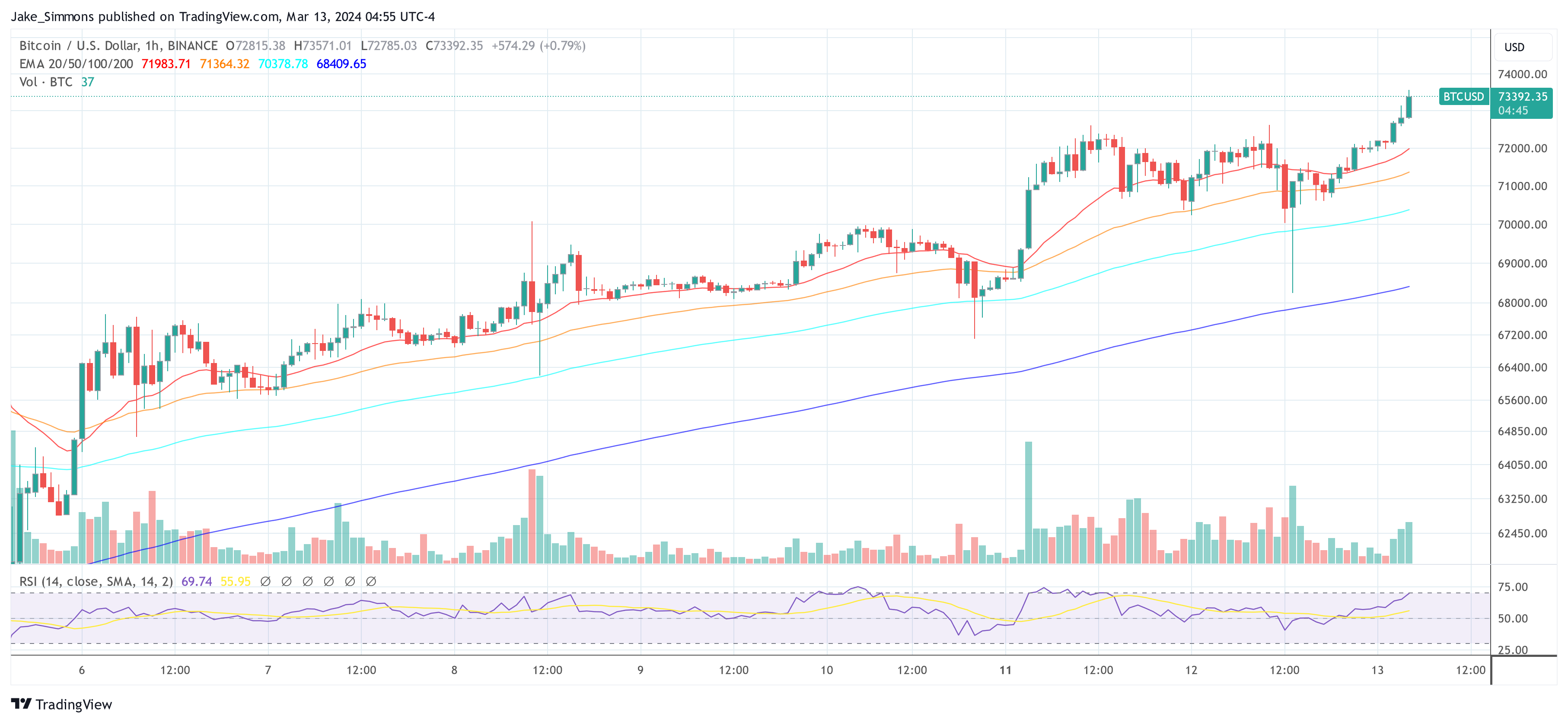

Bitcoin’s value motion was a high-octane curler coaster yesterday, initially surging to the $73,000 mark earlier than encountering a risky liquidation occasion. The incident resulted within the unwinding of over $361 million price of leveraged trades, forcing BTC costs to fall considerably again under $68,300.

Extreme value fluctuations primarily affected lengthy place holders (buyers who speculated on continued value will increase), with losses as excessive as $258 million. Bitcoin costs then staged a outstanding V-shaped restoration, throughout which brief sellers discovered themselves within the crimson, closing their positions at simply over $103 million.

This information from Coinglass marks the occasion as the biggest liquidation of lengthy positions since March 5. On the time, Bitcoin fell to $60,800 after climbing to an all-time excessive of about $69,000.

Bitcoin ETF sees document $1 billion inflows

Maybe spurred by the chance offered by falling costs, buyers in spot Bitcoin exchange-traded funds (ETFs) went on a shopping for spree with unprecedented depth. On Tuesday, March 12, each day inflows into the spot Bitcoin ETF exceeded $1 billion for the primary time, pushed primarily by an $849 million influx from BlackRock IBIT.In line with particulars data Information launched by Farside Buyers confirmed that web inflows throughout all Bitcoin ETFs totaled $1.045 billion (or $1.045 billion).

Constancy, the second-largest Bitcoin ETF, has had a slightly quiet efficiency to this point, with FBTC taking in simply $51.6 million, in contrast with Ark Make investments ($93 million), Bitwise ($24.6 million), Valkyrie ($39.6 million), and VanEck ($82.9 million) earnings is comparatively low. Capital inflows are sturdy. It’s price noting that Grayscale’s GBTC outflows had been solely $79 million.

Bitcoin Analyst Alessandro Ottaviani shared His perception into […] Over the previous 12 buying and selling days, 9T has seen $9.2b of inflows, with a median each day influx of $768m. Simply think about, if we preserve this fee, it may be confirmed that the outflow of GBCT is nearly exhausted. “

Crypto Quant analyst Maartunn supplied extra context on the affect of the inflows, revealing: “Simply now: Bitcoin Change Traded Fund (ETF) skilled its highest ever inflows, including 14,706.2 BTC.” This The assertion additional highlights {that a} vital improve in demand for Bitcoin might result in a severe provide scarcity.

🚨🚨 JUST IN: The Bitcoin exchange-traded fund (ETF) skilled its highest ever inflows, including 14,706.2 BTC. https://t.co/xg7wADbRzy pic.twitter.com/IUAyt1jzGE

— Maartun (@JA_Maartun) March 13, 2024

Crypto analyst @ventureFounder joins the dialog suggestion Potential future value actions primarily based on present tendencies, “Absolute Bitcoin Insanity […] The 5-day shifting common web influx has totally returned to its peak. So… in all probability increased. If this continues, reaching $800,000-$90,000 by the tip of the month shouldn’t be out of attain. There isn’t a retracement lasting greater than 24 hours on weekdays. Apparently, the primary main correction of the 2021 cycle occurred when costs reached 2x the earlier excessive. So will we see a significant correction earlier than $120,000? “

As of press time, BTC has exceeded the $73,500 mark and is buying and selling at $73,392.

Featured picture created with DALL·E, chart from TradingView.com

Disclaimer: This text is for instructional functions solely. It doesn’t signify NewsBTC’s opinion on whether or not to purchase, promote or maintain any funding, and funding naturally entails dangers. It is strongly recommended that you simply conduct your individual analysis earlier than making any funding determination. Use of the data supplied on this web site is solely at your individual threat.