On-chain knowledge exhibits that HODLers’ demand for Bitcoin now exceeds miners’ issuance for the primary time in historical past, and by a substantial margin.

Bitcoin demand from collected addresses is increased than miner issuance

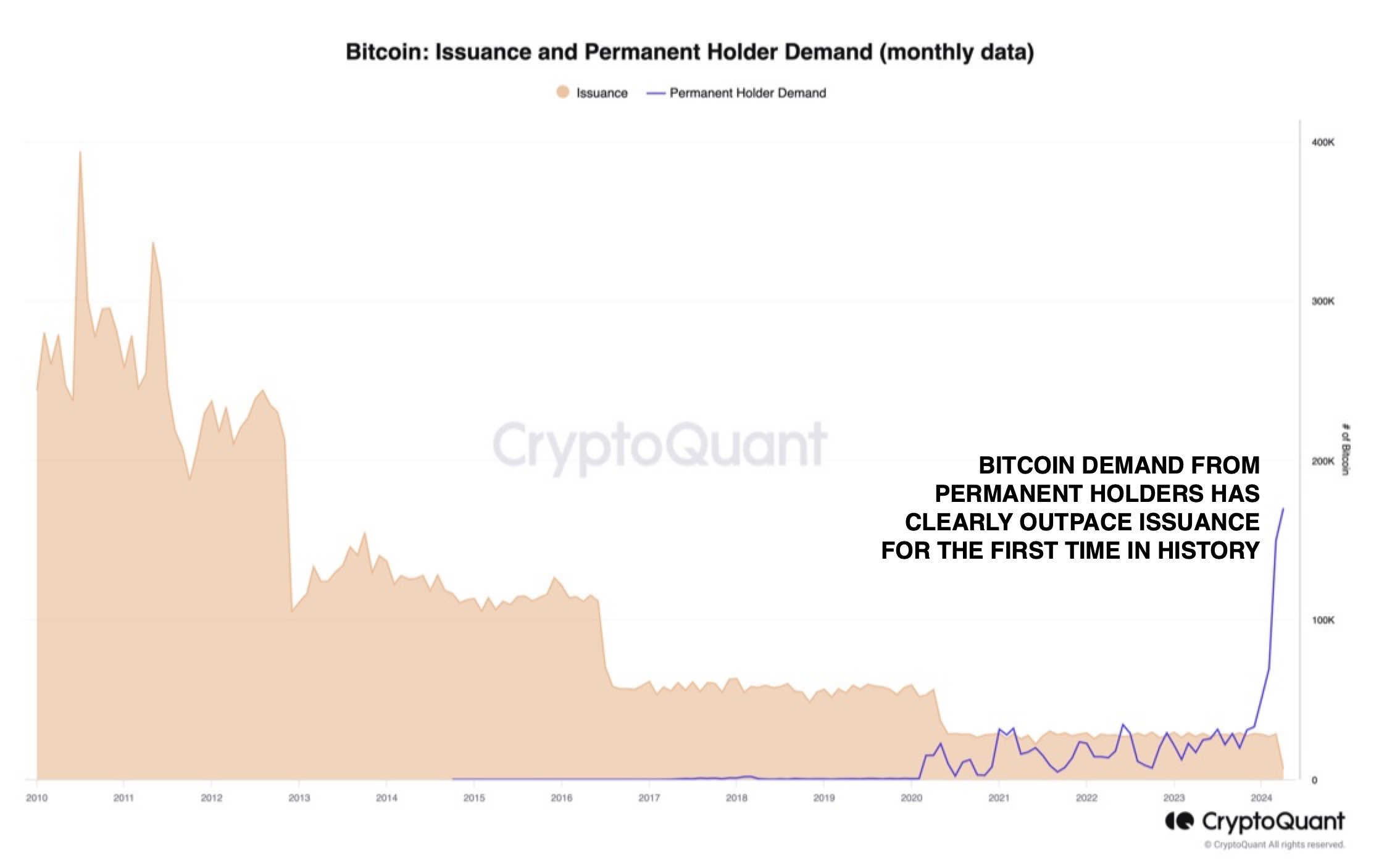

As CryptoQuant head of analysis Julio Moreno explains in a brand new report postal On X, demand for the asset has grown at an unprecedented fee just lately. Under is a chart shared by analysts exhibiting “perpetual holder” demand.

The BTC miner issuance and everlasting holder demand, in contrast | Supply: @jjcmoreno on X

The “everlasting holders” right here discuss with the homeowners of “accumulation addresses”, that are outlined as wallets that solely have a historical past of buying BTC and by no means promoting BTC.

Since these buyers do not know whether or not they may promote, the brand new provide they accumulate might develop into equally illiquid sooner or later. Due to this fact, shopping for from these holders is usually a bullish signal particularly, because it signifies that the out there buying and selling provide of the asset could also be declining.

Within the chart, demand from these holders is measured in opposition to the expansion of their mixed balances. It is clear that accumulation addresses considerably elevated their repurchase efforts in 2020 and maintained these ranges of development within the coming years.

Moreno additionally connected Bitcoin “miner issuance” knowledge to the identical chart. This metric tracks the entire quantity of Bitcoin minted by miners on the community.

Miners “produce” BTC after they remedy blocks and obtain block rewards. These rewards are issued within the type of Bitcoin and are the one technique to enhance the circulating provide of cryptocurrencies.

Because the chart exhibits, circulation has remained kind of secure for a number of years. Between these streaks, its worth abruptly plummets. The reason being naturally halving.

Halvings are periodic occasions on the Bitcoin community through which block rewards are completely minimize in half. These occasions happen roughly each 4 years; the following one is scheduled for round ten days.

Because the chart exhibits, whereas demand for cumulative addresses was fairly excessive beginning in 2020, it by no means absolutely exceeded miner issuance.

Nonetheless, the expansion of collected addresses has exploded just lately, and the indicator not solely stays above the community circulation, but in addition far exceeds its precise worth.

Which means that these holders are buying excess of miners can produce on the community. The particular person in control of CryptoQuant identified that that is naturally solely part of the entire demand on the community, as a result of there are different purchaser entities, so this exhibits how sturdy the demand for BTC has been just lately.

The primary driver behind this demand is the emergence of Bitcoin spot exchange-traded funds (ETFs), which provide a substitute for gaining publicity to cryptocurrencies in a fashion most popular by conventional buyers.

bitcoin value

As of this writing, Bitcoin is buying and selling round $68,400, up greater than 4% up to now week.

Seems to be like the value of the asset has sharply gone down over the previous day | Supply: BTCUSD on TradingView

Featured pictures from Unsplash.com, Kanchanara on CryptoQuant.com, charts from TradingView.com