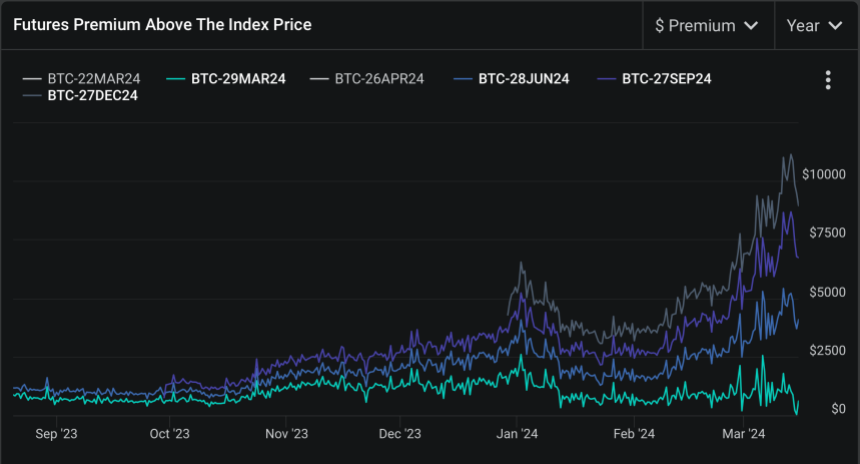

The Bitcoin futures market is exhibiting indicators of traditionally bullish sentiment. Analysts are turning their consideration to the Bitcoin futures foundation – a measure that represents the distinction between Bitcoin’s futures value and its spot value.

Current knowledge exhibits that this foundation has risen to unprecedented ranges since Bitcoin hit an all-time excessive of $69,000 in November 2021.

Bullish Indicators for Bitcoin Futures

Deribit Chief Business Officer Luuk Strijers highlighted the present state of Bitcoin futures foundation, with annual will increase starting from 18% to 25%, a fee paying homage to 2021 market situations.

In response to Strijers’ feedback, this improved foundation is greater than only a quantity and represents a profitable alternative for derivatives merchants.

By taking part in a commerce that buys Bitcoin within the spot market and concurrently sells a futures contract at a premium, a dealer can earn a “greenback achieve” that might be realized when the contract expires, no matter Bitcoin’s value fluctuations.

Strijers additional famous that this technique is especially enticing within the present surroundings, because the inflow of latest investments following the approval of Bitcoin ETFs and expectations for the Bitcoin halving occasion have fueled the pattern.

The implications of accelerating futures foundation prolong past the mechanics of derivatives buying and selling. It additional displays broader market optimism, “supported” by current regulatory approvals and macroeconomic components affecting cryptocurrencies.

The distinction between Bitcoin spot and futures costs factors to a assured market outlook, pushed by continued funding inflows and expectations of the impression of the upcoming Bitcoin halving.

This case creates fertile floor for Bitcoin’s worth to surge, as historic precedent usually hyperlinks bullish futures foundation charges to durations of great value will increase.

Market Sentiment and the Halving Cycle

Though Bitcoin’s present market efficiency is exhibiting a bearish trajectory, with the worth falling 3.9% to $68,203, market analysts advise towards deciphering this as a unfavourable sign. Rekt Capital, a well-respected determine in cryptocurrency evaluation, Opinion The most recent value correction is a “constructive correction” forward of April’s much-anticipated Bitcoin halving.

Halving occasions scale back miners’ block rewards, thereby slowing the speed at which new Bitcoins enter circulation, and have historically catalyzed important value will increase because of the ensuing provide constraints.

Rekt Capital’s evaluation is just like present market traits and historic patterns noticed throughout earlier halving cycles.

The analyst stated that regardless of the fast tempo of those cycles, they exhibit a constant sequence of pre-halving rallies and pullback phases, each of that are according to Bitcoin’s present trajectory. This cyclical view means that the current decline is only a non permanent setback, setting the stage for the following bullish part after the halving.

Though there are indicators that BTC goes by an acceleration cycle…

Regardless of this, historical past continues to repeat itselfBitcoin USD The “rebound earlier than halving” broke out as scheduled

Now, #bitcoin Transition to “pre-halving retracement” as deliberate#cryptocurrency https://t.co/Egqxs9ritl pic.twitter.com/lj0IdQtBEE

— Rekt Capital (@rektcapital) March 15, 2024

Featured pictures from Unsplash, charts from TradingView

Disclaimer: This text is for academic functions solely. It doesn’t signify NewsBTC’s opinion on whether or not to purchase, promote or maintain any funding, and funding naturally includes dangers. It is suggested that you simply conduct your personal analysis earlier than making any funding resolution. Use of the data offered on this web site is fully at your personal threat.