This is only one instance of the number of sudden alternatives that may hit the digital asset house and that Bitcoin fanatics should seize. There are definitely ample alternatives for miners as an entire. In March 2024, month-to-month income from the collective mining {industry} hit an all-time excessive, simply exceeding $2 billion. That is particularly noteworthy since lower than half of this income comes from transaction charges, a far cry from December when transaction charges exceeded mining rewards.

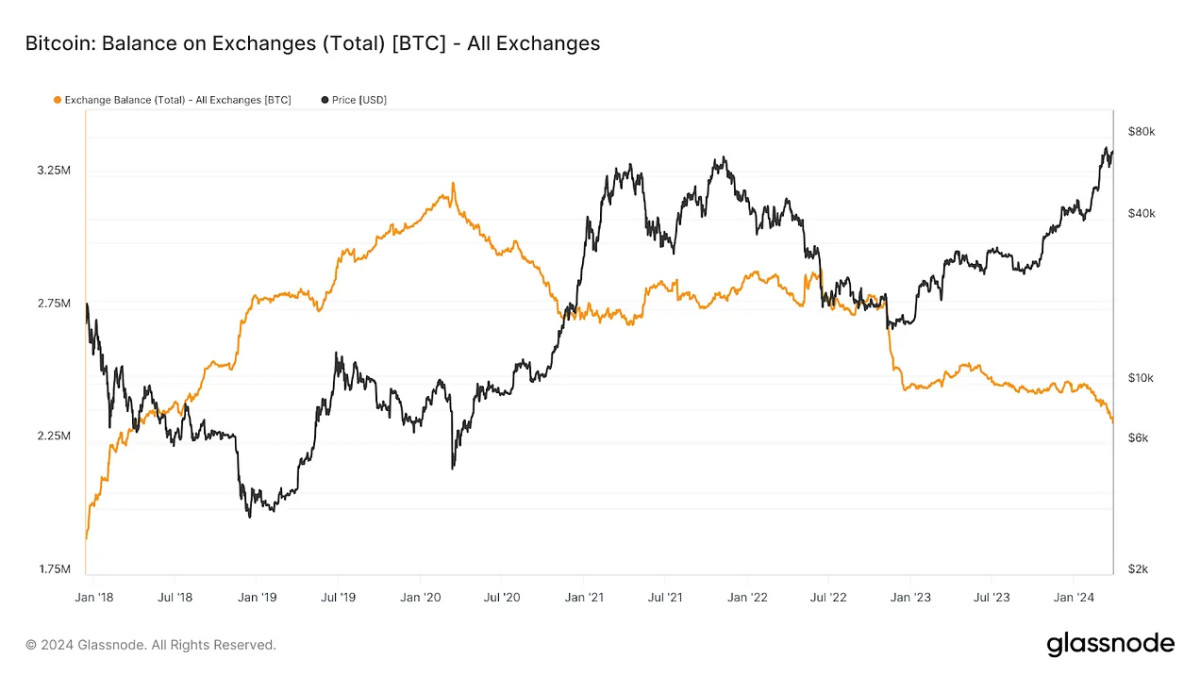

In December, the value of Bitcoin was far decrease than anticipated, and the blockchain encountered congestion. This congestion not solely suppresses the demand to purchase Bitcoin, but additionally will increase the demand for miners to course of the blockchain. Merely settling transactions for already mined Bitcoins was extra worthwhile than mining and promoting new Bitcoins, and the enterprise turned a lifeline for a lot of small corporations. Now, although, cash appears to be flowing in every single place. Bitcoin ETFs are gobbling up Bitcoin at a particularly excessive price – greater than 6 instances the precise output of miners. The massive cash has even introduced enterprise capital curiosity again into the highlight, additional fueling the frenzy. In whole, Bitcoin reserves on main exchanges fell by almost $10 billion within the first three months of 2024, revealing an enormous demand for newly mined Bitcoin. In such market situations, it’s no shock that miners’ income are at document ranges.

Nevertheless, whereas this era of intense gross sales has definitely created alternatives for miners, there are additionally risks related to the halving. These corporations are frantically making an attempt to generate as a lot income as doable earlier than the halving, and the competitors is so fierce for one easy motive: Trendlines might present encouraging information, however they don’t actually assure Bitcoin’s value. After its provide decreases, it can rise accordingly. cut back. The halving hype and the massive success of ETFs have pushed the value of Bitcoin to the best ranges, however this document has been adopted by volatility. Since breaking out of the benchmark, Bitcoin has been hovering round its nice benchmark, however has not continued to rise considerably. If the value of Bitcoin continues to behave in sudden methods, it can ultimately wreak havoc on smaller corporations and promote {industry} consolidation.

Moreover, a very attention-grabbing improvement has occurred within the Bitcoin secondary market. Some long-term holders (LTH) have begun to fret a couple of common liquidity disaster as voracious demand from ETF issuers and different monetary establishments fully outstrips provide. Whales who have been beforehand content material to carry Bitcoin for years at a time have modified their conduct, apparently deciding that now could be the time to lastly understand huge income. In March 2024, long-term holders started promoting property at an unprecedented price, reaping disproportionate income in comparison with different Bitcoin sellers. Clearly, assets like this may’t final eternally, however this is a vital reminder for some miners: simply since you’re making ends meet after the halving, doesn’t imply that’s the top of the {industry}. Adapt, or this house will discover new methods to go away you behind.

Regardless of this, miners massive and small usually are not taking over the halving problem. These runaway income allow companies to put money into quite a lot of preparedness methods and typically considerably change their enterprise fashions. For instance, US firm Arkon Vitality beforehand operated extra as an infrastructure firm, seeing itself as a supplier to its buyer base of unbiased miners. With the large-scale buy of state-of-the-art mining gear introduced on April 2, it joins an industry-wide pattern of making ready for the halving with essentially the most environment friendly machines doable. Nevertheless, Arkon has not made the gear obtainable to earlier prospects, as a substitute saying it intends to change to mining Bitcoin itself. This straightforward shift represents an enormous change of their general enterprise mannequin, which they plan to implement by “aiming to make Arkon probably the most environment friendly miners on the planet.”

Alternatively, main miner Hut 8 has launched its personal enterprise mannequin transformation, however in a barely totally different course. Through the first-quarter earnings name on the finish of March, CEO Asher Genoot admitted that 70% of the corporate’s income comes from asset mining, however this plan is predicted to vary because the halving approaches. Like many different mining corporations, Hut 8 stays centered on upgrading {hardware} and growing vitality assets in new places, however additionally it is investing in a brand new course. This new course is to not goal totally different property, as its mining operations are centered on Bitcoin, however to develop high-performance computing and synthetic intelligence operations. Genoot claimed that these new companies are “small proper now… however we’re enthusiastic about this enterprise as a result of we see it as a basis from which we will develop.” He added, “You will note us proceed to evolve when it comes to how we develop. Get artistic. “Maximizing the worth of each machine,” emphasizes the necessity to preserve an keen and disciplined method to present mining operations.

These are simply a few of the totally different new methods that miners are adopting in anticipation of the halving. The corporate has been making ready for months and there may be nonetheless time to make extra new plans. As of this writing, the halving is lower than three weeks away, and the countdown to the occasion reveals the optimism and celebratory angle of Bitcoin fanatics in every single place. It doesn’t matter what occurs when the long-awaited day lastly arrives, a couple of constants appear fairly strong. There will likely be big demand for the world’s main digital asset, and the Bitcoin neighborhood will stay as revolutionary as ever. Whether or not Bitcoin rises instantly or behaves unpredictably, somebody is certain to emerge as an enormous winner. For us Bitcoin fanatics, this implies there’s loads to stay up for.