On February 7, Bitcoin costs rose above $44,200, a value degree noticed shortly after the spot Bitcoin ETF was permitted final month.

Particularly, as of 10:45 PM UTC, Bitcoin (BTC) was up 2.5% in 24 hours, with a market value of44,263.78 Whole capital is US$868 billion.

This marks an almost one-month excessive, as BTC was beforehand buying and selling at $44,200 on January 12, simply days after the spot Bitcoin ETF was permitted. Nonetheless, the present value remains to be removed from Bitcoin’s one-month excessive of $48,494 set on January 11.

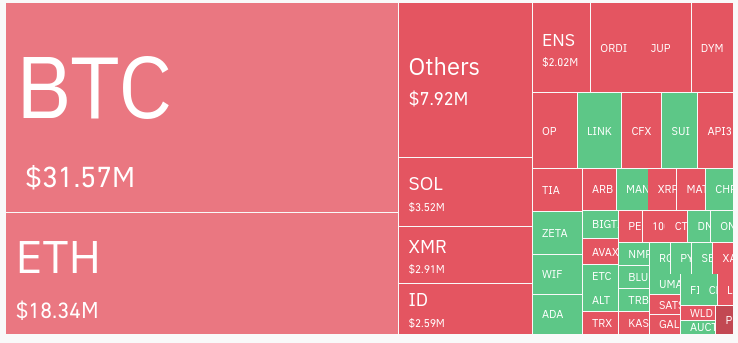

In the meantime, Coinglass information confirmed that the cryptocurrency market liquidated $102.94 million in 24 hours. This whole is primarily made up of $31.57 million in BTC liquidations and $18.34 million in ETH liquidations.

Cryptocurrency markets rose a median of two.3% over 24 hours. High altcoins have seen comparable features: Solana (SOL) is up 3.4%, Avalanche (AVAX) is up 3.0%, Ethereum (ETH) is up 1.9%, BNB is up 1.7%, and Dogecoin (DOGE) is up 1.7%.

A number of elements could also be at play

The explanations for the newest value enhance aren’t fully clear. The January excessive was probably as a result of fading expectations for a spot Bitcoin ETF following its approval.

The latest features could also be partially attributed to expectations for spot Ethereum ETF and spot Bitcoin ETF choices. As we speak’s comparatively small 2.3% achieve throughout the market is in keeping with the dearth of certainty surrounding the approval of those merchandise.

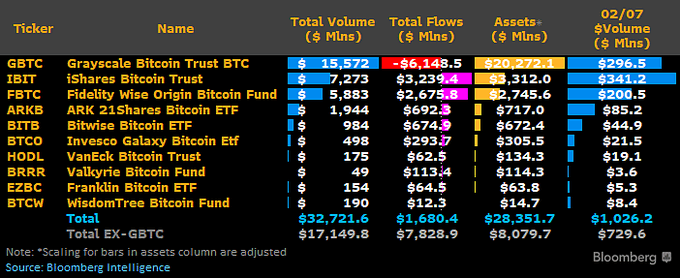

Continued inflows into Bitcoin spot ETFs might also have an effect on Bitcoin costs.Newest information from Bloomberg ETF analyst James Seyffart show Taking into consideration Grayscale’s GBTC outflows, the spot Bitcoin ETF has seen inflows of $1.68 billion. Bitcoin locked in ETF trusts can enhance the value by creating larger demand for remaining provide from traders.

Bitcoin value topped $44,200, a degree reached simply days after the approval of a Bitcoin ETF first appeared on CryptoSlate.